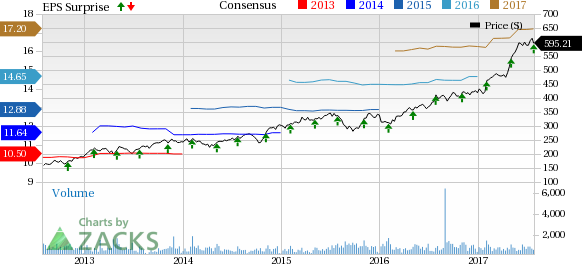

Mettler-Toledo International Inc. (NYSE:MTD) reported second-quarter 2017 adjusted earnings of $3.92 per share, which beat the Zacks Consensus Estimate by three cents and increased 22% from the previous quarter.

Sales increased 7.5% from the year-ago quarter to $653.7 million. In local currency, sales grew 10%, which was better than management’s guided range of 8–9% growth. Excluding the impact of the Troemner acquisition, organic sales growth was approximately 8.5%.

The better-than-expected results were driven by strong growth across all product lines and regions. The company’s growth initiatives - Field Turbo investments, marketing initiatives, Spinnaker sales and new product launches continued delivering positive results.

Overall, we remain positive about Mettler-Toledo’s leading market position, focus on product development and cost reduction, sales and marketing efforts and operational excellence programs. The company is expected to benefit from strong growth prospects in product inspection and services.

Mettler-Toledo’s stock has gained 42.2% year to date, substantially outperforming the industry it belongs to.

Quarter Details

Segment wise Laboratory, Industrial and Food Retail sales increased 9%, 12% and 2%, respectively. Troemner aided laboratory growth by about 3%.

Geographically, Americas (40% of total revenue), Europe (30%) and Asia/Rest of the World (15%) increased 10%, 4% and 15%, respectively. Americas gained approximately 3% from the Troemner acquisition. China sales grew 22% in the quarter.

Gross margin was 57.4%, up 30 basis points (bps) year over year and primarily driven by favorable pricing and productivity gains in the quarter.

Research & development increased 10% year over year (in local currency) to $32.9 million driven by higher spending on new product development. Selling, general & administrative (SG&A) expenses increased 5% (in local currency) to $193.5 million, due to increase in variable compensation investments in Field Turbo programs as well as employee advantage cost.

Adjusted operating margin expanded 150 bps to 22.7% in the quarter.

At the end of the second-quarter, cash and cash equivalents balance was $146.3 million compared with $164.9 million in the previous quarter. Long-term debt was $947.8 million compared with $944.2 million in the previous quarter.

Free cash flow was $113.2 million as compared with $108.9 million in the year-ago quarter.

Outlook

For 2017, Mettler-Toledo expects local currency sales growth to be approximately 8% up from previous guidance of 7%. Adjusted earnings are anticipated in the range of $17.25 to $17.35 per share, up from previous guidance range of $16.95 to $17.15. Earnings are projected to increase 17% over 2017.

Management now expects free cash flow to be in the $400 million range, a 15% increase over 2016.

For the third quarter 2017, local currency sales growth is expected to be approximately 5%. Adjusted earnings are expected to be in the range of $4.25 to $4.30, an increase of 9% to 11%.

Management expects to witness favorable growth growth in China in the third quarter.

Mettler-Toledo expects cash flow to decline in the third quarter but to increase in the fourth quarter.

Zacks Rank & Key Picks

Mettler-Toledo currently has a Zacks Rank #2 (Buy).

Better-ranked stocks in the broader technology sector are Kemet (NYSE:KEM) , Infineon (OTC:IFNNY) and Applied Optoelectronics (NASDAQ:AAOI) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Infineon is expected to report earnings on Aug 1, while Kemet is scheduled to report on Aug 2. Applied Optoelectronics is set to report on Aug 3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Infineon Technologies AG (IFNNY): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Kemet Corporation (KEM): Free Stock Analysis Report

Mettler-Toledo International, Inc. (MTD): Free Stock Analysis Report

Original post

Zacks Investment Research