Metals USA (MUSA) had so much going for it in 2012. Besides a cool name it was the place to hide your money that was allocated toward steel and aluminum as the big names, US Steel and Alcoa cratered in the first half of the year. It just doesn’t go down. Well, until now.

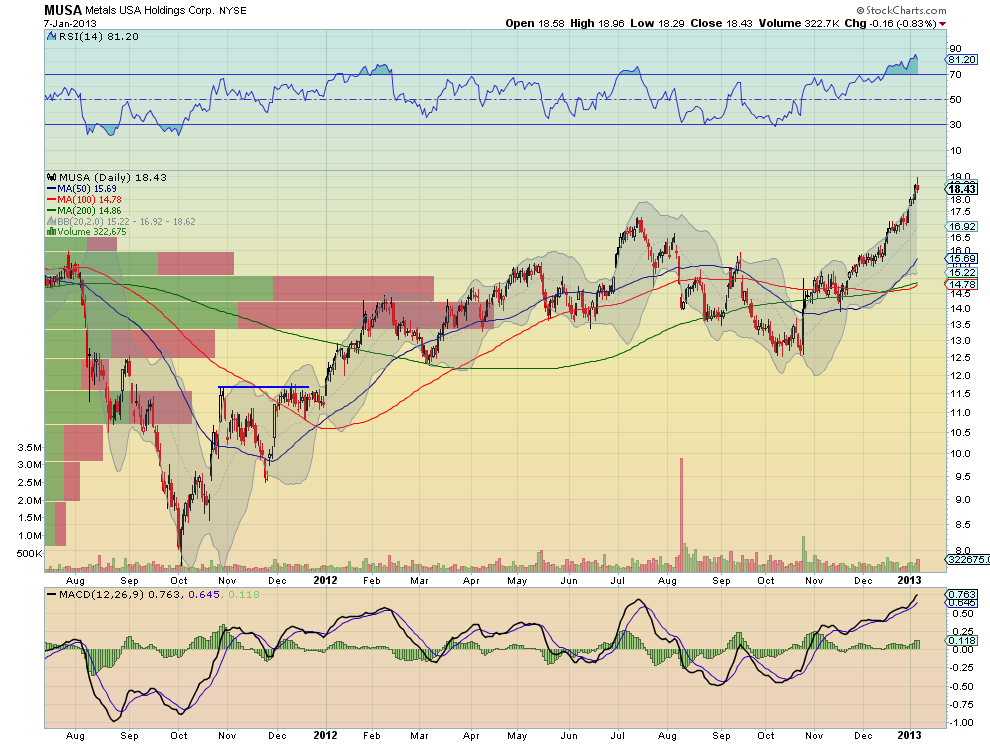

It just might be time to give it a rest, just for a little bit. The daily chart below shows the long run higher through the first half of 2012, followed by a consolidation, then the current rise from late October. The problem with this stock is that it is now technically overbought. Not just a little, but a lot. The Relative Strength Index (RSI) which measures the strength of the trend peaked at 85, and is considered overbought when it gets over 70.

Monday started the pullback with a Shooting Star candle, and if confirmed Tuesday by a continuation lower would signal a pullback. There is some previous price support nearby around 17 and then the 50 day Simple Moving Average (SMA) at 15.69 near another patch of support with a large Volume at Price bar topping at 15.15 so it may not fall far. A pullback to this area would actually be a good thing. A pullout to the weekly view reveals two embedded Inverse Head and Shoulder patterns.

The smaller green one with a price objective of 23.80 is working fine and a pullback to the 15.15 area would just be a retest of that neckline. The larger purple one is more interesting though. With a rising neckline it is set up to succeed and retest before it moves up. This your entry for those of you that have not been in it.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Metals USA Was Great And Will Be Again Soon

Published 01/08/2013, 02:31 AM

Updated 05/14/2017, 06:45 AM

Metals USA Was Great And Will Be Again Soon

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.