- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Metals Still Bearish Despite Shaky Markets

The metal markets have been looking very bearish as of late, and this is a little surprising given the recent activity in global markets.

Last weeks Argentinian debt default had some minor impact on the markets. Was it a shock? No, markets knew well in advance that the possibility of a default was very realistic and they even knew the day it was going to happen; probably why it didn’t make massive headlines.

On top of this American markets disappointed as data was weaker than expected; unemployment data was the worst as the unemployment rate lifted to 6.2%, and non-farm payroll came in at 209K verse an expected 230K, well below what was anticipated by markets.

So we have a sovereign default, and disappointing data from the worlds largest economy; it shouldn’t bode well at all for metal markets - especially precious metals. That was not the case; well, maybe a little for gold. What we have seen on the charts is technicals and long term fundamentals pushing aside bad data and shocks to the financial system, and instead looking ahead.

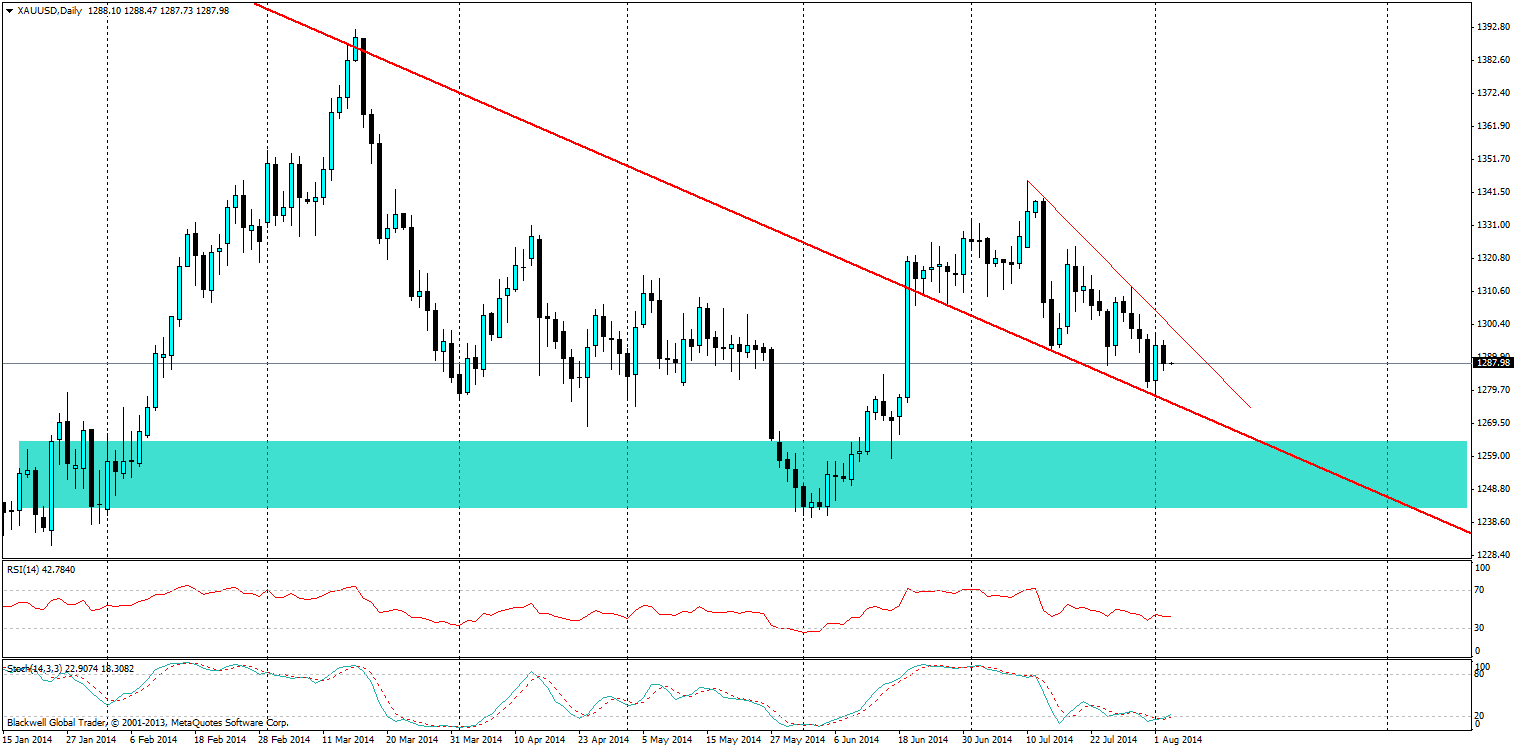

Source: Blackwell Trader (Gold, D1)

The gold market is quite interesting as the old long-term bearish trend line has turned into dynamic support for the precious metal. This might not come as a surprise to many traders, but it has coupled with another trend line to form a descending wedge; which suggests a bullish breakout could be a reality at some point. Though not necessarily true, as wedges can continue to break on the downside more aggressively if the market feels it's warranted.

Markets will be focusing on liquidity and volatility for any change in trend and they will find it in the area I have highlighted which is likely to act as major support for the pair if we are to see any bullish trend higher. While that area is 30 dollars wide on the gold chart, I believe it’s a relevant area which we have seen markets turn from instead of breaking lower into the 1100’s.

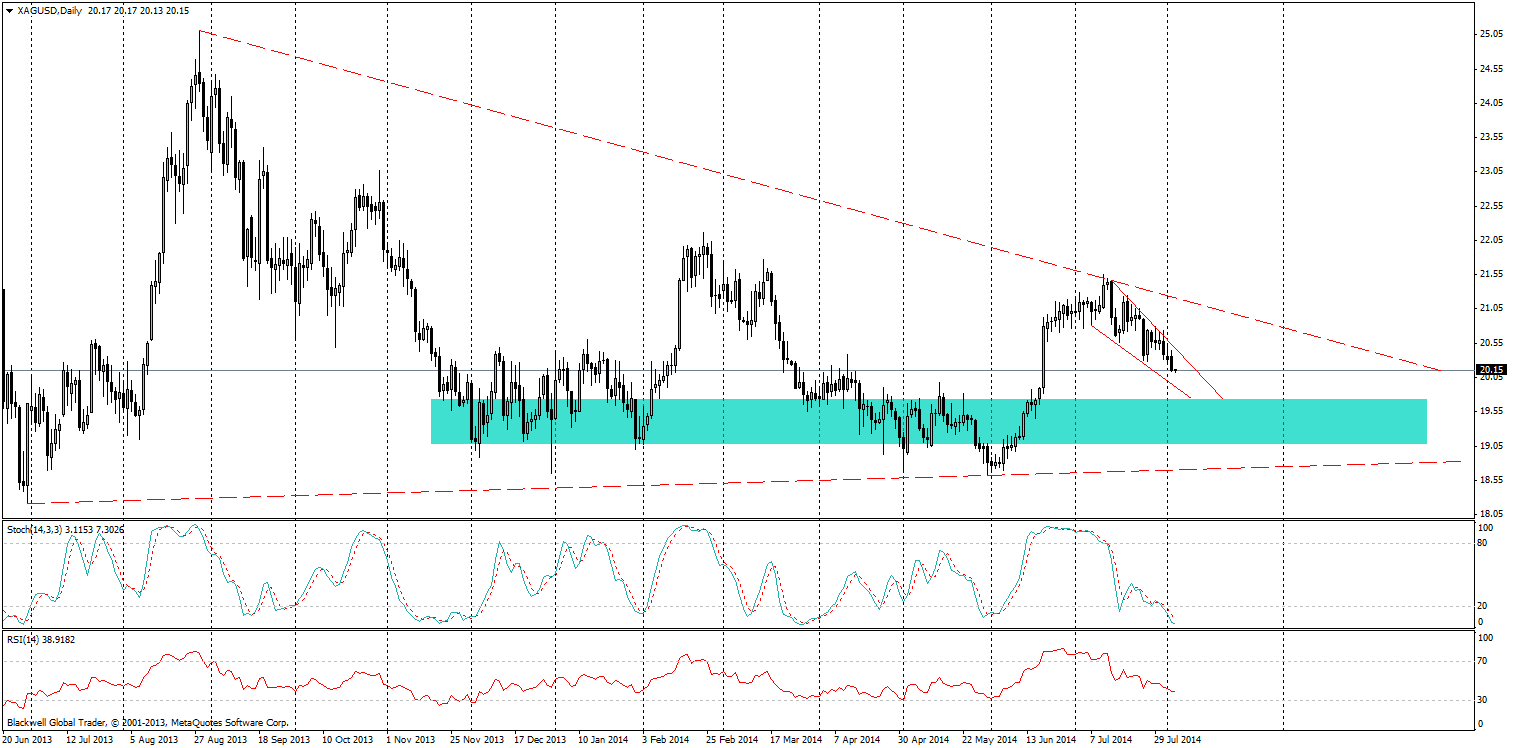

Source: Blackwell Trader (Silver, D1)

Silver though, is the metal I am most looking as of late, and is certainly looking more bearish on the charts after the recent data and moves.

At present just like gold it’s stuck in a descending wedge, and is unlikely to find any bullish support in the marketplace until it shifts lower and find’s more liquidity in the market. It’s also worth noting the triangle that has formed on silver when it comes to bearish patterns, as at present that trend line has not been broken and recent tests off the trend line found no bulls willing to push through; in fact a quick bear swipe sent the market tumbling again.

So while the markets have had their fair share of shocks and weakness, it has not deterred the bears in the market and it would be unwise to look bullish on the present markets as technical patterns and long term fundamentals all points to a move lower for metals.

Related Articles

President Trump has had success bringing down oil prices by sheer force of will and keeping traders off balance. Perhaps the biggest success has a lot to do with not only...

Will WTI crude oil hit 67.00 key level? MACD and stochastics indicate further losses WTI crude oil futures dived below the long-term descending trend line again, meeting the...

Oil prices are largely under pressure amid demand concerns, while the European gas market continues to sell off aggressively Energy – TTF Sell-Off Continues Oil prices continued...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.