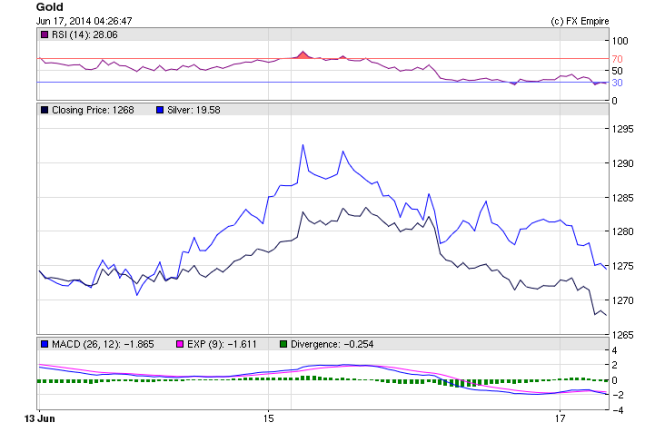

Gold has been surprising traders after climbing on Monday to trade above the 1280 level, it has declined this morning to trade at 1268.60 giving up $6.70 in early trading. Silver is taking its cues from gold but also being weighed down by the IMF downgrade of US growth and disappointing data from China. Metals on the whole are trading in the red. Silver is down 143 points at 19.572 while Platinum is bucking the trend at 1437.70, slightly in the green.

The US Dollar Index traded on a negative note and declined around 0.2 percent yesterday, on the back of a rise in risk appetite during the later part of the trading day, which led to decline in demand for the low yielding currency. However, estimates of another round of QE tapering by the US Federal Reserve in its meeting starting today, and unrest in Iraq, cushioned downside movement in the DX. The currency touched an intra-day low of 80.47and closed at the same levels on Monday. The US dollar regained 6 points in the morning session to trade at 80.60.

The US Empire State Manufacturing Index increased by 0.3 points to the 19.3-mark in June as against a rise to the 19-level in May. Treasury International Capital (TIC) Long-Term Purchases dropped by $24.2 billion in April from rise of $4.1 billion a month ago. The Capacity Utilization Rate was at 79.1 percent in May as opposed to 78.9 percent in April. Industrial Production grew by 0.6 percent in last month when compared to a decline of 0.3 percent in April. National Association of Home Builders (NAHB) Housing Market Index rose by 4 points to 49-mark in June from 45-level in May.

Gold fell on Monday as investors booked profits after earlier in the day hitting a 3-week high on violence in Iraq which—over the last few session— has lifted the metal’s safe haven appeal. Sunni insurgents seized a mainly ethnic Turkmen city in northwestern Iraq on Sunday after heavy fighting, solidifying their grip on the north after a lightning offensive that threatens to dismember Iraq.

Gold is seen as a safe-haven asset at times of geopolitical uncertainty. “Gold is expected to climb this week as the situation in Iraq remains volatile,” said Howie Lee, an analyst with Phillip Futures. “At its current level of $1,282, gold appears to have plenty of upside before facing heavy resistance,” Lee said.

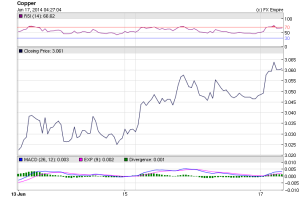

Today, Copper has been the biggest surprise, gaining 12 points in the Asian session to trade at 3.0600. Copper prices rose from last week’s one-month low as investors took heart from China’s efforts to stem any growth slowdown, and as concerns over a Chinese investigation into warehousing fraud faded. China is confident it will hit its growth target of 7.5pc this year, Chinese Premier Li Keqiang said, adding the government was ready to adjust policy to make sure it does. The Chinese economy showed some signs of stabilizing in May as the government unveiled more stimulus measures, but signs of further deterioration in the property market indicate more policy support may still be needed. China consumes some 40pc of the world’s copper,