Another great week for markets as this bull market continues to act great, and we should have another couple years before a major top is in place, but perhaps even longer if infrastructure, regional jobs and made in America really gets rolling.

As for the metals, they looked great last weekend but I did mention the warning the miners flashed with weakness, but that it didnʼt look to be playing out.

I was wrong and the miners showed weakness again early this past week and the metals followed and are looking for more downside.

Canʼt always be right!

Gold lost 2.53% and is set to continue lower still.

The 200 day moving average proved to be strong resistance and gold also broke its uptrend line unfortunately.

Not looking great at all on this chart.

We have support at $1,220 but I think the more significant and longstanding pivot level at $1,180 will once again come into play. Weakness to come is the message.

Silver dropped 3.62% and moved back under the 200 day moving average which is never great.

Iʼm looking at support levels of $17.25 then $16.75 to be tested on this correction.

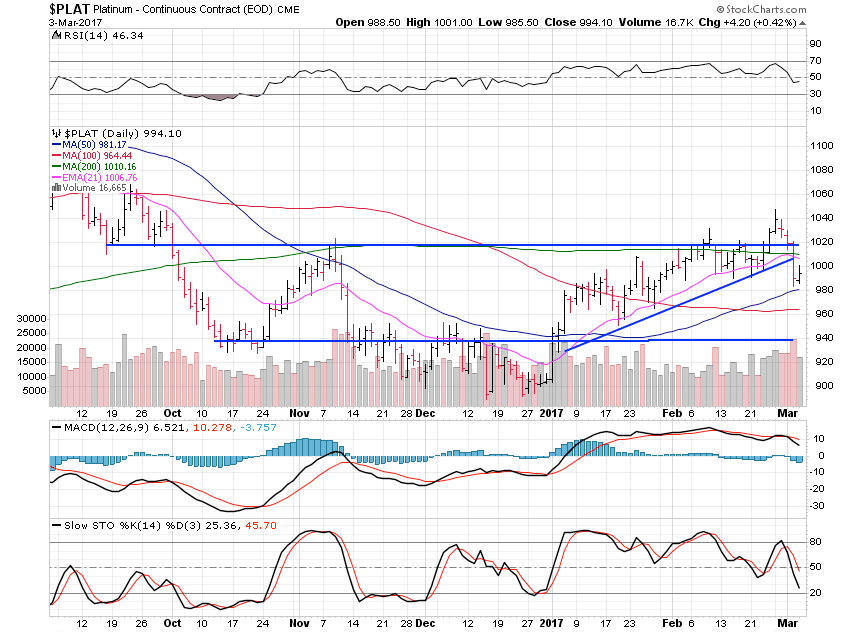

Platinum slid 3.36% after being rejected from the attempted breakout above $1,020.

Pretty weak action that should take platinum down to test the $940 support level over the next couple of weeks. Chart

Palladium fell only 0.68% this past week but does look set for a deeper correction right away.

Iʼm looking to the $730 area as the most likely support level to be tested. All in all, stocks remain great with some rotation being seen back into the explosive biotech sector while metals are floundering.