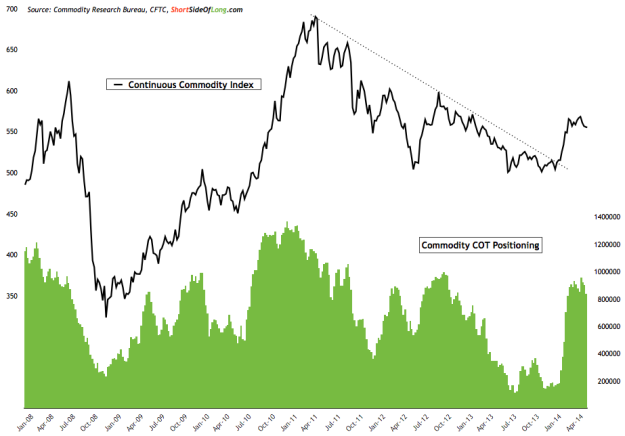

Chart 1: The initial commodity rally has now paused with consolidation

A commodity downtrend was broken at the beginning of the year, and a relief rally started. After three years in a downtrend and quite a disappointing performance (both nominally and relatively), commodities are now surprising investors on the upside. However, it is almost impossible to correctly predict whether this is the start of a new bull market or just a dead cat rebound. After all, every bull market starts with a relief rally, which manifests into more and more participation.

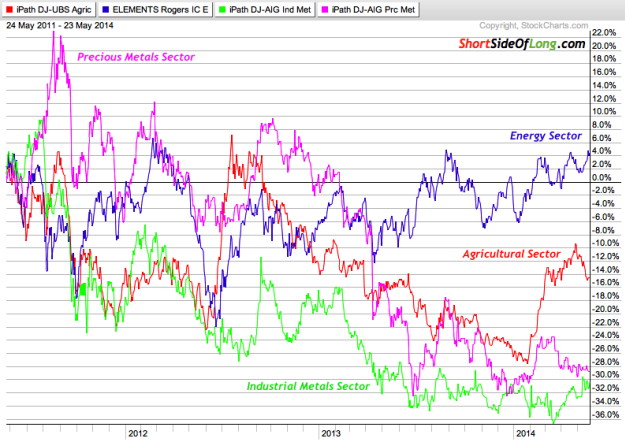

Chart 2: Metals are not participating in the current commodity rally…

Only two out of the three sectors have participated in the current commodity rally. The chart above (3 year rolling performance) shows that energy has moved up slowly, while agriculture has been one of the main catalysts for this year's commodity index strength. For the current rally to turn into a more sustainable bull market, we would need stronger participation from the metals sector (both industrial and precious metals). Both of these sub-sectors continue to base since middle of 2013, without any progress.

If commodities were to continue higher, what should one focus on?

That is a very interesting question and I believe the answer lies in value. Assets with strong long-term fundamentals that are currently trading at a major discount. Chart 2 clearly shows that metals tick all the right boxes.

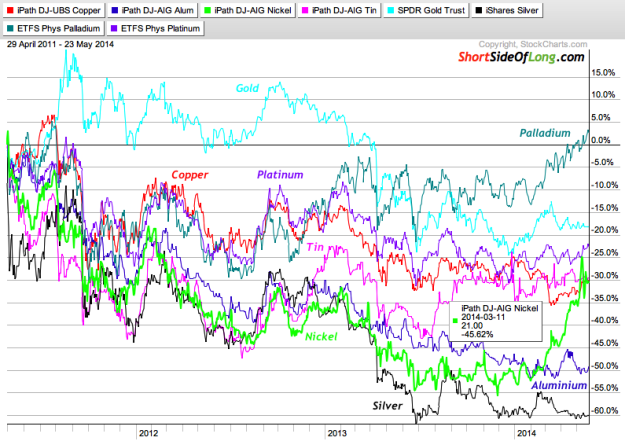

Chart 3: Nickel exploded higher Aluminium & Silver eventually to follow?

The commodity index itself peaked in late April and early May of 2011. Over the last three years, the metals sector had performed awfully. However, breaking down the sector into various components, we can see that that certain metals have had better performance then others. For example, Palladium is actually up over the last three years, which is very rare for any other commodity. Interestingly, that is why so many traders are raving about the recent breakout in the metal, as they chase performance as trend traders.

Personally, I like to chase bears instead of bulls and look for value / discount / oversold conditions. After the beating and selling pressure of the last three years, coming into 2014, there hasn’t been a lot of better assets to purchase other than Nickel, Aluminium and Silver. These three metals have been the worst performers, down at least 50% since May 2011.

If we refer to Chart 3 again, we can see that after a prolonged basing period, nickel recently exploded higher and almost doubled in the space of just a few months (highlighted green line). I hold the view that if nickel can double from oversold levels in a few months, despite constant bearish news out of China, and if the Greek stock market more then doubled in 2012, despite constant bearish news out of EU PIIGS, other extremely cheap and oversold assets like Silver can do it too.

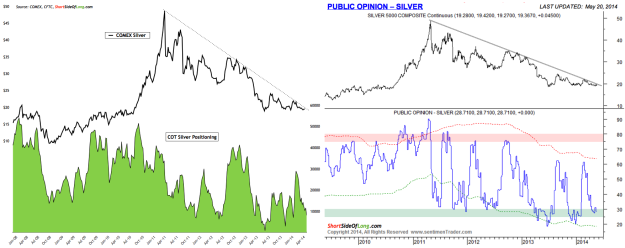

Chart 4: Sentiment is once again extremely negative on metals like Silver

Sentiment is extremely negative on Silver right now, as it finds itself at a major decision point. That does not mean that Silver cannot drop further in the short term. As a matter of fact, the market loves to scare investors by doing a false breakdown on extreme sentiment. The last of the weak hands usually panic, sell their holdings and right afterward we see a powerful reverse. This exact scenario is quite possible if Silver breaks lower, below its current $18 per ounce support.

Regardless of what happens over the short term, I would not be surprised to see Silver (and other very cheap metals) eventually follow in the footsteps of nickel and surprise on the upside with rallies in a very short space of time at multiples of 50%, 75% or even 100%. As I see it, another sell-off is a buying opportunity, the same way a breakout on the upside is also a buying opportunity.