Markets found lows last week and are moving back to the top of their ranges for now but the big question remains, can they breakout with heavy volume?

I still think we won’t see a major breakout until the fall but I’ve been wrong before.

As for the metals, gold found a low and is now trading in a range as it sets up for another leg lower, most likely to finally test the $1,000 level.

Gold lost just 0.31% over the past week but is setting up well for a move lower anytime now.

This tight range points to a move lower very soon.

That said, if we move back above $1,105 then we may widen this range and move back up to $1,140.

The trend remains solidly lower and even if we move up to test the breakdown level at $1,140, the dominant trend remains down.

A break below $1,080 is the short level but it has to hold below that the first day it breaks to hold the position.

Preferably, volume would be high on the breakdown.

The chart points to lower very soon but I’d not be surprised to see this consolidation last until the end of August.

Silver fell 0.34% this past week and is also pointing to a move lower sooner rather than later.

$14.50 is the short level in silver but if it moves back above $15 then we should go up to test $15.50.

Platinum lost 0.58% this past week and looks the same as gold and silver.

$975 would be the short level here while a move above $1,000 should see $1,025 tested.

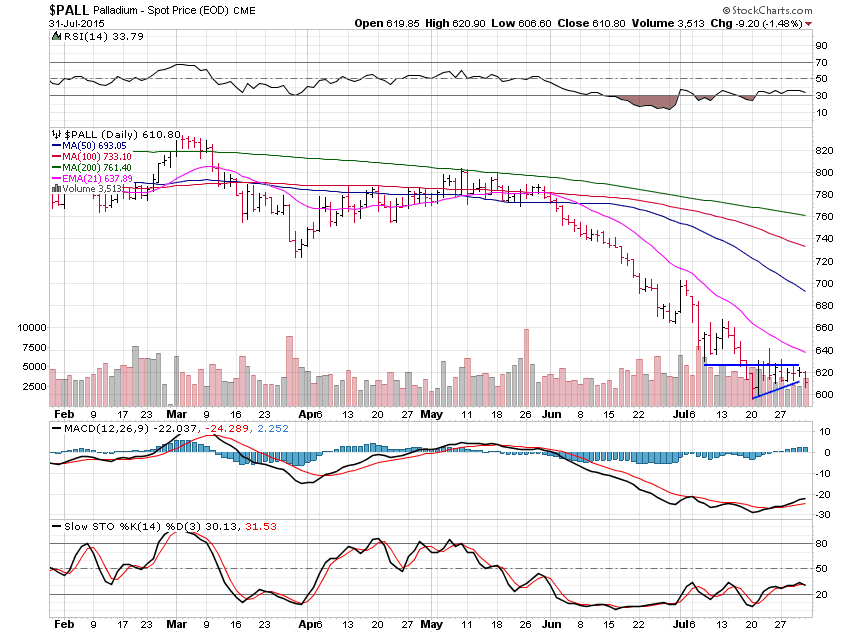

Palladium lost the most, falling 2.14% on the week, and is trying to breakdown now.

Palladium is falling on increasing volume and trying to lead the other metals lower.

Only time will tell if this lead can last but we should know Monday or Tuesday.

All in all, the metals are acting great as they approach their final fall.