Markets continue to show weakness as we continue to move a bit lower during this likely 6-to-8 week consolidation period.

It’s all good and will keep this bull market strong and set for much more upside over the next couple of years or so.

The metals continue to act fine with more upside appearing to be in the cards. Gold took the leading role from silver and gained 1.49% this past week.

Gold has a sweet little bull flag just under the 200 day moving average which tells me we should move above said moving average shortly. Next resistance to watch is $1,306 or so.

Looking good to me! Silver gained 1.92%, a bit more than gold, but the chart is not as clean, hence, I’m saying gold is leading with its cleaner chart.

Silver is trying to move above this $17.75 resistance level with some resistance to be expected at the 200 day average, just above $18 as silver makes its way to $18.50 most likely.

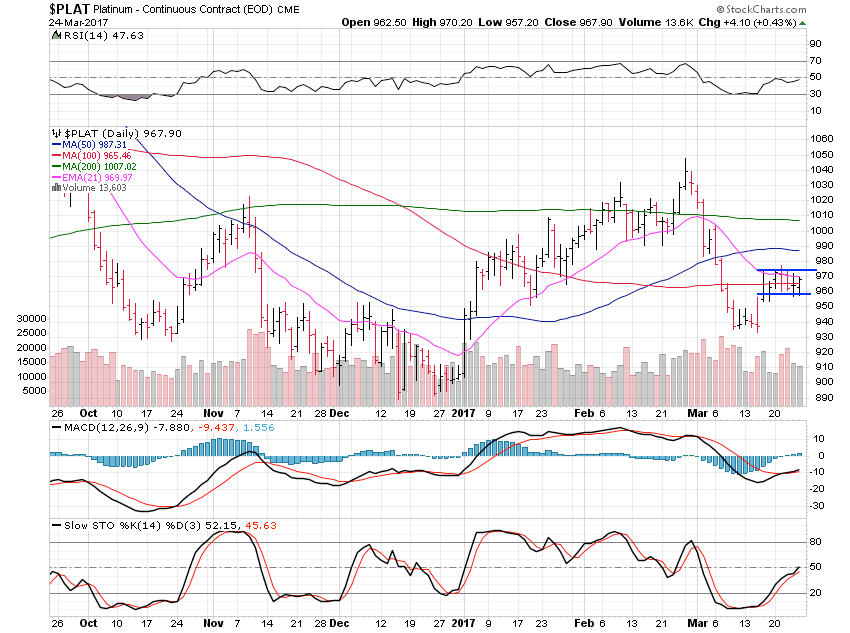

Platinum gained just 0.51% as it continues to build a nice little consolidation area to move up from. A move above the $975 area should quickly see $1,010 then $1,020.

We’ve seen three efforts at trying to move past $1,020 which have failed but often the fourth time seems to be the charm.

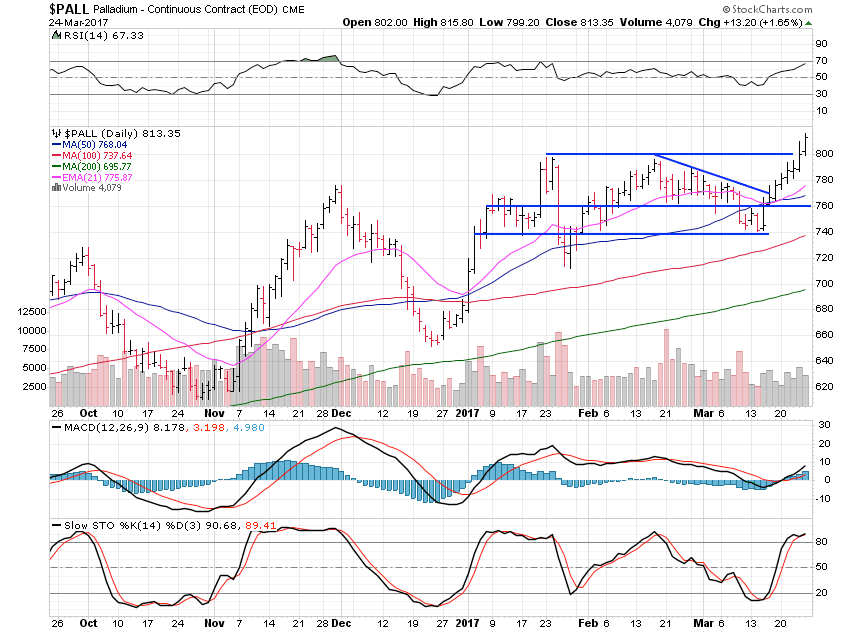

Palladium was the big winner grabbing gains of 4.84% after breaking out on Thursday. Solid action indeed on increasing volume.

I see $845 as resistance to keep an eye on and that dates back to late 2010 on the monthly chart. Superb action on this chart and from the metals which look to be one of the few sectors showing strength at the moment.