Markets rested and worked off the extreme overbought conditions they were seeing last weekend and then Thursday they began to breakout and then rested a bit on Friday.

The fact is, seasonality is working well so far and markets and stocks are in our favour.

I’m starting to build positions now and we are seeing more and more stocks setup so it won’t be long until I have a full load of stocks to work with.

I’m still looking for a strong end to the year as this bull market continues on.

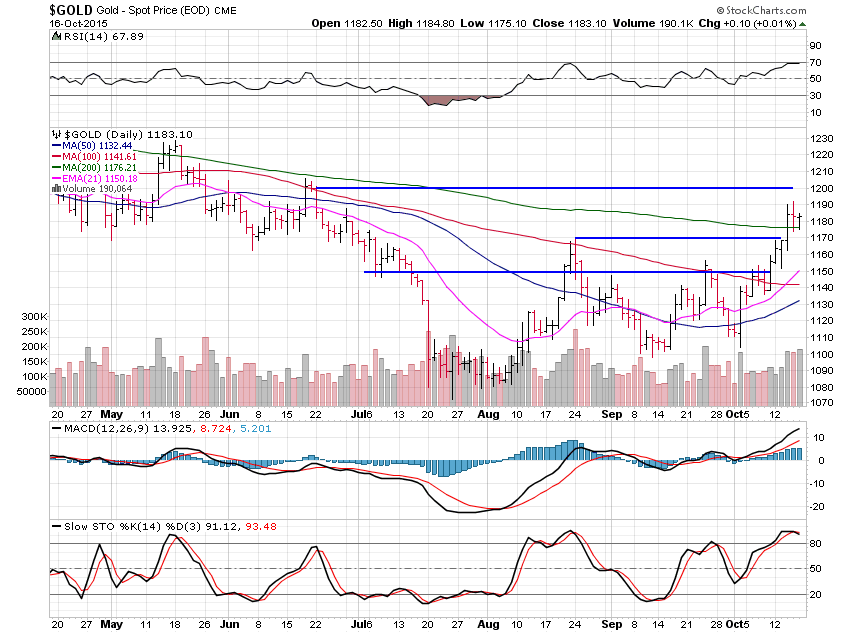

The metals moved well, and higher, this past week but gold is nearing resistance and I still do not think the major low is yet in, but I’ve been wrong before and will readily flip sides if I see the right evidence.

Gold rose 2.38% this pat week and did so with good volume.

I still see the $1,000 as the area we need to hit before a major low is in place and we see the dominant trend switch to up once again.

Gold has resistance at $1,200 now and that has been a heavy support and resistance area dating back to 2009 so it will be hard to sustain a move above that at this point in time.

Last week I talked about the chances of seeing history rhyme by seeing gold show a breakout failure and that is likely as gold attempts to move past $1,200 if it can get there at all.

I’d consider a breakout failure at $1,200 a good short area.

Silver gained 1.86% this past week but couldn’t move up as well as gold.

A break above the $16.20 level can be bought with $16.75 the likely area to lock in gains.

So far, silver is having trouble getting away from the 200 day moving average as so often happens.

I do not think the major low is yet in for silver either so if silver can get to $16.75 and stall then that can be a short level as well.

Platinum gained a solid 4.12% on the week.

If platinum can continue above this $1,025 area then $1,075 is the next resistance level.

I’d consider a short if platinum stalls at $1,075.

Palladium lost 1.74% and is having trouble with the 200 day moving average.

If palladium can best $725 then $750 is the next resistance area to looks for but as always the caveat exists that platinum and palladium follow gold and silver so they must be watched carefully.