The precious metals took last week off and have formed very nice patterns, which point to breakouts in the week to come so Iʼm into one mining stocks and may grab another couple or few positions early in the week if the action continues to be right.

All in all, we look all good to continue our winning ways!

Gold gained just 0.22% but looks awesome!

A little cup and handle pattern here says higher anytime. A break above the 200 day is the buy level and it should trigger very soon. I really like the look of gold here and am looking into a few mining stocks as a result.

On the flip side, if we move under $1,240 at the 21 day moving average, that would tell me strength is not coming, but this chart says higher. Charts and chart patterns arenʼt always correct but they put the odds on your side if you can read them.

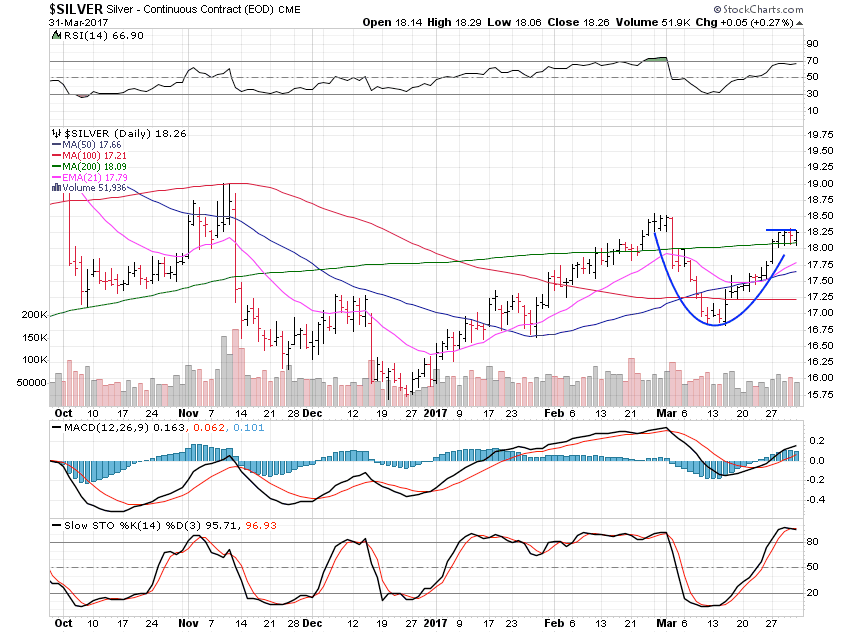

Silver leapt 2.86% and looks great for a move higher.

With silver now nicely above the 200 day moving average, and gold not, silver has taken the lead. This cup and handle pattern has the buy at $18.25 with $19.50 or so the target area.

Looks good to me!

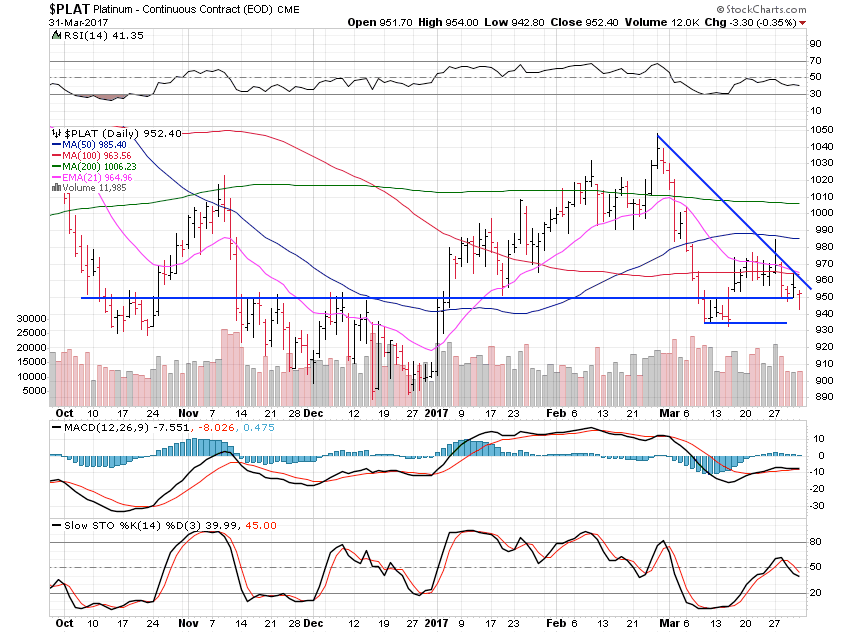

Platinum lost 1.60% and wasnʼt looking especially good until Friday.

Seeing platinum move under the large pivot level at $950 but snap back hard and close the week above it is quite bullish. We should soon see this downtrend line snapped and then a move to the 200 day average near $1,010 should be in the cards in short order.

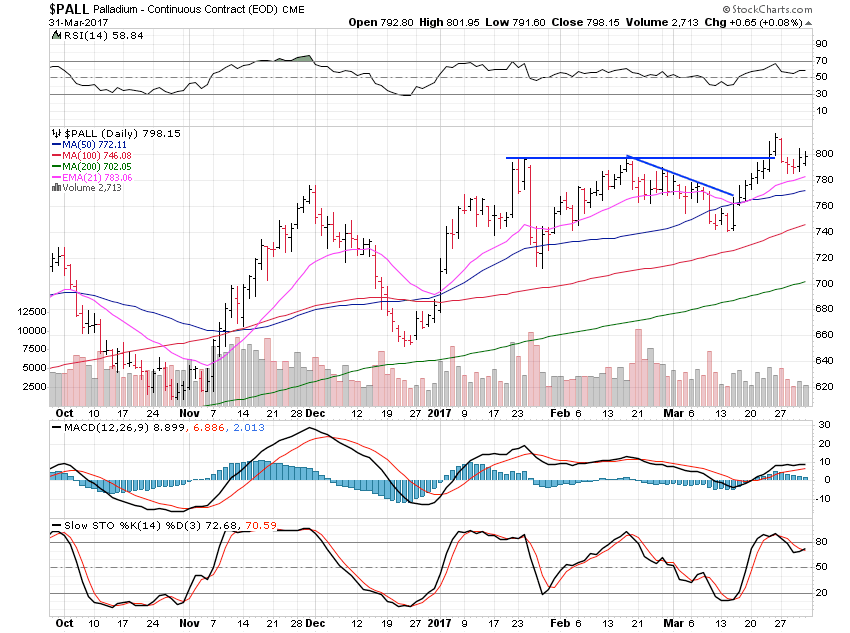

Palladium fell just 1.87% after a failed breakout above the $800 area. That said, palladium is curling around and looking to move past $800 for real this time.

As long as gold and silver break out, palladium will almost certainly follow them higher.