Street Calls of the Week

Meatal Mining Company Common, (MMG) is a leading global producer of zinc, also producing significant amounts of copper, lead, gold and silver at its owned and operated mines in Laos, the Democratic Republic of Congo and Australia. MMG’s aim is to become a top three mid-tier global base metals producer and it is actively pursuing internal and external growth opportunities. We value MMG at US$1.3bn, equating to HK$1.90 per share, and see potential upside from internal exploration and development, joint venture exploration projects and potential acquisition opportunities.

Copper more significant than zinc

Following the acquisition of the Kinsevere project in 2012, copper has become a major commodity for MMG and our valuation is most highly geared to the copper price. We calculate that a 10% change in our long-term copper price assumption would have a 19% impact on MMG’s valuation, while a 10% change in our long-term zinc price assumption would have a 7% impact. We forecast that copper will contribute 55% of revenues in FY13 while zinc will contribute 33%.

Weaker A$/US$ benefits H213e and FY14e earnings

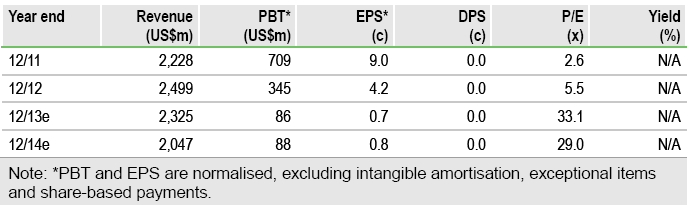

MMG reported substantially lower profits in H113 than in H112 and H212 due to lower production, lower commodity prices and higher operating expenses due to additional mining of waste material. In H213, we forecast lower commodity prices will drive a decline in revenues, although we expect a stable EBITDA benefiting from a weaker A$/US$ rate. A higher depreciation charge as a result of increased mining activity at Century leads to a decline in H213 profit after tax. In FY14, we forecast lower operating costs will partly offset weaker revenues and a reduction in the depreciation charge will more than offset increased finance charges, resulting in a stable profit after tax and EPS increasing 26% compared to FY13.

Valuation: HK$1.90 per share

We value MMG at US$1,294m, equivalent to HK$1.90 per share based on its current operations in Laos, the DRC and Australia, and the Dugald River and Izok Corridor development projects. We see potential upside to our valuation from mine life extension at existing operations, current development projects, 100%-owned and joint venture exploration, and acquisition opportunities. We consider that all are currently at too early a stage to quantify but believe that mine life extension at existing operations provides near-term potential, while MMG’s project development pipeline provides medium- and long-term valuation upside potential.

To Read the Entire Report Please Click on the pdf File Below.