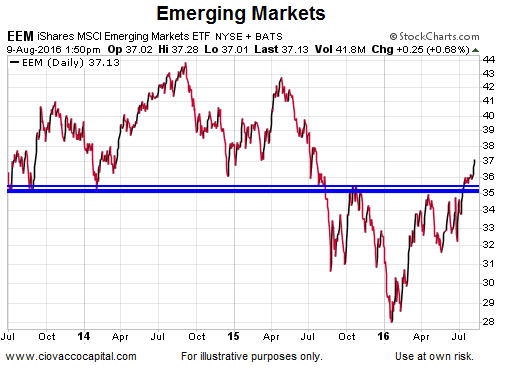

Emerging Markets Break Out

Assisted in part by some improvement in China, emerging markets (iShares MSCI Emerging Markets (NYSE:EEM)) recently cleared a resistance zone that had bounded prices for several months. From Bloomberg:

Since China is a major export market for developing nations from Brazil to South Africa, signs of an improvement in the nation’s manufacturing industry bolsters the case for investing in riskier assets….“Reasonable data from China has opened a window for emerging markets to outperform,” said Maarten-Jan Bakkum, a senior strategist at NN Investment Partners in The Hague, who favors Indian shares. “Emerging markets have been very strong relative to developed markets in the past week.”

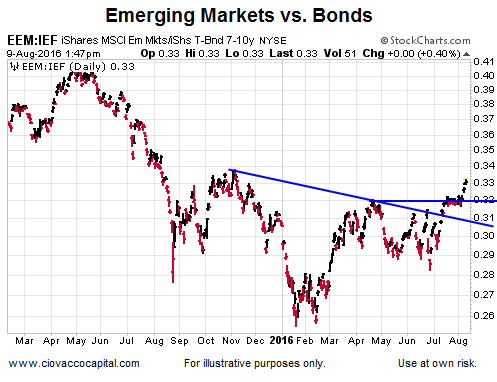

Improvement Relative To Defensive Assets

A tick up in the market’s tolerance for risk can be seen in the chart below, which shows the performance of emerging markets relative to intermediate-term Treasuries (iShares 7-10 Year Treasury Bond (NYSE:IEF)). Increasing expectations for even more easing from central banks have assisted numerous risk markets since the Brexit referendum, including emerging economies.

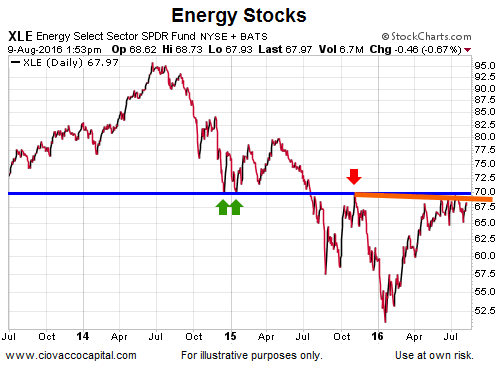

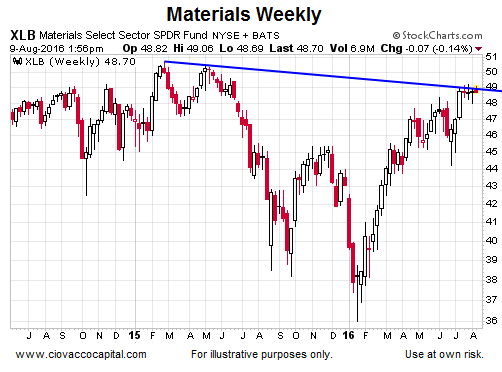

Some Hurdles Left

It would be easier to take, or add to, a stake in any of the markets covered in this post if energy (XLE (NYSE:XLE)) and materials (Materials Select Sector SPDR (NYSE:XLB)) can clear the areas of possible resistance shown below. Therefore, emerging markets and some cyclical sectors are sending mixed messages, especially on a shorter-term time frame. The longer-term message, given what we know today, is an increasing willingness for investors to own more growth-oriented assets.

If materials and energy can break to the upside, the bullish case for emerging markets would be bolstered. Conversely, if materials and energy are rebuffed at areas of past resistance, it may mean emerging markets are due for a breather. We will learn something either way.