The British pound rose on the back of optimistic comments from Angela Merkel, who hinted that a deal could still be reached before the Oct. 31 deadline. This comes just after Emmanuel Macron said a hard Brexit would be Britain’s fault and that Boris Johnson’s demands for a Brexit renegotiation were unworkable. Still, the GBP rallied across the board and cable enjoyed its most bullish session in nearly 4 months. Whether it can maintain this momentum remains to be seen, yet with UK parliament in recess until 3rd of September, we could see traders willing to take less risk on the pound.

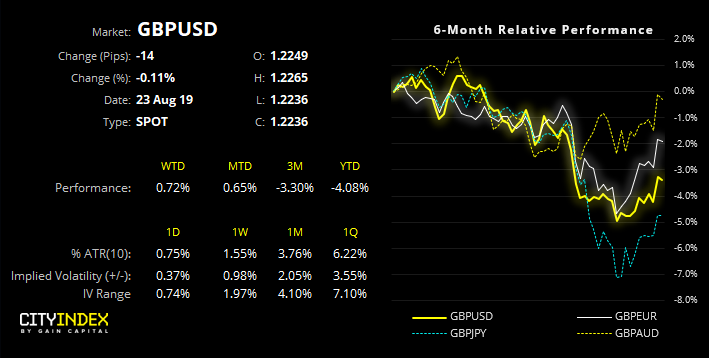

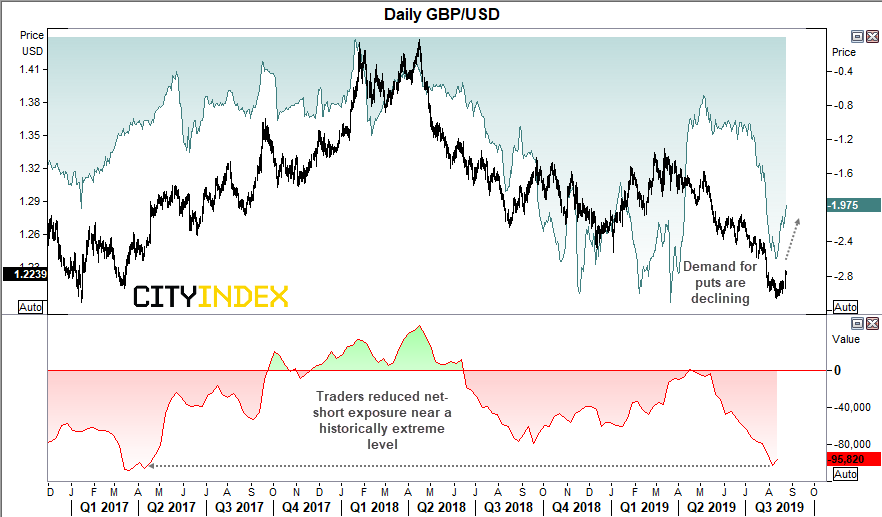

As noted in this week’s COT report, speculative positioning on GBP points towards a sentiment extreme. Traders have begun to reduce short exposure after hitting a historically bearish level (with net and gross shorts trading below -2 standard deviations from its long-term mean). However, bearish bets appear to be on the decline as seen on the 25-day risk reversals, which has seen put demand hit a 4-week low.

GBP/USD remains within a clear bearish trend, although is amidst a counter-trend rally. As mentioned in our weekly COT report on market poisoning, there does appear to be risk of further upside. That said, the trend remains bearish below 1.2579 which allows for a deep retracement along the way.

EUR/GBP is an interesting one as it sits at a technical juncture. At its peak just below 0.94 it had enjoyed no less than 14 consecutive, bullish weeks. Still, all good things must come to an end, although the jury is still out as to whether it’s due a complete reversal or is about to complete a correction. With prices now resting on key support after a momentum shift from the highs, there are two scenario’s we’re watching.