On Aug 24, we issued an updated research report on Meritor, Inc. (NYSE:MTOR) .

Meritor reported adjusted earnings per share of 64 cents for third-quarter fiscal 2017 (ended Jun 30, 2017), beating the Zacks Consensus Estimate of 44 cents. Quarterly revenues rose 9% year over year to $920 million. The top line also surpassed the Zacks Consensus Estimate. The company raised its outlook for fiscal 2017.

For 2017, Meritor expects revenues to be around $3.25 billion compared with the previous projection of $3.1 billion. Adjusted EBITDA margin is likely to be 10.2%. Adjusted earnings per share from continuing operations are anticipated to be roughly $1.70 compared with the previous view of $1.40.

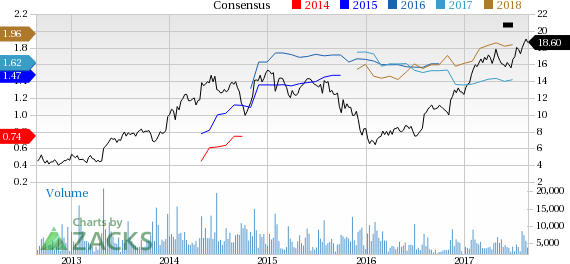

Meritor, Inc. Price and Consensus

The company has also increased free cash flow estimate to $80-$90 million from $50–$70 million, projected earlier for 2017. Operating cash flow is now expected in the range of $165-$175 million compared with the previous guidance of $140–$160 million.

Earnings estimates for Meritor have been going up of late. In the last 30 days, estimates for fiscal fourth quarter have moved up 13% to 43 cents.

Meritor should benefit from the M2019 plan, which includes new business wins and continued investments in new products and technologies. The company is also aiming to enhance shareholders’ value through share repurchases.

Meritor is regularly gaining new businesses. The company is also looking to introduce 20 new products over the next 3 years. The primary objectives of the plan are to grow revenues by 20% above the market.

Price Performance

Meritor’s stock has surged 49.8% year to date, substantially outperforming the 18.7% rally of the industry it belongs to.

Zacks Rank & Other Key Picks

Meritor currently flaunts a Zacks Rank #1 (Strong Buy).

Other top-ranked automobile stocks are Allison Transmission Holdings Inc. (NYSE:ALSN) , Ferrari N.V. (NYSE:RACE) and Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) , all currently sporting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission has a long-term growth rate of 11%.

Ferrari has an expected long-term earnings growth rate of 14.1%.

Volkswagen has a long-term growth rate of 8.9%.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Volkswagen AG (VLKAY): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Meritor, Inc. (MTOR): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Original post

Zacks Investment Research