Meritor, Inc. (NYSE:MTOR) recently launched the North America Authorized Rebuilder Program for drive axle carriers. This includes the company’s products such as 160, 14X and 145.

The move enables four Canadian companies — The Gear Centre, Capital Gear, Powertrain and Coast Powertrain, Ltd., to supply wholesale dealers and distributors across Canada with Meritor carriers.

Meritor’s partnership with rebuilders will help to ensure the company’s commitment to optimize fleets uptime with coast-to-coast, guaranteed delivery of highly reliable, rebuilt carriers.

Commercial vehicle technicians trained by Meritor at each rebuilder will be equipped to update the carriers with the newest product innovations.

Rebuilders will ensure that they conform to OEM rebuild specifications of Meritor. For quality assurance purpose, all rebuilt units, having a unique serial number, will be tracked and documented by the company. Moreover, all authorized rebuilders have to abide by the environmental and safety norms.

Notably, Meritor will offer program members with marketing assistance. This will help to support the authorized rebuilder distinction and marketing literature. The company will also back each carrier rebuilt by authorized rebuilder carrying two-year nationwide warranty coverage. Meritor also intends to extend the Authorized Rebuilder Program to the United States this year.

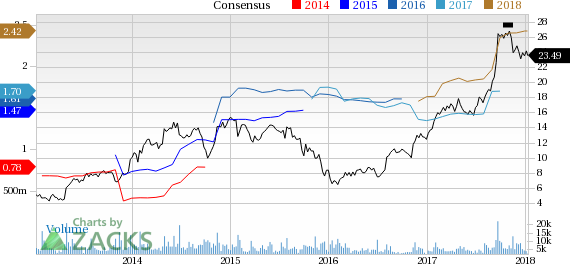

Meritor’s shares have moved up 32.8% in the last three months, outperforming the industry’s 21% growth.

In November 2017, Meritor stated that for fiscal 2018, the company expects revenues to be roughly $3.6 billion. Adjusted earnings from continuing operations are anticipated in the range of $2.2-$2.4 per share. Adjusted EBITDA margin is expected to be in the range of 10.8-11% compared with 10.4% in fiscal 2017.

Meritor is likely to benefit from its new M2019 plan. Per the plan, the company aims to win new contracts and invest in new products and technologies.

The company has also successfully achieved the objectives stated in its M2016 plan that has improved operational excellence and reduced debt, among other financial gains. The carryover of $100 million worth of new businesses from the plan is expected to be felt at the company from 2018.

However, Meritor is faced with the problems of high capital expenditures. Moreover, rising steel prices and customer concentration are other headwinds.

Zacks Rank & Key Picks

Meritor currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the auto space are Allison Transmission Holdings, Inc. (NYSE:ALSN) , BorgWarner Inc. (NYSE:BWA) and BMW AG BAMXF, all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Allison Transmission has an expected long-term growth rate of 10%. Over a year, shares of the company have moved up 31.9%.

BorgWarner has an expected long-term growth rate of 8.6%. Over a year, shares of the company have soared 36.3%.

BMW has an expected long-term growth rate of 4.2%. Over a year, shares of the company have moved up 13.8%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Bayerische Motoren Werke AG (BAMXF): Free Stock Analysis Report

BorgWarner Inc. (BWA): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Meritor, Inc. (MTOR): Free Stock Analysis Report

Original post

Zacks Investment Research