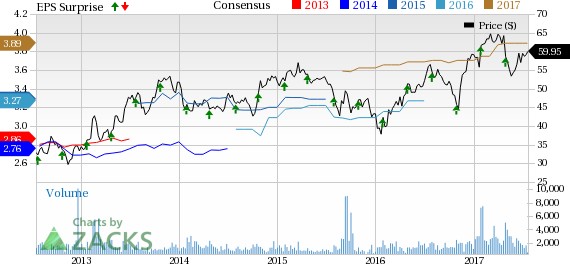

Meredith Corporation (NYSE:MDP) , one of leading media and marketing companies in the U.S. is slated to release fourth-quarter fiscal 2017 results on Jul 27. In the previous quarter, the company’s earnings came in line with the Zacks Consensus Estimate. However, in the trailing four quarters, it has posted an average earnings beat of 3.9%. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The question lingering in investors’ minds now is whether Meredith will be able to post positive earnings surprise in the quarter to be reported. The current Zacks Consensus Estimate for the quarter under review is 96 cents, reflecting a year-over-year decrease of over 11%. We note that the Zacks Consensus Estimate has been stable in the past 60 days. Analysts polled by Zacks expect revenues of $440.6 million compared with $435.8 million reported in the year-ago quarter.

Factors Influencing this Quarter

Strategic endeavors such as increase in digital offerings, the launch of new magazine, The Magnolia Journal, and addition of newscasts across television stations, along with its focus on non-advertising revenue generating avenues such as retransmission fees, brand licensing and e-commerce are likely to drive the top line higher.

To strengthen position, Meredith has launched additional newscasts in the Atlanta, Phoenix, Portland, Nashville, Greenville and Flint/Saginaw markets. The company also renewed licensing program with Wal-Mart Stores (NYSE:WMT), which allows it to showcase 3,000 SKUs of Better Homes & Gardens branded products at 5,000 outlets and on Walmart.com. For the fourth-quarter earnings are anticipated to be in the range of 93–98 cents per share. Local Media Group’s revenue is expected to be up mid-single digits, while that of National Media Group is likely to be down marginally in the final quarter.

However, with advancing technology, the print media is on a decline. Shift to online is likely to put enormous pressure on Meredith’s magazine portfolio. Though the company is expanding digital presence, it will take time to complete the metamorphosis.

What the Zacks Model Unveils?

Our proven model does not conclusively show that Meredith is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Meredith has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 96 cents. The company’s Zacks Rank #3 increases the predictive power of ESP. However, we need to have a positive ESP to be confident about an earnings surprise.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

L Brands, Inc. (NYSE:LB) has an Earnings ESP of +2.38% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco Wholesale Corporation (NASDAQ:COST) has an Earnings ESP of +0.50% and a Zacks Rank #3.

Nordstrom, Inc. (NYSE:JWN) has an Earnings ESP of + 4.92% and a Zacks Rank #3.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Meredith Corporation (MDP): Free Stock Analysis Report

Nordstrom, Inc. (JWN): Free Stock Analysis Report

L Brands, Inc. (LB): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Original post

Zacks Investment Research