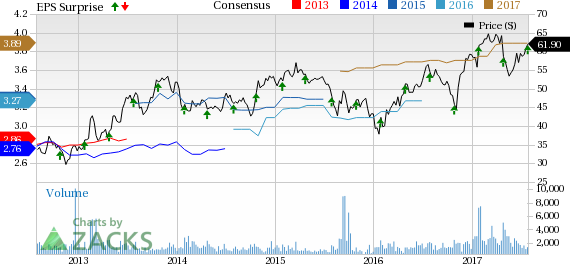

Meredith Corporation (NYSE:MDP) posted fourth-quarter fiscal 2017 adjusted earnings of $1.07 a share that surpassed the Zacks Consensus Estimate of 96 cents but declined 0.9% from the prior-year quarter. We note that the company’s earnings have topped our estimate in 14 of the trailing 15 quarters. Following the results, its share jumped nearly 3% yesterday. Notably, in the past two years the stock has gained 23.9% outperforming the industry’s gain of 14%.

For the fiscal, adjusted earnings per share came in at $4.00, ahead of the Zacks Consensus Estimate of $3.89 per share.

Moreover, management provided fiscal 2018 outlook. The company expects adjusted earnings in the band of $3.20–$3.50 per share, compared with fiscal 2017 earnings of $4.00 per share. For the first quarter, earnings are anticipated to be in the range of 60-65 cents a share, down from 75 cents reported in the prior-year quarter. The Zacks Consensus Estimate for the first quarter and fiscal 2018 are pegged at 62 cents and $3.43, respectively.

Meredith’s total revenue came in at $445.4 million, up 2.2% year over year and surpassed the Zacks Consensus Estimate of $441 million, marking the third consecutive quarter of sales beat. Meredith envisions total revenue to be flat to up slightly in fiscal 2018.

Advertising revenues declined 0.5% to $230.4 million, while circulation revenues fell 3.5% to $90.2 million. However, other revenues advanced 12.7% to $124.9 million. Digital advertising revenues grew 20% in fiscal 2017. Digital traffic averaged 86 million unique visitors per month.

Strategic endeavors such as an increase in digital offerings, the launch of new magazine, The Magnolia Journal, and addition of newscasts across television stations, along with its focus on non-advertising revenue generating avenues such as retransmission fees, brand licensing and e-commerce bode well for the stock. Meredith has brand licensing program with Wal-Mart Stores, Inc. (NYSE:WMT) .

Adjusted operating profit came in at $77.7 million, down 4.3% from the prior-year period, while operating margin contracted 120 basis points to 17.4%.

Segment Details

Meredith’s National Media Group revenues fell 0.5% to $293.2 million due to 1.2% decline in advertising revenues to $135.1 million and 3.5% slump in circulation revenue to $90.2 million, marginally offset by a 5.5% gain in Other revenues to $68 million. The segment’s adjusted operating profit totaled $42.7 million, down 17.4% year over year.

In fiscal 2017, digital advertising revenue jumped above 20% and represented more than 30% of total National Media Group advertising revenues driven by growth from engagement-based video, programmatic advertising and shopper marketing. As per Publishers Information Bureau, Meredith's share of total magazine advertising revenue expanded 130 basis points to 13.3% led by robust performance of Martha Stewart Living, The Better Homes & Gardens, Family Circle and Midwest Living brands.

Meredith now expects National Media Group’s first-quarter revenue to be flat to up marginally.

Revenues at the company’s Local Media Group segment climbed 7.8% to $152.2 million. Non-political advertising revenues inched up 0.6% to $90.9 million. Political advertising revenues came in at $4.4 million, down 2.2% from the year-ago quarter. Meanwhile, other revenues jumped 22.8% to $56.9 million. In fiscal 2017, digital advertising revenue increased in an excess of 15%.

The segment’s adjusted operating profit came in at $47.6 million, up 8.6% from the year-ago period.

Management now expects Local Media Group’s revenues to be in the range of flat to down marginally in the first quarter.

Other Financial Details

Meredith ended the quarter with cash and cash equivalents of $22.3 million, long-term debt of $635.7 million and shareholders’ equity of $996 million. As of Jun 30, 2017, Meredith had $68 million remaining under its existing share repurchase authorization. The company generated cash flow from operations of $219 million in fiscal 2017.

Zacks Rank and Stocks to Consider

Meredith currently carries a Zacks Rank #3 (Hold). Better-ranked stocks worth considering include Gray Television, Inc. (NYSE:GTN) and Rogers Communications Inc. (NYSE:RCI) . Both the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Gray Television have gained 27.9% in the past six months.

In the past three months, Rogers Communications stock has increased 12.6%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Gray Television, Inc. (GTN): Free Stock Analysis Report

Rogers Communication, Inc. (RCI): Free Stock Analysis Report

Meredith Corporation (MDP): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Original post

Zacks Investment Research