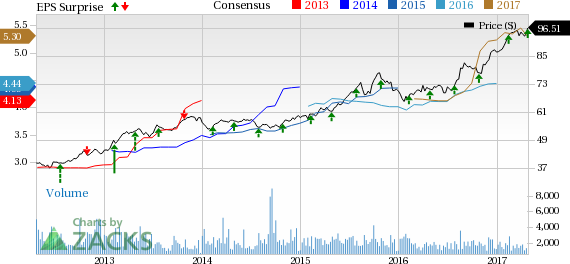

Arch Capital Group Ltd. (NASDAQ:ACGL) reported first-quarter 2017 earnings per share of $1.42 that beat the Zacks Consensus Estimate of $1.33 by 6.8%. Moreover, earnings improved 21.4% from the year-ago quarter.

Arch Capital Group’s net income jumped 45% year over year to $1.74 per share.

Behind the Headlines

Gross premiums written climbed 15.3% year over year to $1.7 billion on higher premiums written at the Mortgage segment.

Net investment income jumped 36.1% to $95.8 million. The upside was supported by income on the acquired United Guaranty portfolio and higher returns on fund investments.

Arch Capital Group’s underwriting income soared 83.3% year over year to $212.1 million. Combined ratio improved 700 basis points (bps) to 81.4%.

Segment Result

Insurance Segment: Gross premiums written declined 2% year over year to $782.3 million.

Underwriting income of $10 million plummeted 66.7% from the year-ago quarter. Combined ratio deteriorated 380 bps to 99.4%.

Reinsurance Segment: Gross premiums written in the quarter dipped 1.2% year over year to $475.8 million.

Underwriting income decreased about 6% year over year to $55.4 million. Combined ratio improved 40 bps year over year to 77.2%.

Mortgage Segment: Gross premiums written in the quarter skyrocketed 213.3% year over year to $348.6 million, largely driven by growth in U.S. primary business.

Underwriting income skyrocketed 438.8% year over year to $148.9 million. Combined ratio improved 2060 bps year over year to 40.8%.

Financial Update

Arch Capital Group exited the first quarter with total capital of $10.84 billion compared with $10.49 at year-end 2016.

As of Mar 31, 2017, diluted book value per share was $55.69, up 4.5% year over year.

Operating return on equity was 10.3% as of Mar 31, 2017 compared with 9.8% as of Mar 31, 2016.

Zacks Rank

Arch Capital Group presently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other P&C Insurers

Among other players from the same space that have reported their first-quarter earnings so far, the bottom line at The Progressive Corporation (NYSE:PGR) , The Travelers Companies, Inc. (NYSE:TRV) and RLI Corp. (NYSE:RLI) missed their respective Zacks Consensus Estimate.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information >>

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL): Free Stock Analysis Report

Original post