Crown Holdings Inc. (NYSE:) delivered second-quarter 2017 adjusted earnings per share of $1.12, which came ahead of the Zacks Consensus Estimate of $1.10 but declined 6% on a year-over year basis. Earnings came within management’s guidance of $1.05–$1.15.

On a reported basis, earnings came in at 94 cents per share, down 22% from $1.21 in the prior-year quarter.

Net sales in the quarter inched up 0.9% year over year to $2,161 million. Revenues beat the Zacks Consensus Estimate of $2,145 million. Improved global beverage can volumes and the pass through of higher material costs to customers were partially offset by negative impact of currency translation.

Cost of products sold increased 1.7% year over year to $1,719 million. On a year-over-year basis, gross profit dipped 2% to $442 million, while gross margin contracting 60 basis points (bps) to 20.5% in the quarter.

Selling and administrative expenses declined 2% year over year to $92 million. Adjusted segment operating income increased 3% year over year to $297 million in the quarter. Operating margin improved 30 bps to 13.7% from 13.4% in the year-ago quarter.

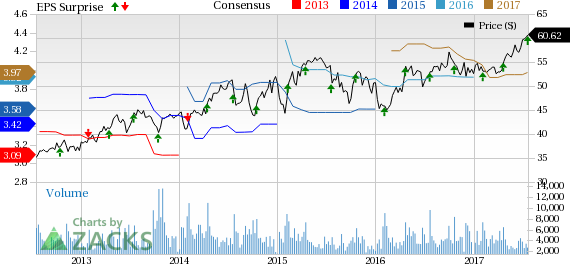

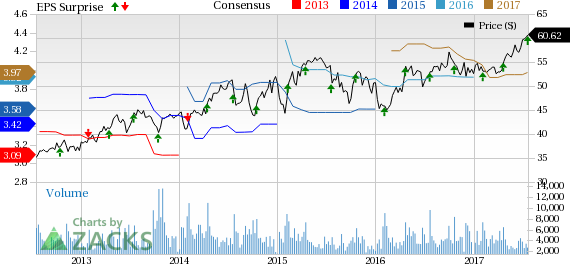

Crown Holdings, Inc. Price, Consensus and EPS Surprise

Crown Holdings, Inc. Price, Consensus and EPS Surprise | Crown Holdings, Inc. Quote

Segment Performance

Net sales from the Americas Beverage segment were $729 million, down 1.4% from $739 million in the year-ago quarter. Segment operating profit decreased 1% to $109 million from $110 million in the year-ago quarter.

The North-America Food segment’s sales went down 0.6% year over year to $167 million. Operating earnings remained flat year over year at $22 million.

The European Beverage segment’s sales dropped 3% year over year to $402 million. Operating income declined 3% year over year to $72 million.

Revenues in the European Food segment were down 3% year over year to $459 million. Segment operating profit dipped 3% to $67 million from $69 million in the year-ago quarter.

Revenues in the Asia-Pacific segment decreased 1% year over year to $287 million. Operating profit remained flat at $45 million in the reported quarter.

Financial Update

Crown Holdings had cash and cash equivalents of $301 million at the end of the second quarter compared with $370 million at the end of the prior-year quarter. Cash flow from operations was $14 million in the first half of fiscal 2017 compared with $63 million in the prior-year comparable period. Adjusted free cash flow was $241 million in second-quarter 2017 with $379 million in the prior-year quarter. As of the quarter end, Crown Holdings’ total debt increased to $5.36 billion from $5.28 billion as of the prior-year quarter end.

Crown Holdings repurchased 5.1 million of shares for $277 million in the first half of fiscal 2017. The company repurchases an additional 0.3 million shares for $19 million subsequent to the end of the second quarter.

Outlook

The company currently expects 2017 adjusted diluted earnings per share to be in the range of $3.90 to $4.05, higher than earlier guidance range of $3.80–$4.00. Adjusted diluted earnings per share for the third quarter are projected in the range of $1.35–$1.45.

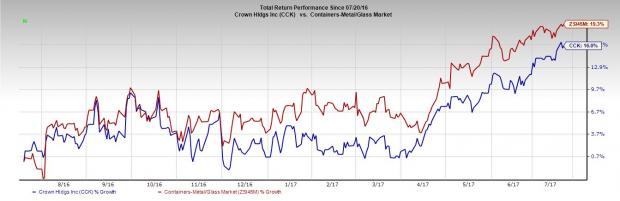

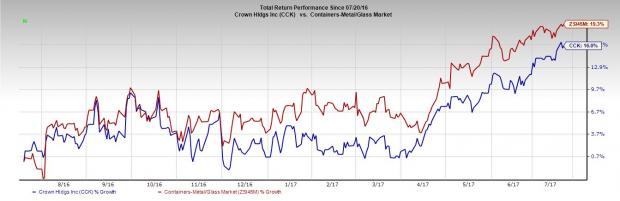

In the past one year, Crown Holdings has underperformed the Zacks categorized Containers- Metal/ Glass sub industry. The company’s shares increased 16%, while the industry gained 19.3%.

Zacks Rank & Key Picks

Crown Holdings currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the same space include AptarGroup, Inc. (NYSE:) , Sonoco Products Co. (NYSE:) and Avery Dennison Corporation (NYSE:) . All three of these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AptarGroup generated a positive average earnings surprise of 1.78% in the trailing four quarters. Sonoco has delivered an average positive earnings surprise of 3.79% in the last four quarters. Avery Dennison has delivered an average positive earnings surprise of 5.53% in the trailing four quarters.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Crown Holdings, Inc. (CCK): Free Stock Analysis ReportSonoco Products Company (SON): Free Stock Analysis ReportAptarGroup, Inc. (ATR): Free Stock Analysis ReportAvery Dennison Corporation (AVY): Free Stock Analysis ReportOriginal post