Mercadolibre, Inc. (NASDAQ:MELI) reported mixed second-quarter 2017 results.

Adjusted earnings of 61 cents missed the Zacks Consensus Estimate by 41 cents while revenues of $317 million beat the same by $14 million.

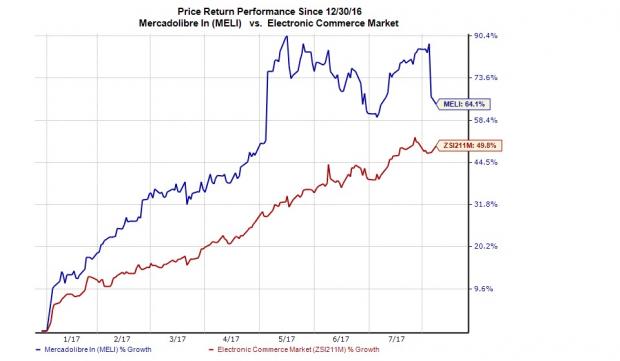

Shares fell 12.4% since the earnings release. However, year to date, shares have gained 64.1%, substantially outperforming the industry’s gain of 47.8%.

In the quarter, top-line growth was substantially supported by solid momentum across all the key performance metrics. On a year-over-year basis, units sold grew 41%, gross merchandise volume (GMV) surged 56%, total payment volume grew 76% and total payment transactions increased 63%. Total confirmed registered users, unique buyers and unique sellers accelerated a respective 20.6%. 23.4% and 14.2% for the same time frame.

Mercadolibre continues to make advances with its newly deployed free shipping and loyalty program. In the quarter, the company launched this program in Brazil, Columbia and Chile. The company is also progressing well on the product front. Exiting the quarter, it launched its marketplace shopping cart in Mexico. The company’s mobile initiatives are also delivering results and currently represent two-third of all visitors on its platform and 43% of total GMV.

Let’s check out the numbers in detail.

Revenues

Revenues were up 15.6% sequentially and 58.5% year over year. The improvement was driven by continued strength across multiple geographies.

By geography, Brazil contributed 57% of second-quarter revenues (up 12.7% sequentially and 75% year over year); Argentina accounted for 28% (up 23.3% sequentially and 30% year over year); Mexico brought in 6.4% (up 29.9% sequentially and 2976.3% year over year); Venezuela accounted for 4.5% (down 1.5% sequentially but up a massive 90.1% year on year) and other countries contributed 4.5% (up 10% sequentially and 39.1% year over year).

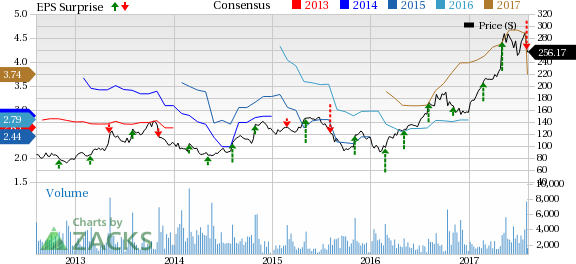

MercadoLibre, Inc. Price, Consensus and EPS Surprise

Margins

Non-GAAP gross profit was $171.6 million, up from $168.9 million in the previous quarter and $126.3 million in the year-ago quarter. Gross margin of 54.2% was down 744 basis points (bps) sequentially and 906 bps year over year.

Adjusted operating expenses were $116.7 million, reflecting an increase of 10.6% sequentially and 54.6% year over year. Operating margin of 17.3% was down 579 bps sequentially and 812 bps year over year.

The year-over-year margin compression was due to increased investments toward free shipping and loyalty programs, marketing, chargebacks, as well as higher maintenance, hosting and fraud prevention cost.

Pro forma net income was $26.9 million, down 44.5% sequentially and 17.8% year over year.

Balance Sheet

Mercadolibre exited the quarter with cash and cash equivalents of $382.8 million compared with $301.4 million in the prior quarter. The company does not have any long-term debt.

Cash from operations was $121.6 million in the second quarter compared with $104.8 million in the prior quarter. Free cash flow was $99.8 million in the second quarter.

Zacks Rank and Stocks to Consider

Mercadolibrecurrently has a Zacks Rank #5 (Strong Sell).

Better-ranked stocks in the broader sector include Alibaba (NYSE:BABA) , Lam Research Corporation (NASDAQ:LRCX) and Luxoft Holding (NYSE:LXFT) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected earnings per share growth rate for Alibaba, Lam Research and Luxoft is projected to be 29%, 17.2% and 20%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

MercadoLibre, Inc. (MELI): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Luxoft Holding, Inc. (LXFT): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research