- US growth slowed in end-2016

- Final domestic demand rebounded

- 2016 as a whole was particularly weak

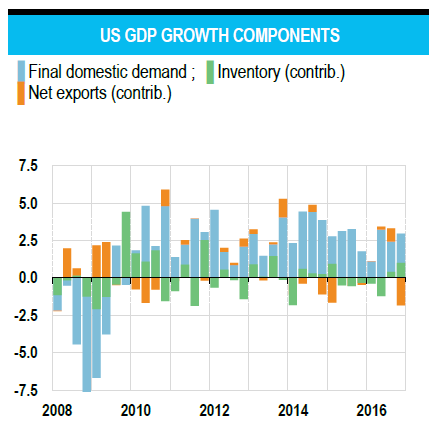

The first estimate for end-2016 GDP growth proved disappointing in the US. After a bounce in Q3 (+3.5%, quarterly annualised rate), activity slowed to 1.9% in Q4. On top of that, 1 point of growth was due to surging inventories, meaning that final demand grew by just 0.9%. Still, details are more encouraging, as the main negative contribution came from international trade: after a surge in Q3, exports decreased while imports gained 8.2%. Final domestic demand actually accelerated, up 2.7% in Q4, after 2.1% in Q3, with strong demand from households and a rebound in business spending on equipment and software.

2016 as a whole marked a slowdown. The average annual growth stands at 1.6%, the second weakest performance since the US emerged from the Great Recession. In nominal terms, 2016 was the worst year. This is quite conflicting with the apparent strength of the labour market. In December 2016, the unemployment rate was as low as 4.7%, as close to 2.5 million jobs have been created. How come employment can be dynamic in a soft economy? Answering that question is long and complex while not always consensual. What is unquestionable is that 2016 saw Corporate America spending cutting on investment while hiring: less capital and more labour. This is clearly the recipe for actual and projected productivity. Consequences are clear but how about causes? Well, it might be interesting to think in terms of relative prices, having in mind how weak real wages have been in the recent past.

by Alexandra ESTIOT