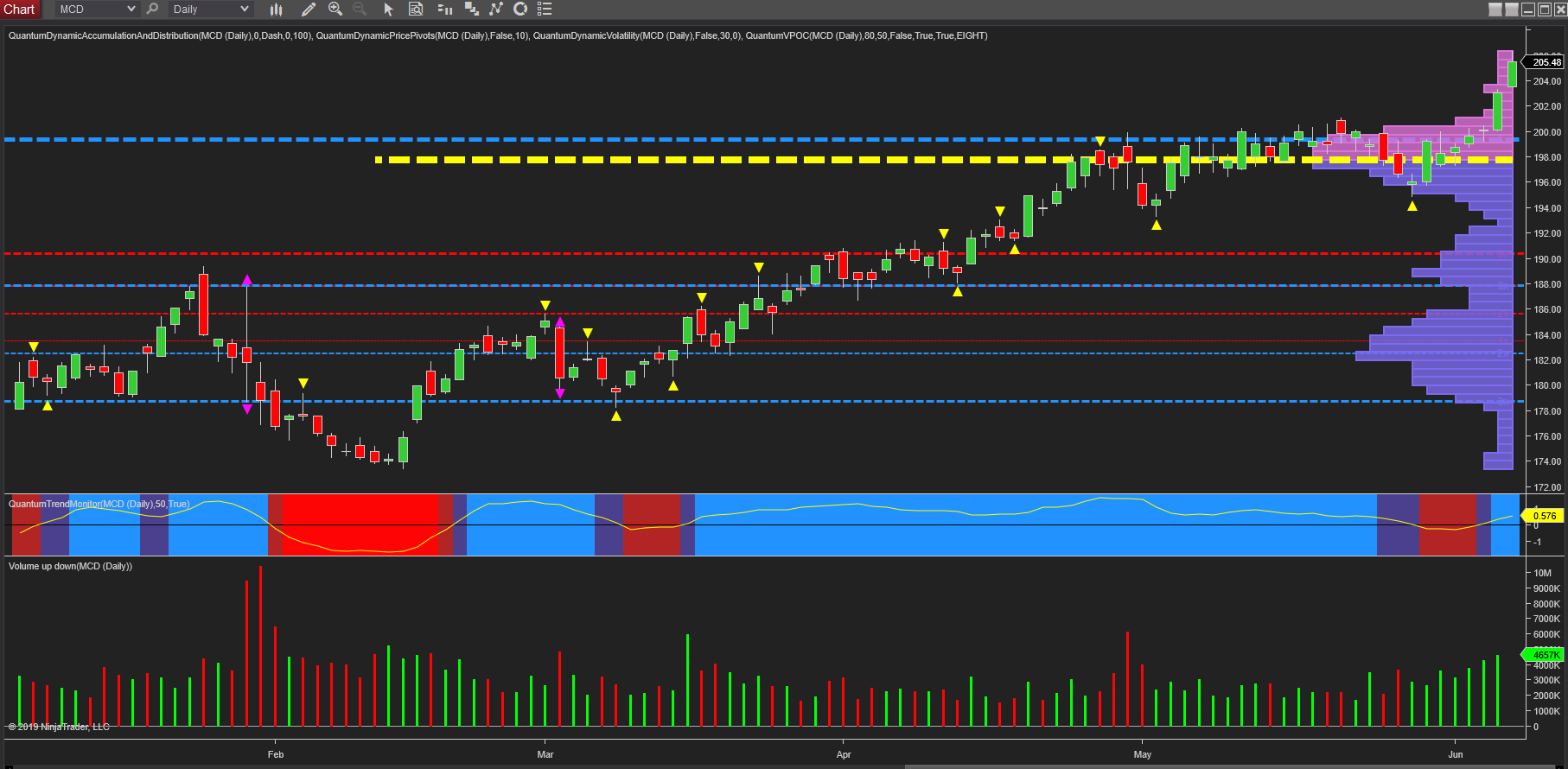

McDonald’s (NYSE:MCD) is a stock I’ve written about several times already this year, first when it was trading around the $188 per share and more recently at $195 ahead of earnings. In both posts, I suggested the stock was a buy as bullish momentum was firmly in place for this stock, and last week’s price action has confirmed this once more, with the stock closing at $205.48 with two solid up candles on the daily chart, a rise of almost 10% on the year. What is also interesting about McDonald is that it has raised its dividend each and every year since paying the first in 1976 which is quite an achievement.

So no surprise this year has been an excellent one for longer-term investors in the stock although the extended congestion phase of the last few weeks around the volume point of control at $198 has required patience. However, this has now been broken with McDonald’s moving firmly higher. From a technical perspective, we also have a strong platform of potential support denoted with the blue dashed line which was acting as a ceiling of resistance during the congestion phase. In addition, immediately above the current price, we have a low volume node on the volume histogram to the right of the chart, and as a result, the stock is likely to move through this area very quickly. Note also the volume at the bottom of the chart which is rising steadily with rising price action, a classic Wyckoff relationship for volume traders signalling further upside momentum to come, and all confirmed with the trend monitor indicator which has returned to bright blue.