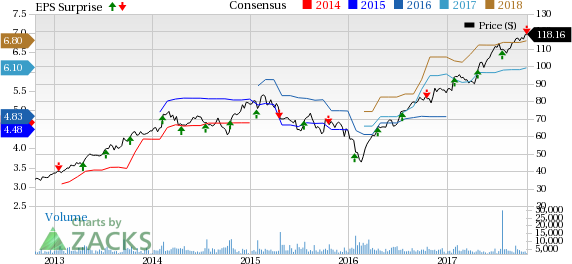

Packaging Corporation of America (NYSE:PKG) reported third-quarter 2017 adjusted earnings of $1.68 per share, up 29% year over year. Earnings came in line with management’s guidance, however the figure missed the Zacks Consensus Estimate by a penny.

Compared to the third-quarter guidance, earnings were negatively impacted by 2 cents per share due to hurricane-related items at certain mills and corrugated products facilities, offset by a partial insurance recovery related to the DeRidder Mill incident of 2 cents per share.

Including one-time items, earnings came in at $1.47 per share compared with $1.26 per share in the year-ago quarter.

Operational Update

Net sales for the quarter were $1.64 billion, up 10.5% from $1.48 billion recorded in the year-ago quarter. Sales also beat the Zacks Consensus Estimate of $1.62 billion.

Cost of products sold increased 7.6% year over year to $1.24 billion in the quarter. Gross profit jumped 14.7% to $397 million from $329.5 million witnessed in the prior-year quarter. Gross margin expanded 200 basis points (bps) to 24% in the quarter. Selling, general and administrative expenses escalated 11.4% to $130 million from $116.9 million incurred in the year-ago quarter. Operating income rose 17.4% year over year to $242 million.

Segment Performance

Packaging: Sales from this segment increased to $1.35 billion from $1.17 billion reported in the prior-year period. Segment EBITDA, excluding special items, was $341.3 million in the reported quarter compared with $256 million in the year-earlier quarter. Containerboard production was 996,000 tons, while containerboard inventory was up 7,000 tons compared to third-quarter 2016.

Printing Papers: Sales from this segment were $271.4 million in the reported quarter versus $292.8 million recorded in the year-earlier quarter. Segment EBITDA, excluding special items, for the quarter jumped to $39.4 million from $59.3 million reported a year ago.

Cash Position

At the end of the reported quarter, the company had cash balance of $370.5 million compared with $279.8 million at the end of the prior-year quarter.

Moving Forward

Packaging Corporation expects packaging segment demand to remain strong in fourth-quarter 2017 compared to the third quarter. Although the fourth quarter will witness seasonally lower volumes, which includes one less shipping day, as well as a seasonally less rich mix in corrugated products.

The company also expects contribution from its recently acquired Sacramento Container operations in the fourth quarter. In the paper segment, it has started implementing the recently announced price increases. While recycled fiber prices will likely move lower, higher wood and energy costs, along with higher prices for certain key chemicals and higher freight costs, are also expected in the next quarter.

Finally, Packaging Corporation anticipates annual outage costs of 12 cents per share, higher than the third quarter due to scheduled maintenance work at four mills. Considering these items, the company guided fourth-quarter earnings of $1.50 per share. However, this does not include any potential additional costs or anticipated recoveries related to the Deridder Mill insurance claim.

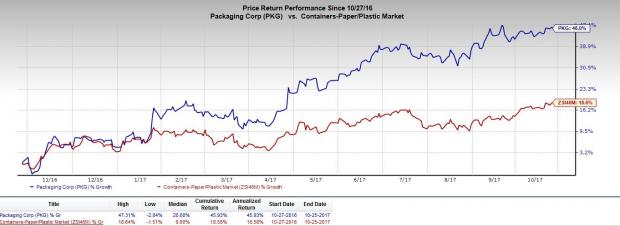

Share Price Performance

Over the last year, Packaging Corporation has outperformed the industry with respect to price performance. The stock has gained 46%, while the industry ascended 18.6%.

Zacks Rank & Key Picks

Packaging Corporation currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the same sector are Barnes Group Inc. (NYSE:B) , Nine Dragons Paper (Holdings) Limited NDGPY and Lakeland Industries, Inc. (NASDAQ:LAKE) . All three stocks flaunt a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Barnes Group has an expected long-term earnings growth rate of 10%.

Nine Dragons Paper has an expected long-term earnings growth rate of 18%.

Lakeland Industries has an expected long-term earnings growth rate of 10%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Packaging Corporation of America (PKG): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Lakeland Industries, Inc. (LAKE): Free Stock Analysis Report

NINE DRAGONS (NDGPY): Free Stock Analysis Report

Original post

Zacks Investment Research