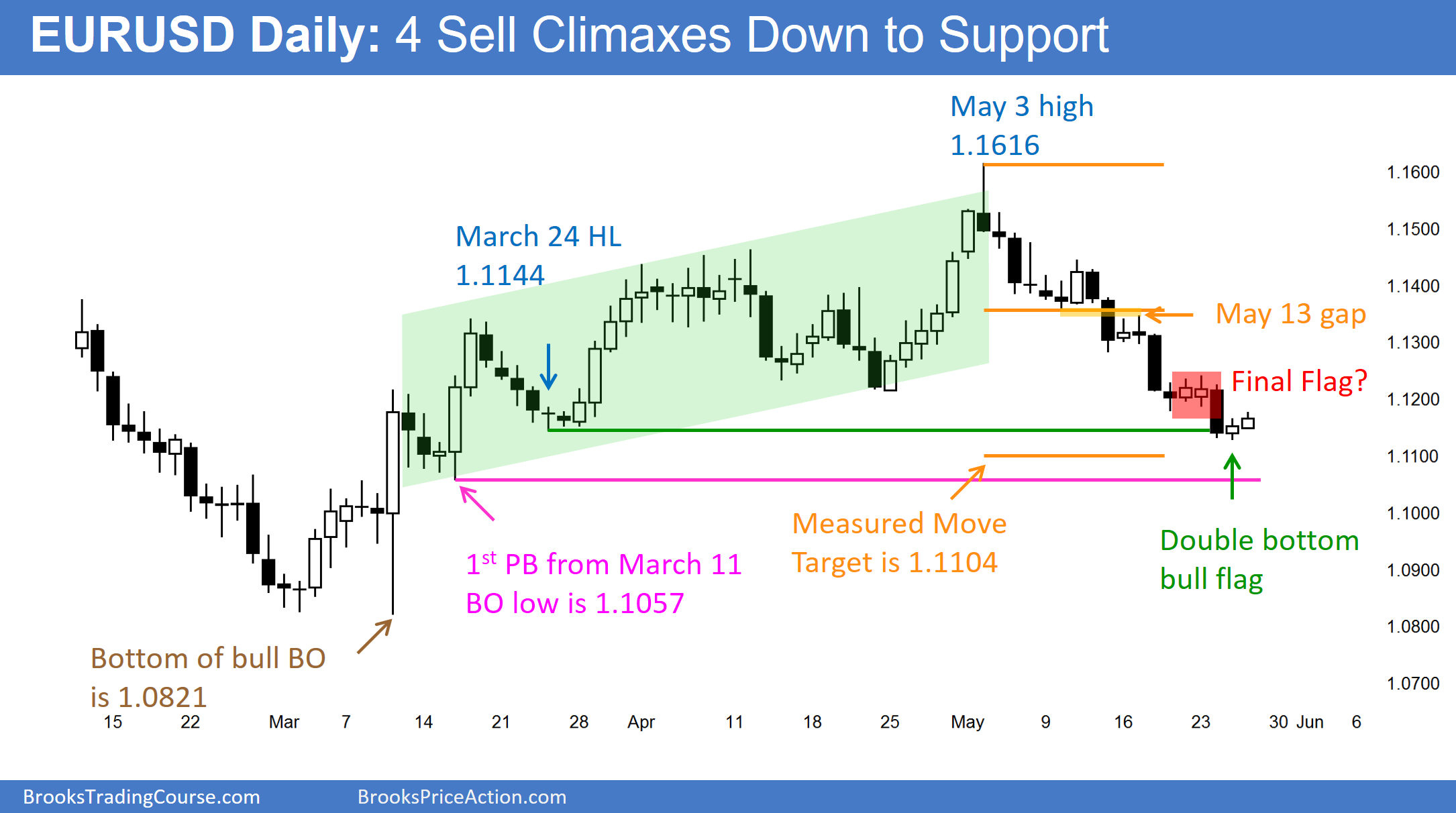

The EUR/USD daily chart has fallen in a series of 4 consecutive sell climaxes and is in a support zone. This means that it can bounce at any time. However, the bear channel from the the May 3 high has been tight. This means that the first reversal up will probably be minor. A minor reversal is a leg in a trading range. Bears will sell it, looking for a test back down. The bears would see the rally as a right shoulder in a head and shoulders top.

Measuring gaps are reliable when clear, and the May 13 gap was clear. The odds still favor a test of the measured move target at 1.1104, which is only 24 pips below Wednesday’s low. This might be close enough for bears to take profits and for bulls to begin to buy, expecting a tradeable bounce from this support area after a series of sell climaxes over the past month. Is also close to the bottom of the March 11 first pullback from the strong bull reversal. The bottom of the first pullback in a spike and channel rally is also a magnet that often gets tested.

Although the bears might break strongly below this support, especially after a wedge top on the weekly chart, this is not the type of selloff that typically falls relentlessly. A series of sell climaxes without much of a pullback usually is followed by a TBTL (ten bar, two leg) rally. Traders will be ready for this and the EUR/USD can reverse up quickly, since everyone expects it. However, there is no credible bottom yet, and there are still targets just a little lower.