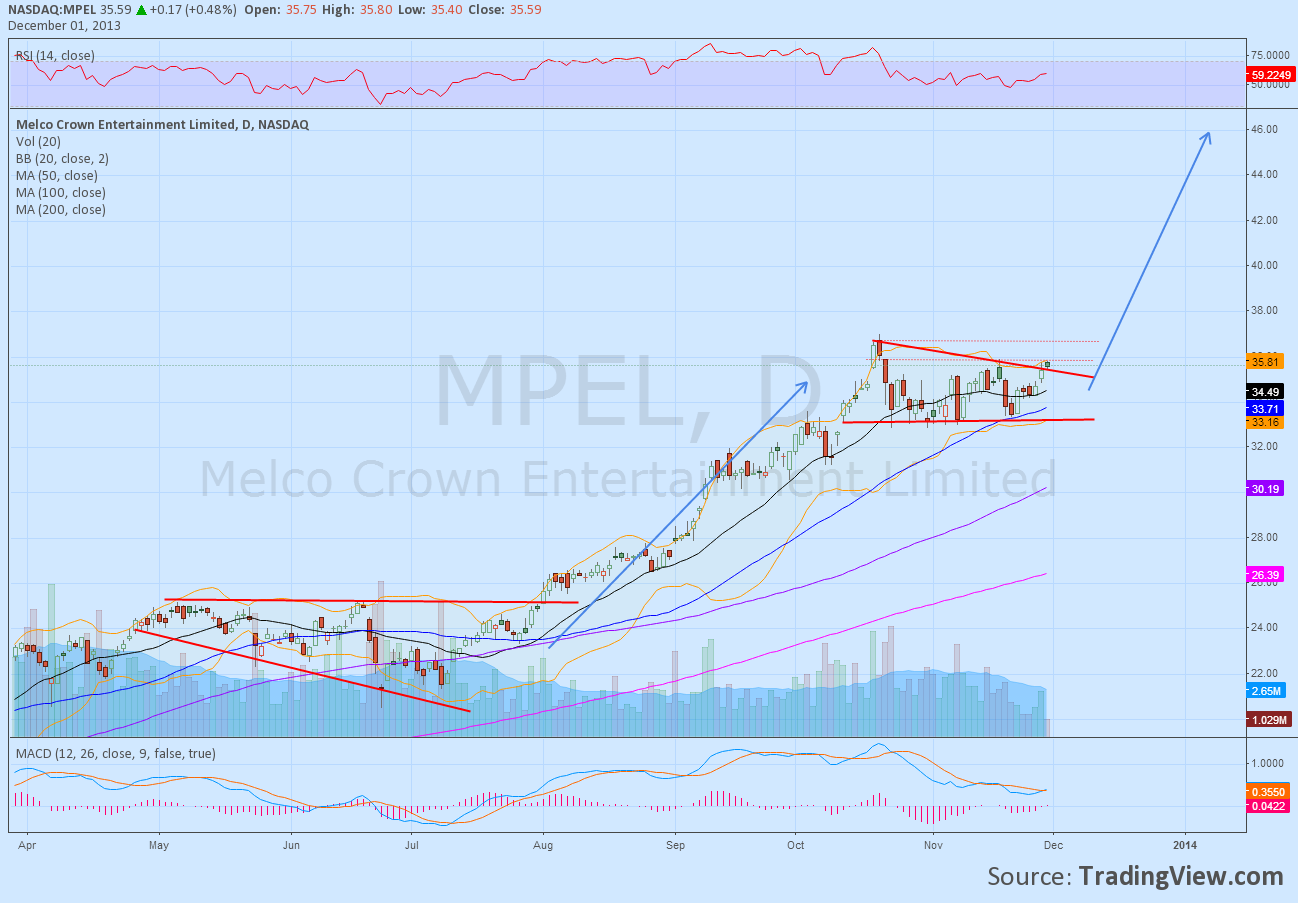

Melco Crown Entertainment, (MPEL)

Melco Crown Entertainment, (MPEL) moved higher out of the ascending triangle over the summer to a consolidation zone over 33.20 support. Notice this move started when 3 of the Simple Moving Averages (SMA) were packed into a tight zone. Now it can be called breaking a descending triangle or more conservatively approaching resistance at 36.60. The Relative Strength Index (RSI) is holding over the mid line and may be turning up with a MACD that is crossing up and starting to rise. The total beak of resistance and a new high targets a price of 46 on a Measured Move higher. There is support lower at 33.20 and 31.40 followed by 30.60.

Trade Idea 1: Buy the stock now (over 35.50 with a stop at 34.80) or on a move over 36.60 with a stop at 35.50.

Trade Idea 2: Buy the December 36 Calls (offered at $1.00 late Friday) on a move over 36.

Trade Idea 3: Buy the January 36 Calls ($1.55) on a move over 36.

Trade Idea 4: Buy the December 36 /December 6th 36.50 Call Diagonal, buying the December monthly and selling the weekly (80 cents).

Trade Idea 5: Buy the January 36/December 37 Call Diagonal ($1.00).

Original post