Investing.com’s stocks of the week

The “fund of funds” style is a portfolio tactic that has been used successfully for many large investment companies. Think about those target-date or target-risk funds in your 401(k). They are essentially a single mutual fund filled with 8-12 underlying funds to create a highly diversified investment strategy using varying asset classes.

It was initially assumed that this same dynamic would be readily embraced in the exchange-traded fund format as well. However, after several failed attempts, it’s becoming apparent that ETF investors want certain attributes within a “fund of fund” strategy that they can’t find elsewhere. The following three examples highlight the largest of this breed and how they have developed over the last decade.

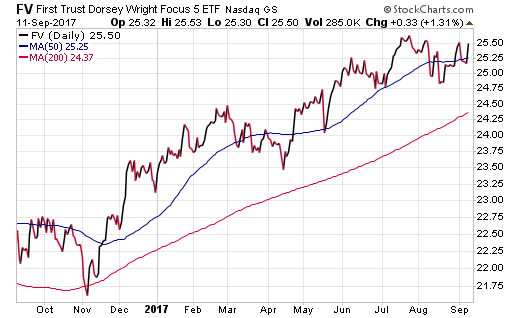

The First Trust Dorsey Wright Focus 5 (NASDAQ:FV) is the largest of this class with $2.3 billion in assets under management and a unique stock-focused methodology. FV conducts relative strength assessments on a wide universe of sector and industry-based ETFs to determine the funds shows the strongest momentum. It then selects five of those top-ranked ETFs to make up its underlying portfolio and equally weights each component.

The result is a sector-rotation style fund built around a highly dynamic, rules-based index that can shift as often as monthly. FV charges a management fee of just 0.30% in addition to the acquired expenses of the underlying funds at 0.59% to implement the strategy.

The FV portfolio clearly checks all the boxes of low-cost, transparency, and a structured approach for fans of momentum or sector investing.

Another large example of the “fund of funds” style is the IQ Hedge Multi-Strategy Tracker (NYSE:QAI). As its name implies, this ETF is designed to track the broad performance of the hedge fund universe alongside low correlation to the equity markets. It’s multi-asset approach allows for long and short positions in stocks, bonds, currencies, and commodities according to its index mandate.

QAI has just over $1 billion in total assets and charges a management fee of 0.75% in addition to acquired fund fees of 0.22%. Many of its underlying assets are low-cost index funds from the likes of Vanguard and Blackrock (NYSE:BLK), which keeps holding expenses to a minimum.

The type of strategy implemented by QAI will most likely be sought after by institutional-type portfolios seeking to augment their traditional investment exposure with an alternative style.

The third largest of the group may be the easiest to understand. The iShares Core Growth Allocation (NYSE:AOR) recently crossed the $1 billion mark and touts a total net expense ratio of just 0.25% with underlying holdings included. AOR is the largest of a suite of target-risk portfolio models from BlackRock that span the gamut from conservative to aggressive.

Its underlying portfolio is a traditional 60/40 split of stocks and bonds composed from 10 of the iShares core ETFs. This includes both domestic and international exposure for both asset classes, which gives it a truly global reach. It can be used as either an all-inclusive portfolio solution with a highly diverse pool of assets or as a core holding alongside conventional index or active funds.

The Bottom Line

Many investors prefer to use individual ETFs as building blocks to create a cohesive portfolio solution. Yet in that framework, there are desirable attributes of owning a highly diverse multi-asset ETF for its risk framework or an unconventional strategy with a rigid investment discipline. One of the under realized features of these funds are their strict rebalancing and index methodologies that create more efficient tracking over time.

Whether you are an investment novice or swarthy veteran, there are many options to consider in this category to augment or immediately implement a well-rounded portfolio.

Disclosure: At the time this article was written, the author owned shares of AOR.