While H117 results reflect a slower than expected performance in each of the key divisions, Medserv (MT:MDS) looks set to deliver sequential improvement in H2. We have lowered FY17 estimates; however, our FY18 estimates remain largely unchanged as momentum from the increased drilling program from Q417 should continue. The longer-term investment case is underpinned by established contracts for drilling and OCTG services together with workover programs. In addition, the company is well placed to secure business in new geographic markets to support growth.

H117 results

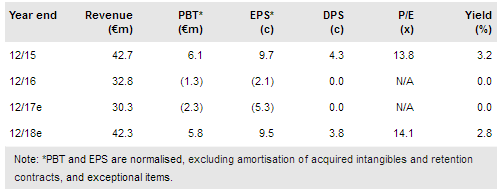

Medserv reported H117 revenues of €13.6m, down from €17.3m in H116, with reported EBITDA of €1.6m, down from €3.6m. Divisionally, Integrated Logistic Support Services (ILSS) reported revenues of €5.8m, with a lower than expected contribution from Malta. The Oil Country Tubular Goods (OCTG) operations of METS reported H117 revenues of €7.5m, up from €6.5m in H116. With a lower H1 contribution, the company has reduced group FY17 revenue guidance from €35.9m to €30.0m. However, H217 could see a sequential improvement as drilling programme support increases.

To read the entire report Please click on the pdf File Below: