Overview:

Medley (MDLY) is a rapidly growing asset management firm with approximately $3.3 billion of AUM (assets under management) as of June 30, 2014, focused on private junk bonds. Based in New York, NY, Medley Management (MDLY) scheduled a $126 million IPO on NYSE with a market capitalization of $616 million at a price range midpoint of $21 for Wednesday, Sept. 24, 2014.

MDLY focuses on credit-related investment strategies, primarily originating senior secured loans to private middle market companies in the United States that have revenues between $50 million and $1 billion of revenue. MDLY generally holds these loans to maturity.

The full IPO calendar is available at IPOpremium. . There are nine new IPOs scheduled for the week of September 22.

Manager, Co-managers: Goldman Sachs, Credit Suisse

Overview

The offering is for 6 million shares of class A stock which are entitled to dividends. Virtually all voting control is held by 23 million class B shares.

The annual expected dividend is $.80, or 3.8% at the price range mid-point of $21

MDLY’s year over year AUM growth as of June 30, 2014 was 62% and its compounded annual growth rate of AUM from December 31, 2010 through December 31, 2013 was 31%, which have been driven in large part by the growth in MDLY’s permanent capital vehicles.

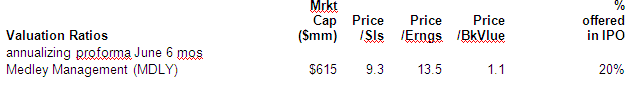

Valuation

Glossary

Conclusion

MDLY has found a private junk bond niche, and grew assets under management 62% for the year ended June 30, 2014.

Pays 3.8% yield at the price range mid-point.

The rating is neutral.

To put the conclusions and observations in context, the following is reorganized, edited and summarized from the full S-1 referenced above.

Business

Medley is a rapidly growing asset management firm with approximately $3.3 billion of AUM as of June 30, 2014.

MDLY provides institutional and retail investors with yield-oriented investment products that pay periodic dividends or distributions that it believes offer attractive risk-adjusted returns.

MDLY focuses on credit-related investment strategies, primarily originating senior secured loans to private middle market companies in the United States that have revenues between $50 million and $1 billion of revenue. MDLY generally holds these loans to maturity.

MDLY manages two permanent capital vehicles, both of which are BDCs (business development corporations) as well as long-dated private funds and SMAs.

MDLY’s focus on senior secured credit, combined with the permanent and long-dated nature of its vehicles, leads to predictable management fee and incentive fee income.

MDLY’s year over year AUM growth as of June 30, 2014 was 62% and its compounded annual growth rate of AUM from December 31, 2010 through December 31, 2013 was 31%, which have been driven in large part by the growth in MDLY’s permanent capital vehicles.

31% AUM (assets under management) growth rate

MDLY believes its 31% compounded annual growth rate of AUM from December 31, 2010 through December 31, 2013 compares favorably with both its small and middle market asset manager peers, who had an average compounded annual growth rate of AUM of 18% for the same period, and the 26 component BDCs of the Wells Fargo Business Development Company Index, who had average total asset growth of 19% for the same period.

As MDLY has grown its AUM in permanent capital vehicles over time, MDLY also has maintained a consistent presence in the institutional market, with AUM in long-dated private funds and SMAs growing from $1.0 billion as of January 1, 2012 to $1.5 billion as of June 30, 2014.

Since the launch of MDLY’s first permanent capital vehicle in January 2011, permanent capital has grown to represent 55% of its AUM as of June 30, 2014. For the six months ended June 30, 2014, 90% of its standalone revenues were generated from management fee income and performance fee income derived primarily from net interest income on senior secured loans.

Competition

MDLY expects to face competition in its lending and other investment activities primarily from other credit-focused funds, specialized funds, BDCs, real estate funds, hedge fund sponsors, other financial institutions and other parties.

Many of these competitors in some of MDLY’s businesses are substantially larger and have considerably greater financial, technical and marketing resources than are available to MDLY.

Many of these competitors have similar investment objectives to us, which may create additional competition for investment opportunities.

Some of these competitors may also have a lower cost of capital and access to funding sources that are not available to MDLY, which may create competitive disadvantages for MDLY with respect to investment opportunities.

In addition, some of these competitors may have higher risk tolerances, different risk assessments or lower return thresholds, which could allow them to consider a wider variety of investments and to bid more aggressively than MDLY for investments that MDLY wants to make.

Lastly, institutional and individual investors are allocating increasing amounts of capital to alternative investment strategies.

Several large institutional investors have announced a desire to consolidate their investments in a more limited number of managers.

MDLY expects that this will cause competition in its industry to intensify and could lead to a reduction in the size and duration of pricing inefficiencies.

5% shareholders pre-IPO

Brook Taube 42.9%

Seth Taube 42.9%

Jeffrey Tonkel 7.8%

Dividend Policy

Following this offering and subject to legally available funds, MDLY intends to pay quarterly cash dividends to the holders of its Class A common stock initially equal to $0.20 per share of Class A common stock, commencing with a dividend payable in the first quarter of 2015 in respect of the fourth quarter of 2014.

The annual expected dividend is $.80, or 3.8% at the price range mid-point of $21.

Use of proceeds

MDLY intends to use the $117 million in proceeds from its IPO as follows:

- to purchase a number of newly issued LLC Units from Medley LLC that is equivalent to the number of shares of Class A common stock that MDLY offers and sells in this offering.

- to repay $15.0 million of indebtedness under the Term Loan Facility and the remainder for general corporate purposes. The Term Loan Facility matures on June 15, 2019. As of August 15, 2014, borrowings under the Term Loan Facility bore interest at a variable rate equal to adjusted LIBOR plus an applicable margin of 5.50%.

Disclaimer: This MDLY IPO report is based on a reading and analysis of MDLY’s S-1 filing, which can be found here, and a separate, independent analysis by IPOdesktop.com. There are no unattributed direct quotes in this article.