Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

We make up a weekly medium-term trade list based on CFTC reports and technical analysis.

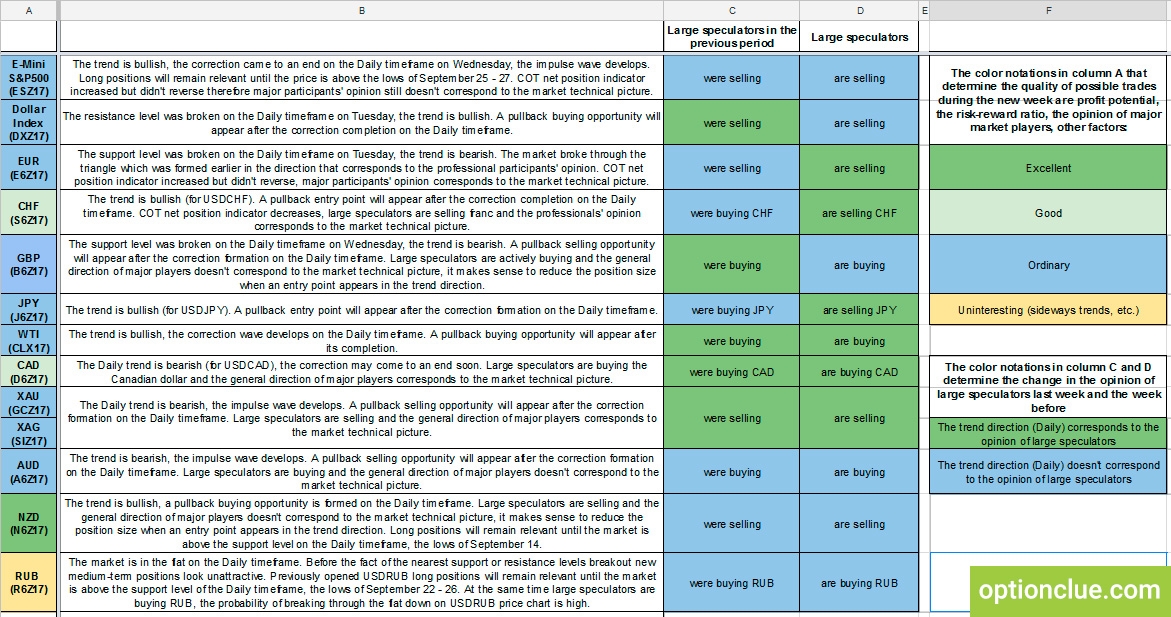

The table below provides a description of the technical condition of the market on the most popular financial instruments, as well as information on the large speculators’ actions according to the last COT reports and the previous period.

If you want to use CFTC reports in your trading practice, you should understand that for an objective assessment of the situation it’s not enough to know the data of the last report. The dynamic is more important, in other words, comparing the statistics of large speculators’ actions in the current period with the previous one, so we publish both values in the table.

Conclusions

In terms of medium-term trading, financial instruments with the correction close to completion on the Daily timeframe and with potentially the most promising risk-reward ratio are NZD/USD and EUR/CHF.

USD/CHF, USD/CAD, EUR/GBP, AUD/JPY, EUR/USD are less interesting, but in the near future they can also become noteworthy depending on the depth of the market correction.

After breaking through the triangle, USD/RUB may become interesting (the market is likely to break this converging formation down due to large speculators’ active purchases of roubles).

Other financial instruments in the trade list may be also interesting, but in these markets pullback signals on the Daily timeframe are likely to occur no earlier than a week.

Good luck in trading!