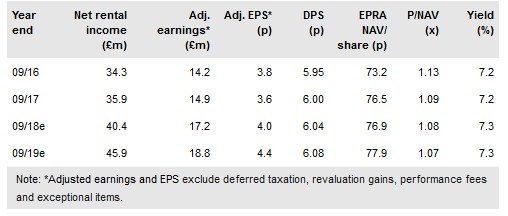

Medicx Fund Ltd (LON:MXF) produced a 3.9% EPRA NAV total return in the three months ended 31 December 2017, with EPRA NAV per share increasing to 78.0p from 76.5p, and including the 1.50p dividend per share paid in the period. A quarterly dividend of 1.51p per share has been approved for payment in March and the fund still targets an aggregate 6.04p payout for the year to 30 September 2018. Capital commitments continued in the period and the pipeline of acquisition opportunities remains strong. While investment advisor fees remain frozen, asset growth should have a geared impact on earnings, contributing towards increased dividend cover.

Yield tightening continues to support total return

The externally assessed quarterly valuation of the investment portfolio increased to £698.6m in the three months to 31 December, up 2.6%. The £18.3m increase included a revaluation gain of £8.3m and £15.2m of capital investment offset by £5.2m of disposals, comprising five small, non-core assets. The valuation reflects a further slight tightening in the UK net initial yield, to 5.05% versus 5.08% at 30 September, and a yield forecast of more than 6% in Republic of Ireland. The capital investment includes two previously disclosed acquisitions including a fifth property in the Republic of Ireland, at Kilkenny. Six properties were under construction at the end of December 2017, four of which are due to complete in the next two months.

To read the entire report Please click on the pdf File Below: