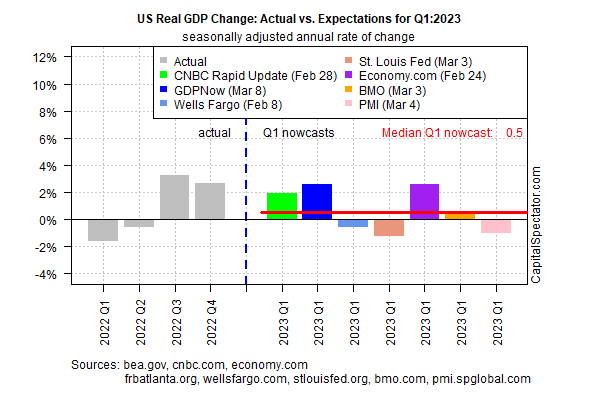

Several indicators are flashing recession warnings for the U.S., but the median estimate for economic activity in the first quarter leaves room for doubt about the timing.

After dipping slightly negative in the Feb. 22 report, the median recovered to a weak 0.5% increase in today's revision. If the nowcast is accurate, the gain will mark the third straight quarterly rise in output, albeit at a stall-speed pace.

The main threat to today’s estimate: heightened uncertainty for incoming Q1 data between now and the government’s initial release of the January-through-March GDP report on Apr. 27. A key variable that’s under scrutiny at the moment: expectations for interest rate hikes after hawkish comments from Federal Reserve Chair Jerome Powell.

Over two days of testimony in Congress on Tuesday and Wednesday, the Fed chief made it clear that he still sees inflation as a pressing threat to the economy.

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” he said in prepared remarks for his visit to Capitol Hill. “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

In reaction to Powell’s comments, Fed funds futures are now pricing in a 76% probability of a 50-basis-points hike at the next FOMC meeting on Mar. 22. Before his testimony, the market expected a 25-basis-point increase.

Alfonso Peccatiello, CEO of TheMacroCompass.com, said,

“The issue is — the tighter you keep borrowing conditions for the private sector, the higher you keep mortgage rates, the higher you keep corporate borrowing rates — the higher the chances you’re going to freeze these credit markets and basically sleepwalk into an accident or, in general, accelerate a recession later on,”

Meanwhile, financial markets are warily eyeing tomorrow’s payroll report for February. The Wall Street Journal noted,

“Analysts [are] warning about the potential for key economic releases to deliver a further blow to investors’ early-year optimism,”

Rick Rieder, chief investment officer at BlackRock, advised,

“We think there’s a reasonable chance that the Fed will have to bring the Fed Funds rate to 6%, and then keep it there for an extended period to slow the economy and get inflation down to near 2%,”