Going into 2016, I was trying to anticipate positive headlines. One potential positive was in the headlines this past week - Median Household Income Back at Level When Great Recession Began in November 2015.

Follow up:

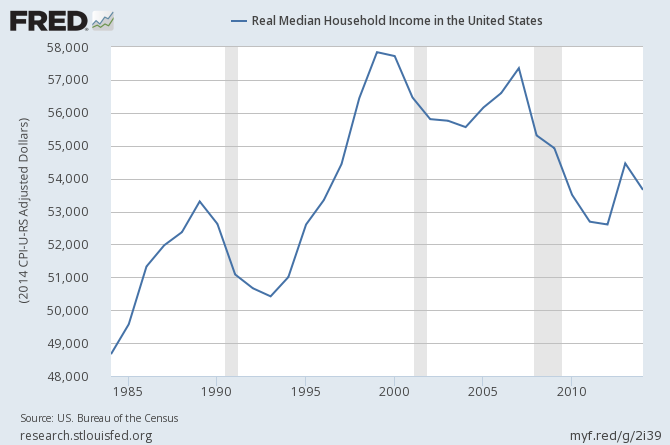

For a little background, inflation adjusted median household income peaked in 1999 at $57,843. According to the St. Louis Fed it has been in a general, but irregular, down trend since.

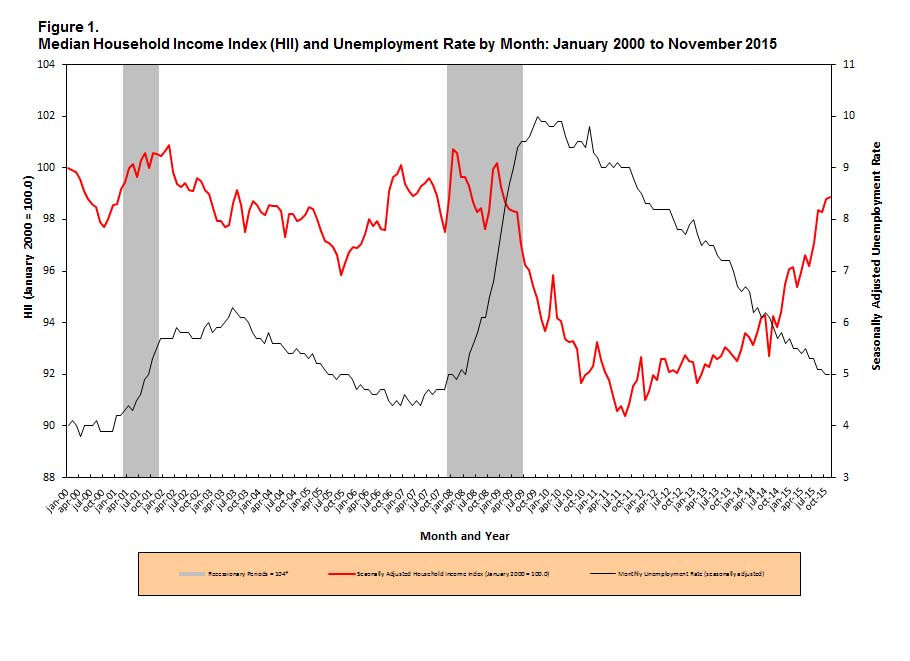

[Note that the FRED graph above uses one data point per year whilst the Sentier Research graph below uses monthly data points. Also the FRED graph cuts off in 2014 whilst the Sentier graph contains data through November 2015. Finally, although the raw data sets analyzed are the same, the methodology is different.]

In a post last week, Gordon Green of Sentier Research stated:

Even though median annual household income did not increase significantly in November 2015, we continue to see an upward trend in income that has been evident since the low point in August 2011. We have now recaptured all of the income losses that have occurred since the beginning of the last recession in December 2007. The November 2015 median is now only 1.1 percent lower than the median of $57,388 in January 2000, the beginning of this statistical series.

Based on what I am seeing (anecdotal data) - I wonder if there is something wrong with the methodology which delivers the median income. I do believe household income is on an upward trend - but I believe (without supporting facts) that the rate of increase is exaggerated. Is there an element explaining the trends? According to US Census:

Income of Households - This includes the income of the householder and all other individuals 15 years old and over in the household, whether they are related to the householder or not.

Could it be all the families that are recombining? Like failure-to-launch kids living with parents. According to a Fannie Mae study:

The percent of young adults, aged 18 to 34, who are living with their parents has increased from an average of 27 percent between 1990 and 2006 to 31 percent in 2013 (a total of approximately 22 million).

Or maybe kids who have taken in their aging parents? Or the number of unrelated people living together?

It does not take much of a swing in trends of living arrangements to begin to skew median household income data. I do not get the feeling most people over 50 feel they are better off than they were in the 1990s. Like all data, you cannot grab one element and believe it is gospel.

Other Economic News this Week:

The Econintersect Economic Index for January 2016 declined - and is now at the lowest value since the end of the Great Recession. The tracked sectors of the economy which showed growth were mostly offset by the sectors in contraction.Our economic index remains in a long term decline since late 2014.

Current ECRI WLI Growth Index

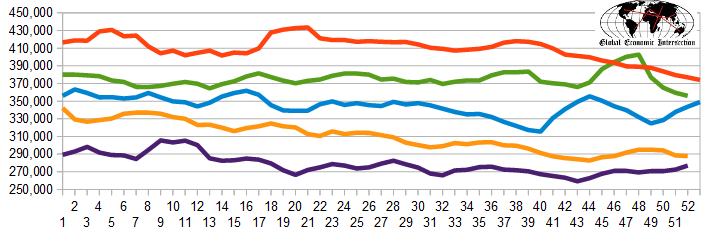

The market (from Bloomberg) was expecting the weekly initial unemployment claims at 268 K to 300 K (consensus 270,000) vs the 287,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 272,500 (reported last week as 272,500) to 277,000. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Privately-held DF Investments, KaloBios Pharmaceuticals

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: