In my recent commentary, “An Assault on Yield-Oriented ETFs,” I discussed the reasons why the markets had been punishing income producers as much as capital appreciators. Briefly, tax rate hikes on dividends and distributions may turn out to be more onerous than those for capital gains.

Additionally, I encouraged investors who had large cash positions to “get their yield on.” Specifically, I suggested that they recognize a high probability of an eventual fiscal cliff resolution as well as a high likelihood that asset classes from master limited partnerships (MLPs) to REITs to business development companies would subsequently soar.

On Friday (11/16), House Speaker John Boehner expressed a modest amount of enthusiasm on fiscal cliff talks, and stocks rocketed more than 1% off their trading day lows. The S&P 500 SPDR Trust (SPY) finished nearly 0.5% higher on the day.

That wasn’t even the impressive part. Guggenheim Multi-Asset Income (CVY) closed 1.4% higher, JP Morgan Alerian MLP (AMJ) surged 3.2% higher and iShares Mortgage REITs (REM) catapulted to a 3.8% finish. In other words, in spite of many journalists declaring the death of high dividend-producing assets, many can and will succeed with a little clarity from lawmakers.

Granted, nobody can guarantee that both the legislative and executive branches will come to terms. In the same vein, it is premature to bury high-yielding investments.

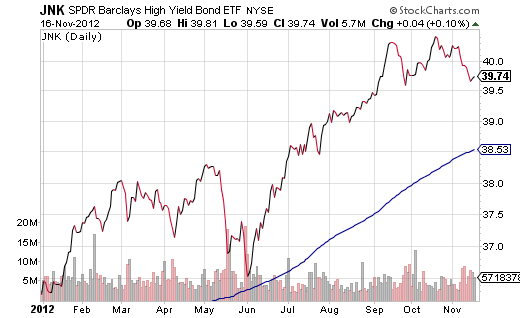

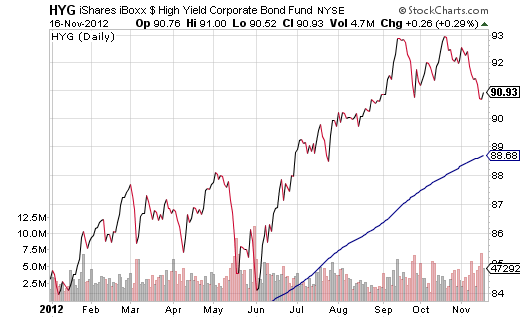

Consider the “hit job” on diversified high yield corporate bonds. The way some writers have described it, investors do not want to have anything to do with SPDR High Yield Corporate (JNK), iShares High Yield Corporate Bond (HYG) or PowerShares High Yield Corporate Bond (PHB). The evidence presented? Investors redeemed roughly $550 million of the nearly $16 billion in assets from HYG and approximately $280 million from the $11.6 billion in JNK in the week ending 11/15.

There are several problems with the simplistic fund flow observation, however. For one thing, the percentage changes in assets under management for the S&P 500 SPDR Trust (SPY ) as well as the iShares Russell 2000 Fund (IWM) were both greater than either of the high yield corporate bond funds. IWM decreased in assets under management by -5.3% to JNK’s -2.3%. In other words, far more money and a far greater percentage had been redeemed from popular Stock ETFs, yet story-tellers chose a “watch-out-for-junk-bonds” angle.

Equally worthy of note, HYG and JNK price declines after the election were less than nearly any other high-yielding ETF. Whereas HYG and JNK suffered -2% drawdowns, funds like JP Morgan Alerian (AMJ) and Guggenheim Multi-Asset Income (CVY) were slammed for -8.6% and -6.3% respectively. (Note: With Boehner’s optimistic outlook on Friday, even these yield-oriented ETFs came roaring back to life.)

I am not suggesting that diversified high yield corporate bond ETFs are immune from panicky market behavior. On the contrary! Expect a genuine exodus to occur if fiscal cliff resolution hopes fade away.

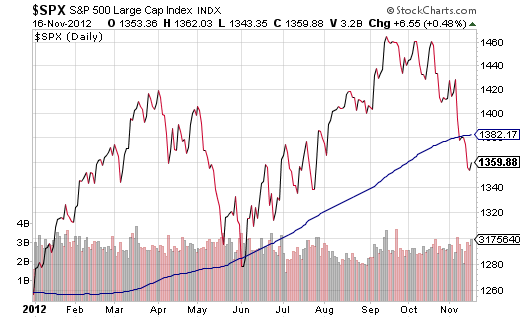

Still, it’s critical to maintain some perspective. A majority of individual S&P 100 constituents sit below respective 200-day trendlines, as does the heralded S&P 500 benchmark. On the other hand, JNK and HYG still offer technical uptrends.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Media Exaggerate Exodus From Junk Bond ETFs

Published 11/17/2012, 02:33 AM

Media Exaggerate Exodus From Junk Bond ETFs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.