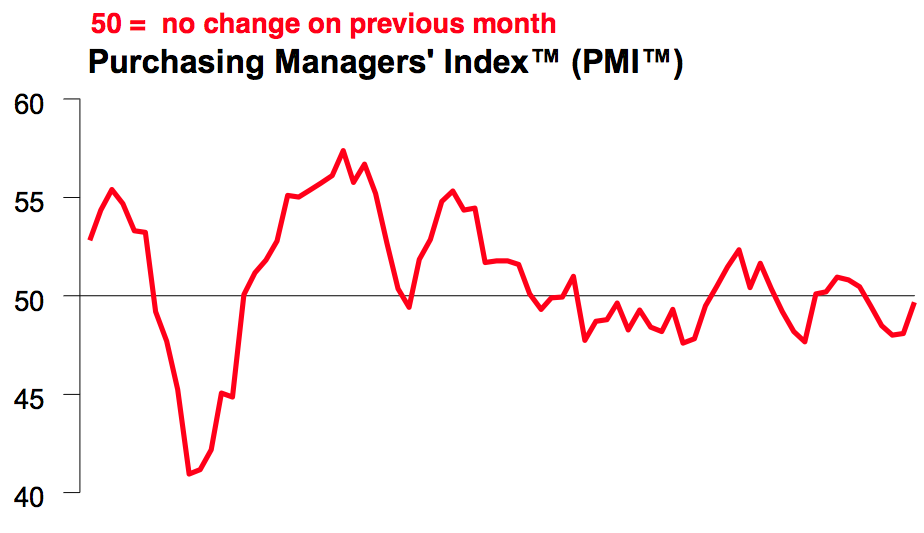

The news out of China continues to be mixed. On one hand, the HSBC China Manufacturing flash PMI beat expectations with a reading of 49.7, which was a five-month high, suggesting stabilization, but remained below 50 indicating contraction.

Measuring market expectations

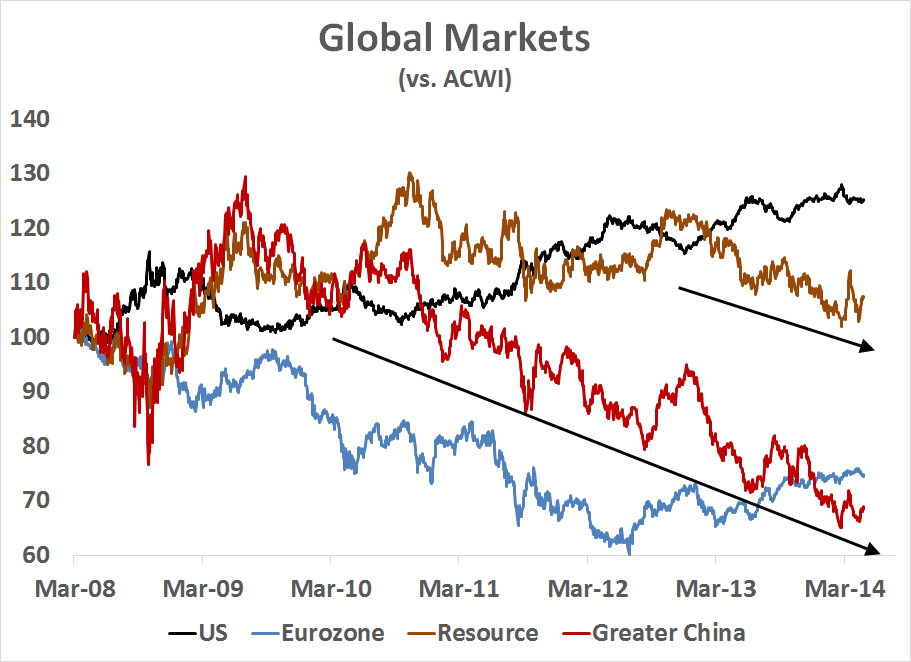

Rather than try to prognosticate myself, I thought that I should ask Mr. Market what he thought of what is happening in China. For the long-term view, I measured the relative performance of several equity market indices against the MSCI All-Country World Index (NASDAQ:ACWI). All returns are total returns and measured in USD, so we have an apples-to-apples comparison in a single currency. The countries and regions that I measured are:

- US (SPDR S&P 500 (ARCA:SPY))

- Eurozone (SPDR DJ Euro STOXX 50 (NYSE:FEZ))

- Resource markets, as they are sensitive to both world growth and Chinese demand: Canada (iShares MSCI Canada (NYSE:EWC)), Australia (iShares MSCI Australia Index (ARCA:EWA)) and South Africa (iShares MSCI South Africa (NYSE:EZA)) on an equal-weighted basis.

- Greater China, defined as China (iShares FTSE/Xinhua China 25 Index (ARCA:FXI)), Hong Kong (iShares MSCI Hong Kong (ARCA:EWH)), Taiwan (iShares Taiwan Index (ARCA:EWT)) and South Korea (iShares South Korea Index (ARCA:EWY)), as a way of better measuring China than just analyzing FXI, which is a somewhat narrow index.

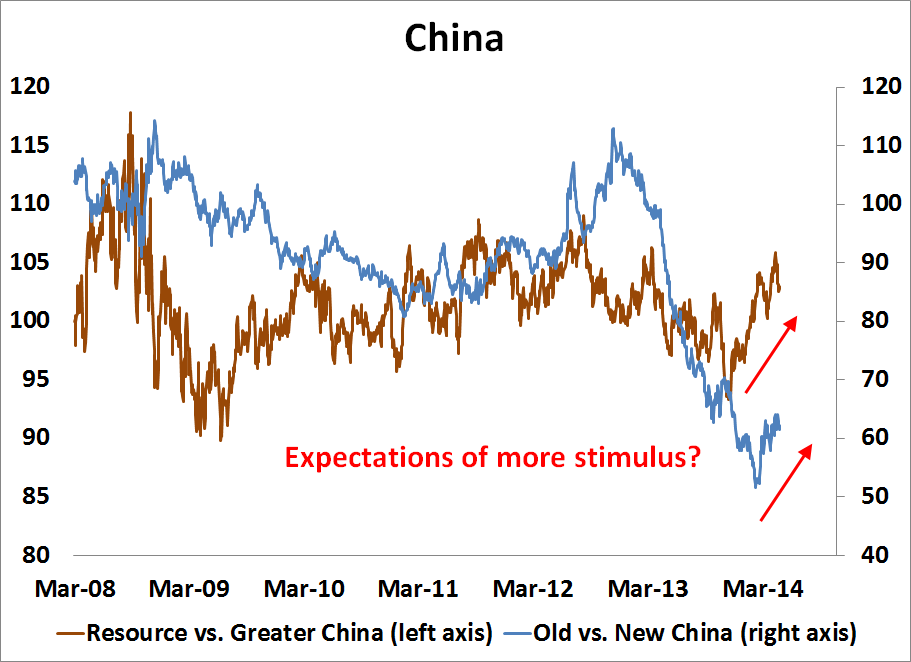

If we were to zoom in further, the next chart shows the relative performance of the Resources basket relative to the Greater China basket and Old China (FXI) to New China (FXI), which is heavily weighted in financials, against New China (Golden Dragon Halter USX China (NYSE:PGJ)), which is heavily weighted towards the consumer-oriented internet and technology sector (see my previous post A New China vs. Old China pair trade).

Based on the last two charts, I can conclude the following about the general level of market expectations:

- Chinese growth has been slowing for years and continues to slow; but

- The latest uptick is expected to be led by the same-old-same-old formula of another round of macro infrastructure spending led stimulus, despite all the official rhetoric.

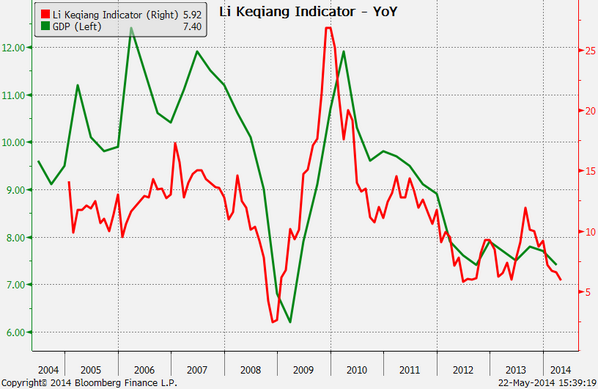

Indeed, Premier Li Keqiang stated last week that the economy needed some "fine tuning" in the face of "downward pressure":

"Currently, the economy is generally stable and we see positive structural changes, but downward pressures are still large and we cannot be complacent," Li said during a visit to the northern region of Inner Mongolia.

"We should use appropriate policy tools and pre-emptive fine-tuning in a timely and appropriate manner to help resolve financing strains for the real economy, especially small firms' difficulties in financing and high borrowing costs," he said.

Such policy fine-tuning should help maintain "reasonable growth" in money supply and bank credit, he said.

If market expectations are correct, China will not crash, but down that road lies a Lost Decade (see China turns Japanese?).

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.