Crude Oil has had a really rough 7 months. The plunge in prices that began in October seems to have settled in for the last 2 months. And perhaps the price is ready to reverse higher. I am not the guy that needs to be able to say I got the absolute bottom so I will continue to wait for proof of not only a bottom, but that the consolidation is over and it wants to head higher.

At times like these it is important to remember that a stock or commodity or index or currency can have 3 different trends, not two. There is an uptrend and a downtrend, but there is also consolidation. The sideways trend. There is no reason that Oil or anything else needs to move from a downtrend directly to an uptrend. It could move sideways for years. In fact it has done this.

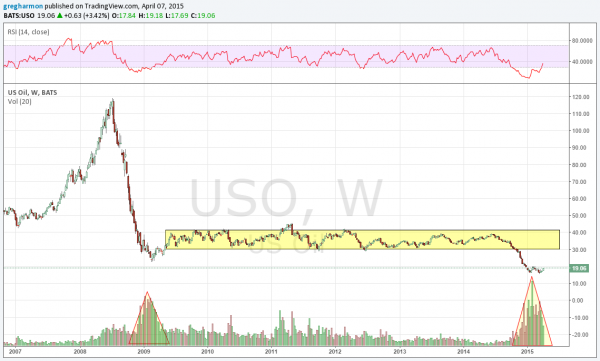

One proxy for Crude oil is the United States Oil Fund (NYSE:USO), who’s price chart is pictured above. There are two characteristics I want to focus on in that chart. The first supports the thesis above. The US Oil ETF fell hard with Oil prices in 2008 into early 2009. But from there is moved sideways for over 5 years. You need proof that a bounce does not always follow a fall then here it is.

The second characteristic is the two oversized triangles of volume that appear. The first occurred after the 2008 fall and the second is finishing out now, after the fall from last October. These triangular patterns signify capitulation. Volume building to a peak and then falling off. This is a real sign that the drop in Oil prices may be over. Now you know why I started with the first point. The drop may be over, but look for proof that the new direction is not sideways before getting involved.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.