Investing.com’s stocks of the week

While not much is happening on foreign exchange markets in North America early this week, the United Kingdom took yet another step toward leaving the European Union (EU).

Parliament has adopted the text allowing British Prime Minister Theresa May to trigger article 50 of the Treaty of Lisbon by the end of the month. We will then see (no doubt heated) negotiations with the other 27 EU member nations on the conditions surrounding this exit.

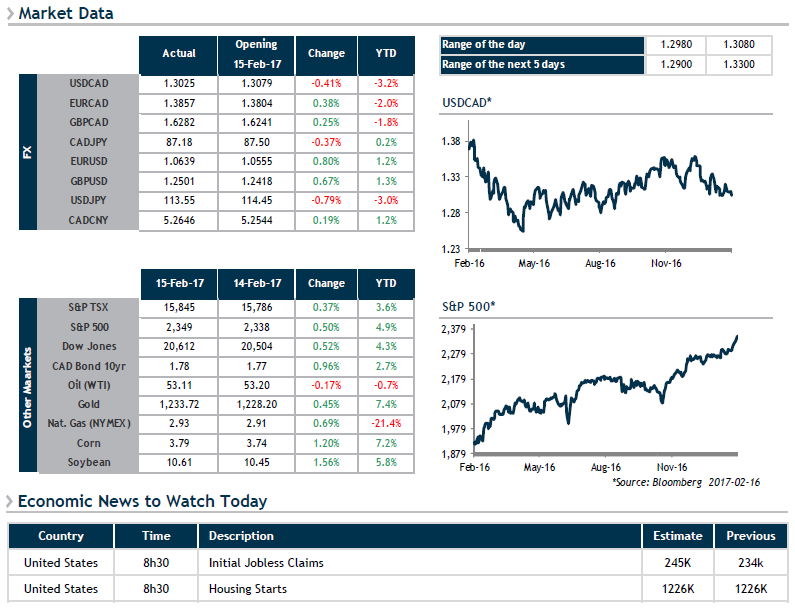

The impact of Brexit has already been sharply felt on the currency front, with the GBP down 20% against the USD and 15% against the EUR since June. But what comes next is a series of unknowns: could the United Kingdom implode further to a referendum in Scotland to remain in the EU? Could there be a political crisis in the EU brought on by the rise to power of far-right parties? Certainly this could be a possibility in the Dutch legislative elections tomorrow and the French presidential election in April/May.

These political uncertainties, coupled with those seen south of the border, could revive volatility on foreign exchange markets and have a negative impact on bottom lines. It is therefore critical to exercise caution and implement appropriate FX strategies.