Yesterday was yet another day of reversing the trends of the previous day. The fear that the lower-than-expected ISM figure created on Tuesday faded and USD managed to recover against most currencies, led by USD/JPY. That was despite a fall in US equities.

The debate over monetary policy continues. The relatively dovish (2 out of 5) Fed Gov. Sarah Raskin warned against an early tapering off, saying that the US economy needs to create many more jobs, while the relatively hawkish (4 out of 5) Kansas City Fed President Esther George said tapering off “would not constitute an outright tightening of monetary policy, but rather, it would slow policy easing" and warned against leaving policy too loose for too long. The disagreement on the pace of “tapering off” makes me more confident that if and when it does occur, the pace will be slow and its impact only gradual.

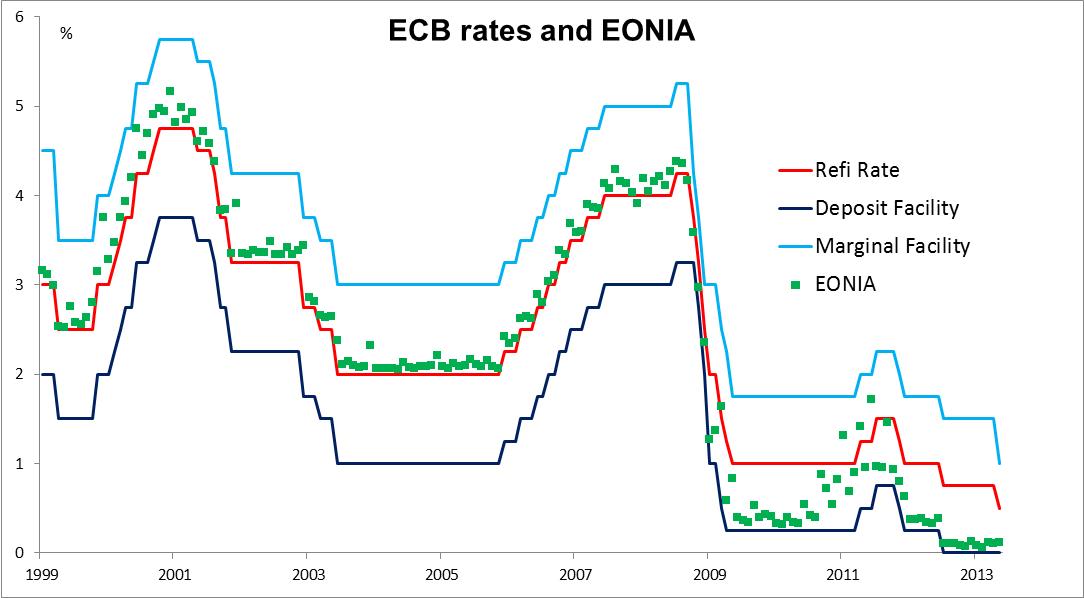

In the Eurozone, sentiment against further easing seems to be growing, which may help to keep EUR/USD in its recent range for longer. Finland's PM Katainen said that he did not think the ECB should ease policy further and that negative rates would not help credit growth in the Eurozone. The FT reports that the ECB is moving away from unconventional methods of channeling credit to SMEs and now believes that the best way to deal with the credit crunch is to ensure that the Eurozone banks are properly capitalised. Nor is there any agreement on the ECB board on where to set rates. One idea being considered is to allow the corridor between the marginal facility – the rate at which they will lend money to a bank in an emergency – and the deposit facility – the rate at which they accept excess money from a bank – to narrow. That spread narrowed last month to 100 bps, a level only equaled during the 2008 financial crash. Another possibility would be quite the contrary: to reaffirm that the corridor will not narrow any further. In that scenario, they cut the refi rate to 25 bps, a fairly meaningless move as long as Eonia is below that, and commit to keep the corridor steady in the future, which would imply that any additional rate cuts have to involve making the deposit rate negative. That would keep the threat of negative rates hanging over the market and be negative for EUR/USD.

Yesterday the Hindenburg Omen was signaled for a fourth consecutive day on the NYSE, based on the new highs and lows, the negative McClellan Oscillator and the fact we are still above the 50-day MA (new highs and lows have yet to be updated on the chart below, hence the missing red diamond). The NYSE has lost in the meantime 2.35%, shedding 4.35% from its all-time high.

Today is a big day for data in both Europe and the US. In Europe it’s the service sector PMIs, with Markit announcing the final numbers for the EU and the EU composite final indicator. Given Monday’s surprise upward revision to the manufacturing PMIs, it would be reasonable to expect an upward revision to the composite PMI as well, which could boost EUR/USD. Then in the US we get the ADP employment report. This is closely watched despite its poor correlation with the nonfarm payrolls that come out two days later. Forecasts are for +165k vs +119k last month.

The Market

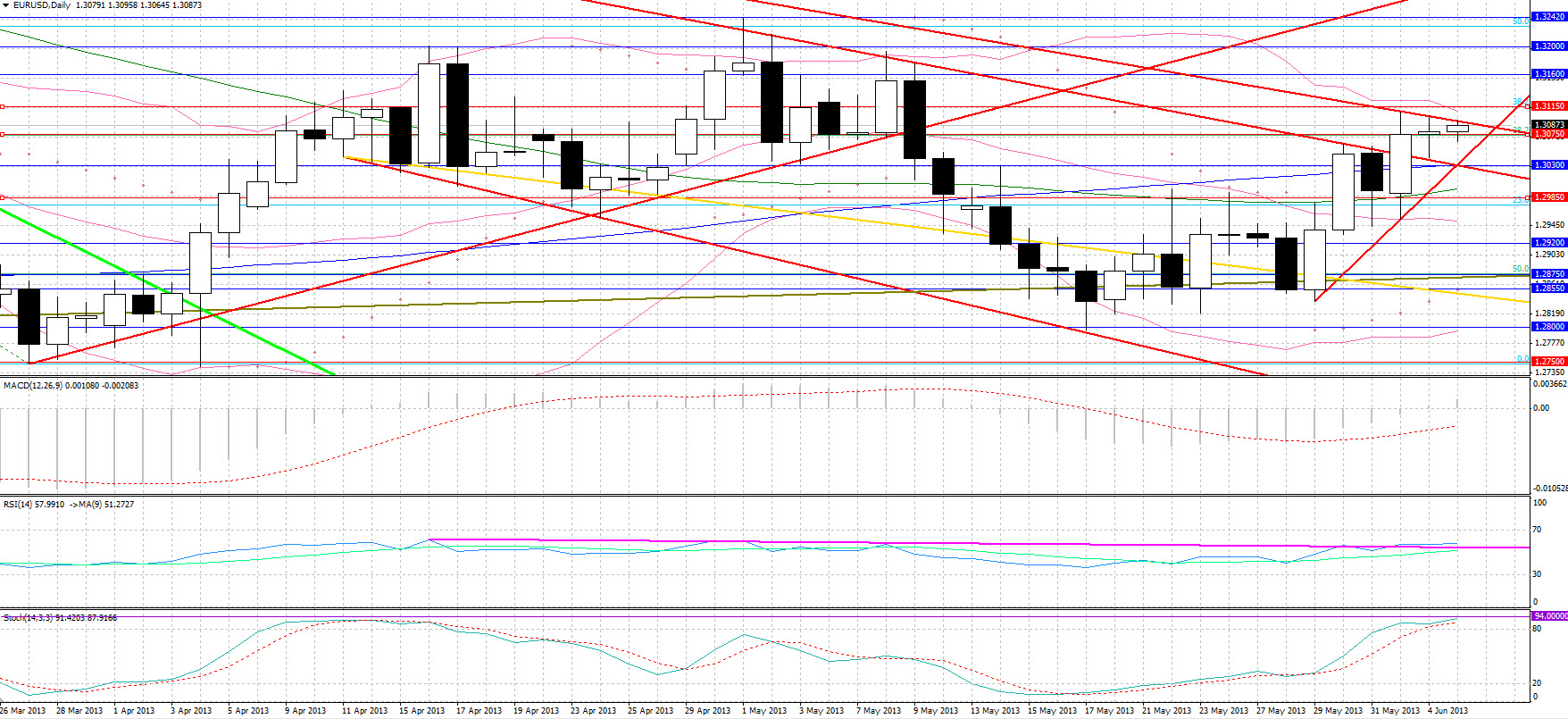

EUR/USD  EUR/USD" title="EUR/USD" width="601" height="348">

EUR/USD" title="EUR/USD" width="601" height="348">

• EUR/USD had a narrow trading range yesterday of less than 60 pips, oscillating around 1.3075, despite the deflationary Eurozone PPI figures. The narrower-than-expected trade deficit widened from the previous month greatly due to increased imports of consumer goods, easing fears that the rate of U.S. recovery may be slowing down and thus strengthening the dollar. The highest IBD Economic Optimism index reading in eight months also aided the dollar, with EUR/USD finding trendline support. Greater volatility is likely today in light of the Eurozone Services PMI and retail sales, with the revised GDP figures expected to remain unchanged. In the US the factory orders and non-manufacturing PMI will be followed by the ADP figures, which are closely watched in anticipation of Friday’s non-farm payrolls. Strong support for the day seems to come at 1.3030, which concentrates two intersecting trendlines and the 200-day MA, with further support coming at 1.2985, which sees the 50-day MA as well as a retracement level. There seems to be some trendline resistance at 1.3095 but stronger resistance is likely to be found at the upper Bollinger band at 1.3115 and 1.3160.

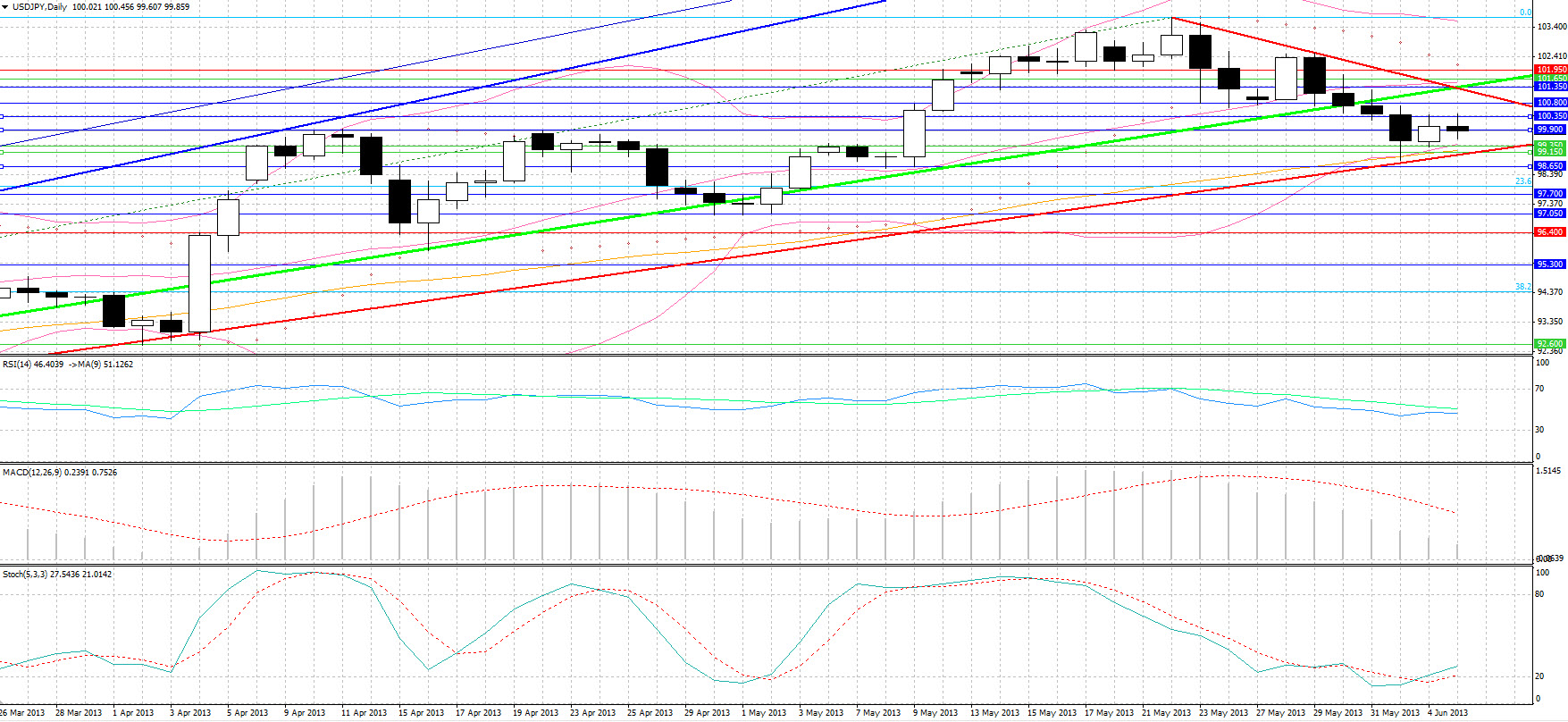

USD/JPY  USD/JPY" title="USD/JPY" width="601" height="348">

USD/JPY" title="USD/JPY" width="601" height="348">

• USD/JPY spent most of the past day trading within the 99.90 – 100.35 trading range. The pair is likely to experience volatility overnight as the Japanese Ministry of Finance releases data on capital flows from and to Japan, shedding light on the investment outcome of the BoJ’s policies. Strong trendline and 50-day MA support is likely to come in the 99.15 – 99.35 area, with 99.90, 100.35 and 100.80 acting as resistance. A breakdown from 99.15 may see the pair head considerably below its lower Bollinger band, towards 98.65.

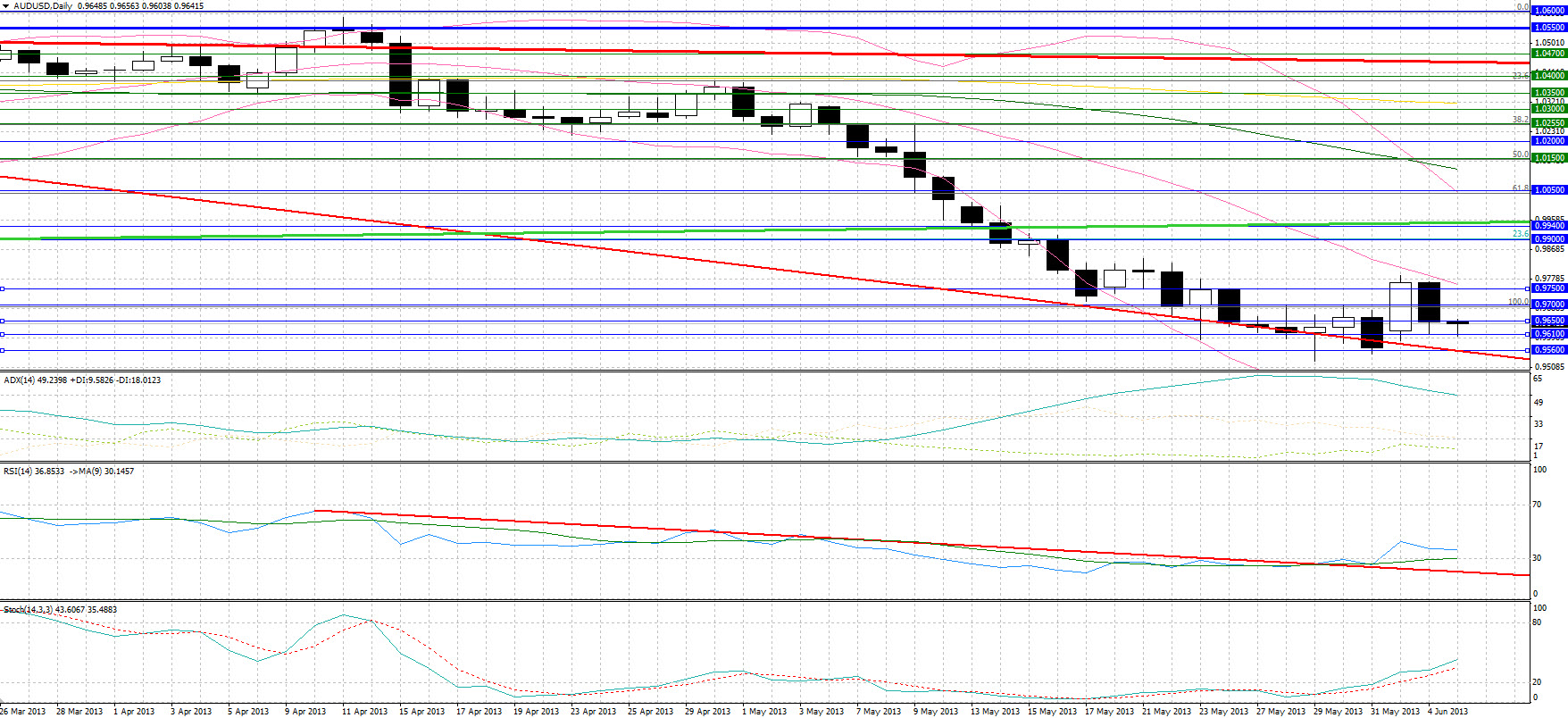

AUD/USD  AUD/USD" title="AUD/USD" width="601" height="348">

AUD/USD" title="AUD/USD" width="601" height="348">

• AUD/USD was a major loser over the past 24-hours, breaking down from 0.9650, finding support at 0.9610 following the worse-than-expected slowdown in the Australian economy’s growth rate. Further support comes at 0.9560 with resistance above 0.9650 found at 0.9700 and 0.9750. A decrease in Australia’s trade surplus overnight may add to the downward pressures the aussie has been experiencing the past four weeks.

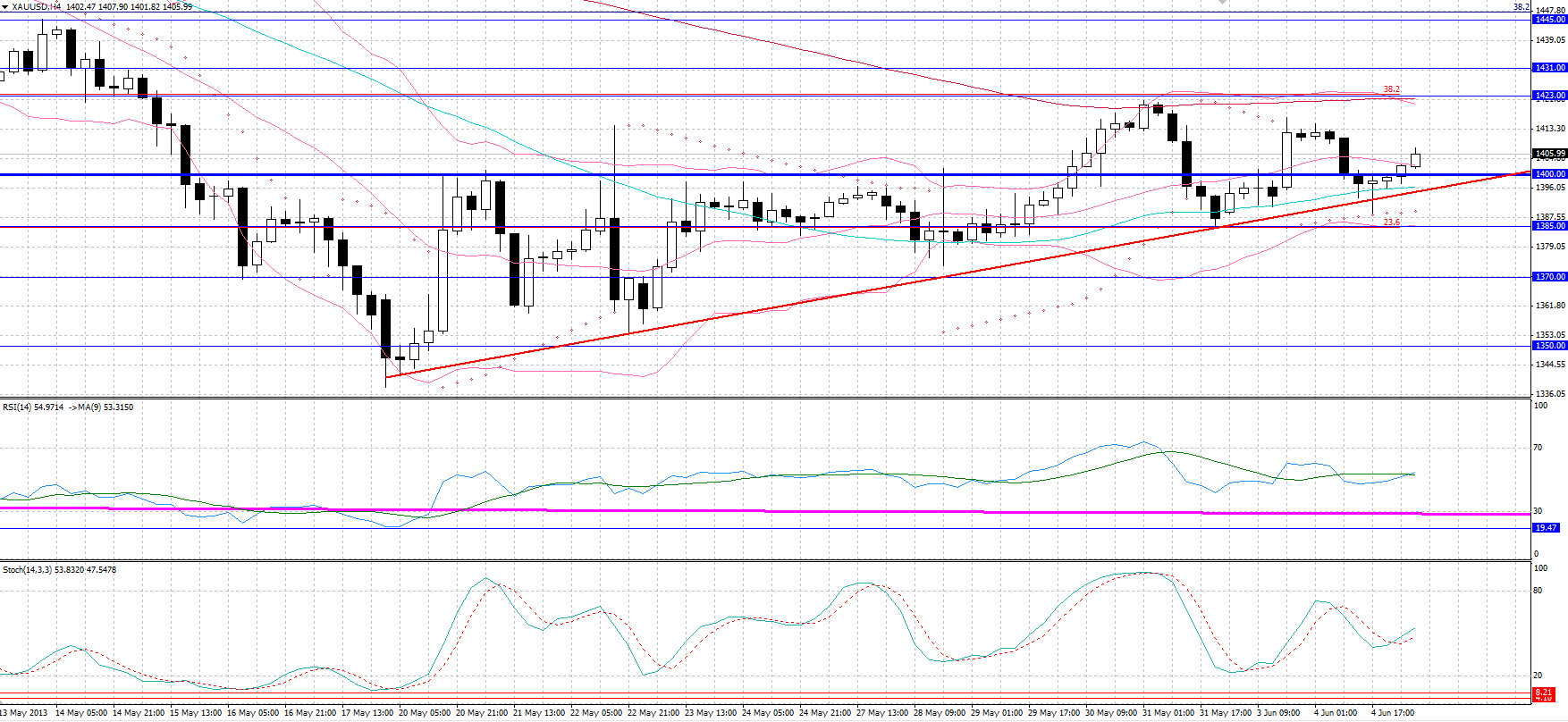

Gold

• Gold rebounded from its upward-slopping trendline as witnessed on the 4-hour chart. A short-lived spike to $1389 was followed by a breakout from the $1400 resistance during the Asian trading session. Spike support for the day is likely to come higher today, at the $1390 – 1395 area, with $1400 being the solid support level and $1423 the initial resistance. A breakout from the $1423 – 1431 area sees resistance at $1445 level, the 38.2% retracement level of the post financial crisis rally.

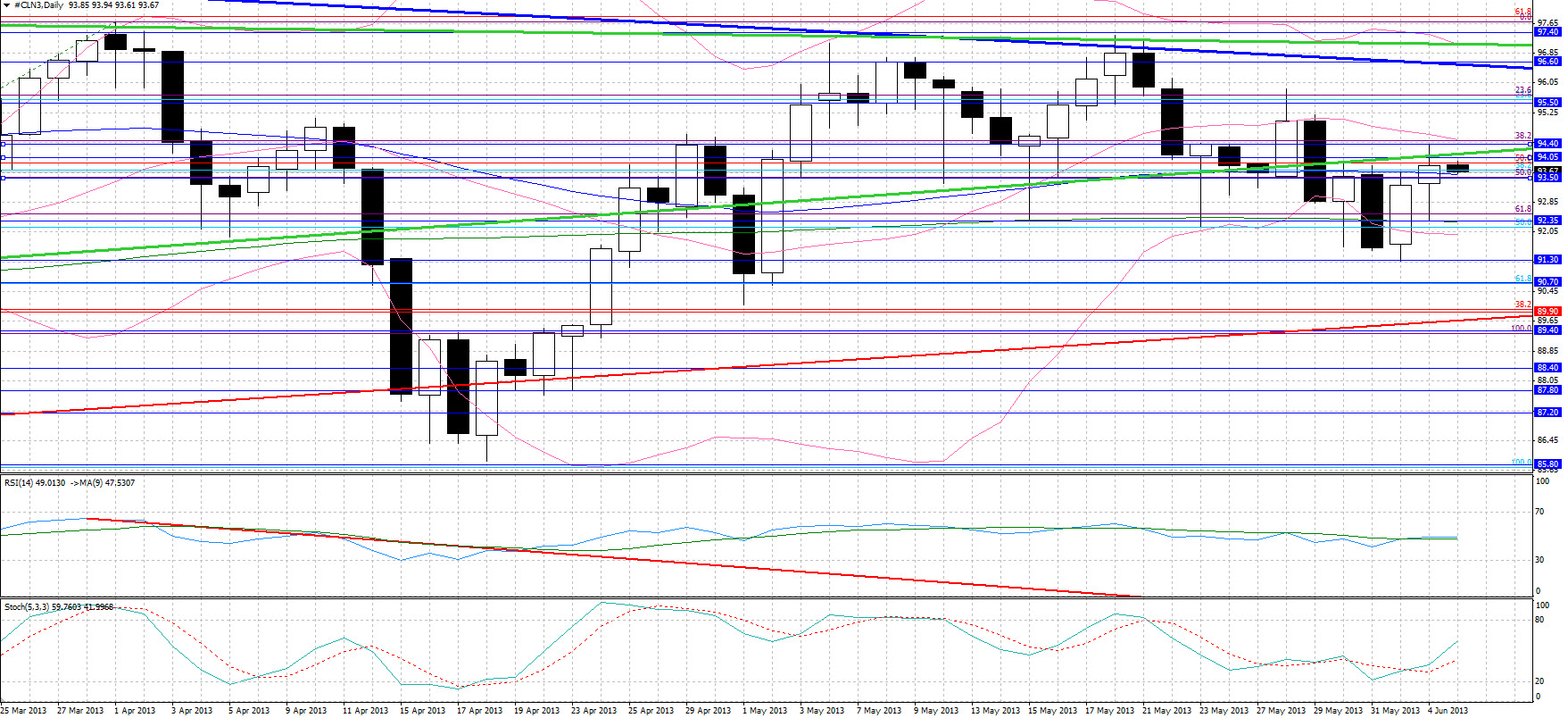

Oil

• WTI was a major gainer yesterday as well, rebounding from the strong 200-day MA support at $92.35, spiking to $94.40. Initial support for the day is likely to come at $93.50, with support below that at $92.35. Resistance levels are seen at $94.05, 94.40 and 95.50, with volatility being likely given the release of the EIA crude inventories, where the largest decrease in 8 weeks is expected.

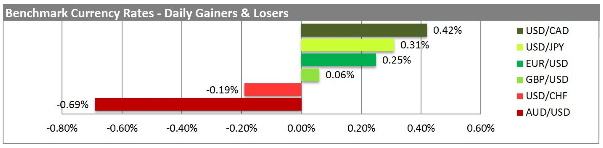

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

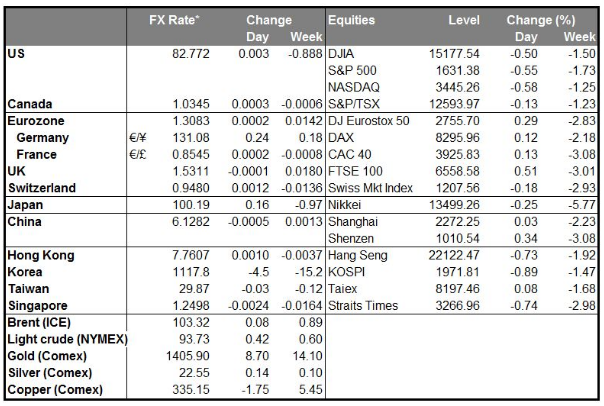

MARKETS SUMMARY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Mean Reversion: USD Recovers Against Most Currencies

Published 06/05/2013, 08:05 AM

Updated 07/09/2023, 06:31 AM

Mean Reversion: USD Recovers Against Most Currencies

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.