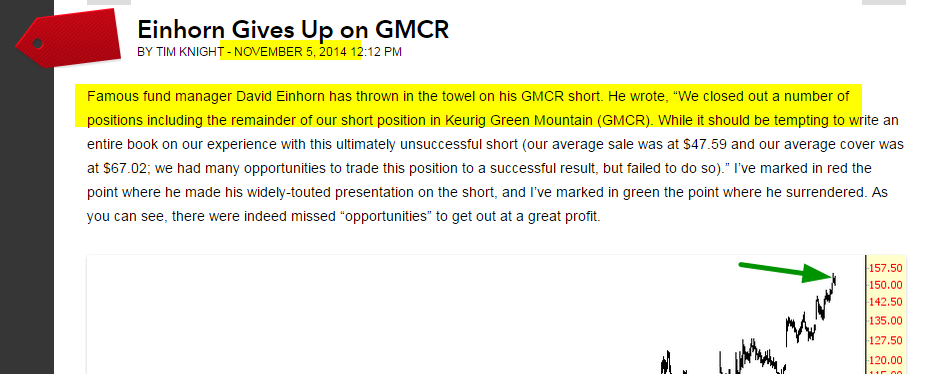

When I saw all the chatter about how Keurig Green Mountain (NASDAQ:GMCR) was getting its balls blown off after-hours, I was reminded of a post I did way back in November. The post relayed the news that, at long last, famed hedge fund manager David Einhorn was throwing in the towel on his GMCR short position. Here’s a snippet from that post:

Well, David Einhorn has clay feet, just like you and me, so—naturally—this very public announcement came within days of the stock’s highest point in history. From that point, well, things looked sort of like this (including after-hours action tonight, which is why I’m using TOS Charts instead of my beloved ProphetCharts). It’s basically down nearly 70%.

It just goes to show you: sometimes you have to be just a little more patient. (And in case you think this is an oddball exception, Einhorn actually just announced his fund had its worst month since August 2008).

A few other unrelated things on my mind…

- Why do I keep getting the feeling that the Tesla X is going to suck once it’s finally released? Every time Musk talks about it (and keep in mind, this goddamned thing has been delayed over and over again, and I’m one of tens of thousands of people with a paid reservation) he whines about how challenging it is. And it always comes back to those gull-wing doors. Just you watch: those doors are going to be failing left and right. The fact they keep bringing up what a nightmare the doors are just tells you it’s going to be a problem, because even with my Model S, one of the (relatively simple!) door handles doesn’t work anymore.

- Oh, and while I’m griping about Tesla (NASDAQ:TSLA), one other thing: I think their success is starting to hurt them. It used to be that I could come in at once for service. These days, they are scheduling appointments nearly two months out! I frankly think Tesla has peaked, and—how shall I say this—there won’t be any operas commissioned about Elon Musk’s life in the coming years.