Investing.com’s stocks of the week

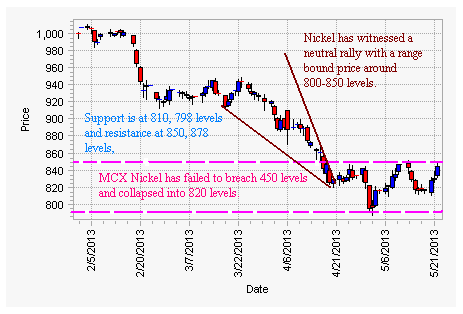

Do you know what has happened to Nickel? The commodity was once in a dream run around 1000 levels. But the commodity lost its path. The commodity has failed several times, breaching 850 levels and collapsing to 820 levels. Could we hope for another dream run?

Nickel prices at MCX were witnessing a consolidation at lower levels. The bear rally of Copper has witnessed downtrend on nickel prices.

The commodity has fallen from 1011 levels and witnessed a sudden collapse to 798 levels. Nickel has not recovered.

The falling wedge pattern was broken at 841 levels and followed a neutral pennant pattern with consecutive fall and rises. The commodity should break the pennant pattern to breach 900 levels.

Nickel was witnessing a mixed picture on the charts. The rate of the Change oscillator (P-ROC) tracked negative momentum with the MACD on the bearish side. RSI at 45 levels is in sideways, and the prices are trading around 20 day SMA at 824 levels.

If nickel breaches 850 levels, a sudden increment to 870 levels is expected. If it fails to breach this levels, range bound prices around 800-840 levels is expected. Lower high and higher bottom may reflect future prices.

Medium Term trend: Sideways-up

Support: 810, 798

Resistance: 858, 870

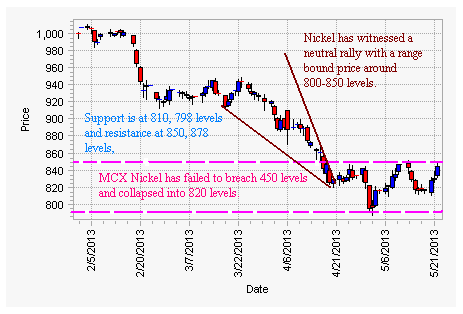

Nickel prices at MCX were witnessing a consolidation at lower levels. The bear rally of Copper has witnessed downtrend on nickel prices.

The commodity has fallen from 1011 levels and witnessed a sudden collapse to 798 levels. Nickel has not recovered.

The falling wedge pattern was broken at 841 levels and followed a neutral pennant pattern with consecutive fall and rises. The commodity should break the pennant pattern to breach 900 levels.

Nickel was witnessing a mixed picture on the charts. The rate of the Change oscillator (P-ROC) tracked negative momentum with the MACD on the bearish side. RSI at 45 levels is in sideways, and the prices are trading around 20 day SMA at 824 levels.

If nickel breaches 850 levels, a sudden increment to 870 levels is expected. If it fails to breach this levels, range bound prices around 800-840 levels is expected. Lower high and higher bottom may reflect future prices.

Medium Term trend: Sideways-up

Support: 810, 798

Resistance: 858, 870