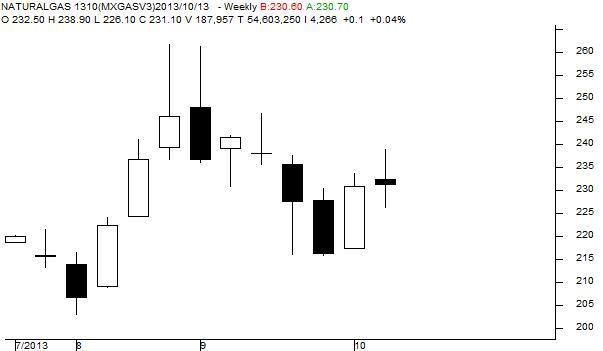

MCX Natural Gas October as seen in the weekly chart above has opened the week at 232.50 levels initially moved sharply higher, but has found very good resistance at 238.90 levels.

Later prices fell sharply towards 226.10 levels and finally closed unchanged from the previous week closing levels.

For the next week we expect Natural Gas prices to find support in the range of 225 –224 levels. Trading consistently below 223 levels would lead towards the strong support at 219 levels and then finally towards the major support at 214 levels.

Resistance is now observed in the range of 238-239 levels. Trading consistently above 240 levels would lead towards the strong resistance at 245 levels, and then finally towards the Major resistance at 248 levels.

MCX / NYMEX Natural Gas Trading levels for the week

Trend: Sideways

S1- 225.00/ $ 3.700 R1-238.00 / $ 3.880

S2-219.00 / $ 3.605 R2-245.00 / $ 3.975

Weekly Recommendation: Sell MCX Natural Gas October between 233-235, SL-238.10, Target -225.

Source: Angel Commodities

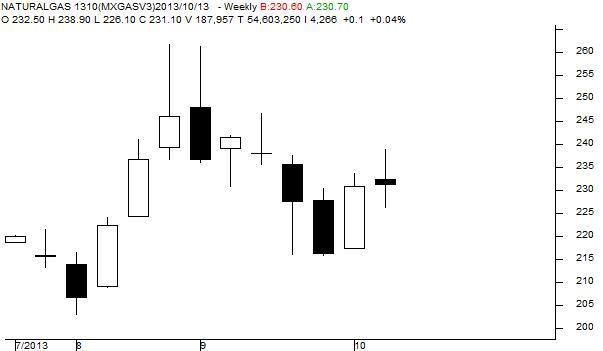

Later prices fell sharply towards 226.10 levels and finally closed unchanged from the previous week closing levels.

For the next week we expect Natural Gas prices to find support in the range of 225 –224 levels. Trading consistently below 223 levels would lead towards the strong support at 219 levels and then finally towards the major support at 214 levels.

Resistance is now observed in the range of 238-239 levels. Trading consistently above 240 levels would lead towards the strong resistance at 245 levels, and then finally towards the Major resistance at 248 levels.

MCX / NYMEX Natural Gas Trading levels for the week

Trend: Sideways

S1- 225.00/ $ 3.700 R1-238.00 / $ 3.880

S2-219.00 / $ 3.605 R2-245.00 / $ 3.975

Weekly Recommendation: Sell MCX Natural Gas October between 233-235, SL-238.10, Target -225.

Source: Angel Commodities