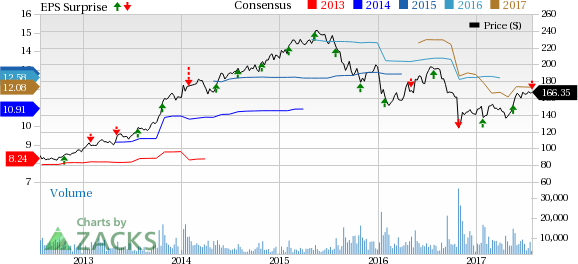

McKesson Corporation (NYSE:MCK) reported first-quarter fiscal 2018 (ended Jun 30, 2017) earnings of $2.46 per share, missing the Zacks Consensus Estimate of $2.81. Earnings also lagged the year-ago figure of $3.15. Performance was muted owing to branded to generic conversions and steep competition in its pharmacy business.

Revenues improved 3% year over year to $51.1 billion but failed to meet the Zacks Consensus Estimate of $51.2 billion.

Quarter in Detail

McKesson operates through two segments, Distribution Solutions and Technology Solutions. All growth rates given below are on a year-over-year basis.

At Distribution Solutions, revenues increased 5% to $50.9 billion. North America pharmaceutical distribution and services reported sales of $43.0 billion, up 5% on market growth and acquisitions. Revenues were hit by branded to generic conversions. Revenues from International pharmaceutical distribution and services were up 6% to $6.4 billion. Medical-Surgical distribution and services generated sales of $1.5 billion, up 4%.

However, revenues from the Technology Solutions business fell from $724 million in the year-ago quarter to $120 million. This was due to the bifurcation of the Technology Solutions businesses to the Change Healthcare joint venture on Mar 1. The segment reflects only the numbers from the Enterprise Information Solutions business.

Financial Condition

As of Jun 30, McKesson had $2.3 million in cash and cash equivalents against $2.8 million as of Mar 31. During the reported quarter (ended Jun 30, 2017), the company generated cash amounting to $741 million from operations. Also in fiscal 2017, McKesson paid $1.5 billion for acquisitions, repurchased $250 million of its common stock, repaid approximately $541 million in long-term debt and paid $62 million in dividends.

Fiscal 2018 Outlook

McKesson expects GAAP earnings per diluted share of $7.10 to $9.00 for the fiscal ending Mar 31, 2018. Adjusted earnings for the same period are expected in the range of $11.80 to $12.50 per diluted share. Distribution Solutions business revenue growth is expected to increase by mid-single digits year over year. The upside is expected to be driven by market growth and acquisitions. Revenues from Technology Solutions are expected to be down on a year-over-year basis.

Zacks Rank & Key Picks

McKesson currently carries a Zacks Rank #3 (Hold). A few better-ranked medical stocks are Mesa Laboratories, Inc. (NASDAQ:MLAB) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . Notably, INSYS Therapeutics sports a Zacks Rank #1 (Strong Buy), while Mesa Laboratories and Align Technology carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

INSYS Therapeutics has a long-term expected earnings growth rate of 20%. The stock has gained around 5.7% over the last three months.

Mesa Laboratories has a positive earnings surprise of 2.84% for the last four quarters. The stock has added roughly 4.1% over the last three months.

Align Technology has an expected long-term adjusted earnings growth of almost 24.1%. The stock has added roughly 32.1% over the last three months.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Mesa Laboratories, Inc. (MLAB): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

McKesson Corporation (MCK): Free Stock Analysis Report

Original post

Zacks Investment Research