And the weekly chart for McDonald’s Corporation (NYSE:MCD) is another interesting one, but for different reasons. This is a stock I monitor closely and one I have written about extensively over the last few years, and in the last few weeks, this stock has received a double whammy of bad news. The first of these came in October with a quarterly earnings miss, the first in two years. This was then followed by the firing of CEO Steve Easterbrook. Both negative events and helping to drive the stock lower.

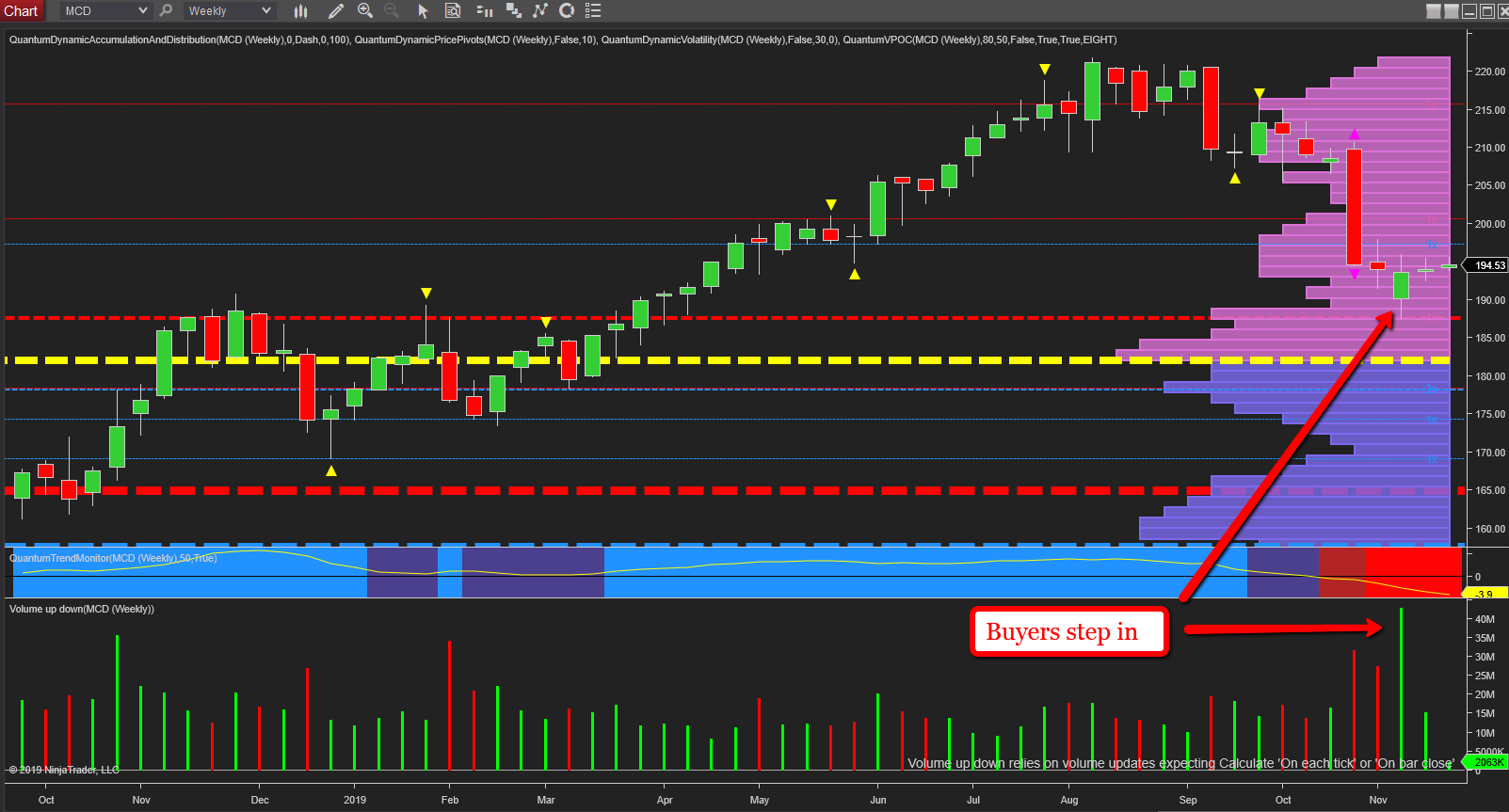

However, from a technical perspective, there is one volume bar which stands out head and shoulders above the others and this is on the weekly candle of two weeks ago. Note the extreme volume which is the greatest on the chart with the price candle closing higher and sending a clear signal of buying on the week. If this had been selling, the candle would have closed in the same way as of two weeks earlier. In other words, widespread and down. Here we see the reverse, where we have a narrow spread up candle on even higher volume as the buyers step in and absorb the selling pressure. The price also tested the solid platform of support below in the $187 area and denoted with the red dashed line of the accumulation and distribution indicator which duly held firm. So over the next few weeks expect to see MCD bounce back and recover.