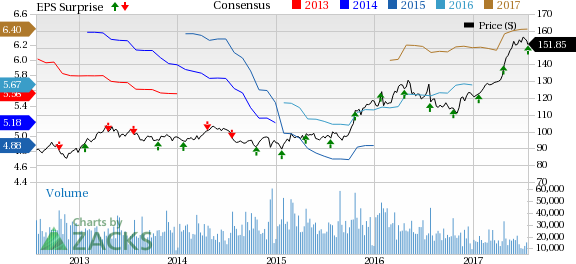

McDonald's Corp. (NYSE:MCD) posted robust results in the second quarter of 2017, wherein both the bottom and the top line outpaced the Zacks Consensus Estimate.

Earnings and Revenue Discussion

Adjusted earnings per share (EPS) of $1.73 surpassed the Zacks Consensus Estimate of $1.62 by 6.8% and improved 19% from the year-ago quarter. The upside reflects stronger operating performance and G&A savings across all the segments. Notably, adjusted earnings exclude the impact of strategic charges.

Meanwhile, foreign currency translation had a negative impact of 3 cents per share on earnings in the quarter. Notably, at constant currency, earnings grew 21% year over year.

Revenues of $6.05 billion declined 3% year over year, mainly due to the impact of the company’s strategic refranchising initiative. At constant currency, the figure declined 2%. However, the same surpassed the Zacks Consensus Estimate of nearly $6 billion by nearly 1%.

Behind the Headlines Numbers

In the quarter, revenues at company-operated restaurants declined 8.9% to $3.57 billion. But revenues at franchise-operated restaurants increased 5.6% to $2.48 billion.

Global comps grew 6.6%, supported by positive guest counts across all the segments. This marked the eighth consecutive quarter of positive comparable sales. Moreover, comps growth was higher than the last quarter’s increase of 4%.

Segment Details

Effective Jul 1, 2015, McDonald's began reporting results under four segments: U.S. (the company's largest segment), International Lead Markets (mature markets including Australia, Canada, France, Germany and the U.K.), High-Growth Markets (markets that have high restaurant expansion and franchising potential such as China, Italy, Poland, Russia, South Korea, Spain, Switzerland and the Netherlands) and Foundational Markets (the remaining markets in McDonald's system).

U.S.: Comps grew 3.9% in the second quarter, given the expansion of the national cold beverage value promotion and the launch of the Signature Crafted premium sandwich platform. Notably, this segment continues to build momentum as it executes strategic menu, value and convenience initiatives to attract customers. Moreover, comps growth was better than the prior quarter rise of 1.7%.

Segment operating income also increased 5% on the back of higher sales-driven franchised margin dollars, G&A savings and higher gains on sales of restaurants.

International Lead Markets: Comps at this segment grew 6.3%, higher than the 2.8% rise witnessed in the last quarter. Continued momentum in the U.K., robust performance in Canada and Germany, and upbeat results across all other markets, drove comps.

Operating income was up 8%, including the impact of foreign exchange headwinds. At constant currency, the figure was up 13%, primarily on the back of sales-driven improvements in franchised margin dollars.

High-Growth Markets: Comps grew 7%, much better than the prior-quarter’s 3.8% increase, led by strong performance in China as well as positive results across the entire segment.

The segment's operating income rose 28% (in constant currencies as well). Notably, about half of the increase came on the back of lower depreciation expense due to the accounting treatment associated with the pending sale of the China and the Hong Kong businesses.

Foundational Markets: Comps in Foundational Markets grew 13%, faring better than the 10.7% growth in the last quarter. Operating income rose considerably primarily owing to strong results in Japan, along with solid performance across the segment's other geographic regions. Comparison to the prior year's strategic charges also drove the segments’ results.

Zacks Rank & Upcoming Releases

McDonald’s carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other firms in the restaurant space, BJ's Restaurants, Inc. (NASDAQ:BJRI) and Dunkin' Brands Group, Inc. (NASDAQ:DNKN) are expected to release their second-quarter numbers on Jul 27. The Zacks Consensus Estimate for the quarter’s earnings is pegged at 51 cents for BJ's Restaurants and 62 cents for Dunkin' Brands.

Yum! Brands, Inc. (NYSE:YUM) is scheduled to report its quarterly numbers on Aug 3. The Zacks Consensus Estimate for the quarter’s bottom line is pegged at 61 cents.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

BJ's Restaurants, Inc. (BJRI): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Dunkin' Brands Group, Inc. (DNKN): Free Stock Analysis Report

Original post