McDonald’s Corp. (NYSE:MCD) is a leading fast-food chain that offers various food items, soft drinks, coffee, and other beverages, as well as breakfast menus. The company aims to continuously build its brand by adapting to changing consumer preference.

McDonald’s comps have improved in its key regions over the last few quarters on the back of the company’s strategic efforts to boost sales. It has been focusing on operational excellence, product innovation, undertaking efficient marketing and promotions, offering a value menu, and rolling out more limited-time offerings to improve guest count – which remains the company’s top priority – and drive the top line.

Meanwhile, efforts to enhance digital capabilities, increased focus on delivery and accelerated deployment of Experience of the Future restaurants in the U.S. should further drive growth.

However, a slowdown in emerging markets and soft industry growth has been hurting sales while high costs along with negative currency translation is denting the company’s profitability.

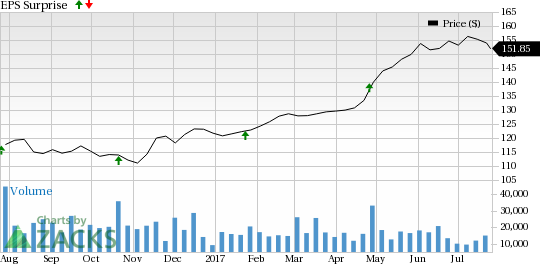

Investors should note that the consensus estimate for MCD has hardly witnessed any significant movement over the last 60 days. Meanwhile, MCD’s earnings have been strong over the past few quarters. In fact, the company’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, with an average beat of 7.01%. Revenues also posted positive surprises in three of the trailing four quarters.

MCD currently has a Zacks Rank #3 (Hold) but that could change following McDonald’s earnings report which was just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: MCD beats on earnings. Our consensus earnings estimate called for earnings per share of $1.62, and the company reported earnings of $1.73 per share. Investors should note that these figures take out stock option expenses.

Revenues: MCD reported revenues of nearly $6.05 billion. This beat our consensus estimate of nearly $6 billion.

Key Stats to Note: Global comps for the second-quarter 2017 grew 6.6%, higher than the 4% growth in the preceding quarter. All the segments posted positive guest counts. However, foreign currency translation somewhat hurt results.

Stock Price Impact: At the time of writing, the stock price of McDonald’s was up nearly 3% during pre-market trading hours following the earnings release.

Check back later for our full write up on this MCD earnings report!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

McDonald's Corporation (MCD): Free Stock Analysis Report

Original post

Zacks Investment Research