McCormick & Company, Inc. (NYSE:MKC) has recently announced a public offering in regard to partly finance the acquisition of food division of Reckitt Benckiser Group plc, announced last month. The $4.2 billion deal, subjected to regulatory approvals, is expected to be completed either in the third or fourth quarter of fiscal 2017.

The underwritten public offering of 5,524,862 shares will be priced at $90.50 per share. McCormick has allowed underwriters 30 days time period to purchase up to an additional 828,729 shares of its common stock, non-voting sold at the public offering price, less than the underwriting discount. The offering is expected to close on Aug 11.

The net proceeds from the offering will be approximately $482 million after estimated underwriting discounts and are expected to partly fund the pending acquisition of Reckitt Benckiser's Food Division. McCormick expects to fund the balance of the purchase price with the net proceeds from debt financings, an unsecured bridge loan facility, as well as cash on hand.

Acquisitions Boosting Portfolio

McCormick, which is well known for manufacturing and distributing spices, seasonings, specialty foods and flavors to the entire food industry across the globe, has been strategically increasing its presence through acquisitions in order to grow its spices and seasonings portfolio. The acquisitions (Gourmet Garden in Apr 2016 and Enrico Giotti SpA in Dec 2016) contributed toward increasing sales by 3% during the second quarter of 2017, reported last month. The Reckitt’s food division is also expected to result in combined pro forma 2017 annual net sales of approximately $5 billion.

The acquisition of Reckitt’s food division, if it materializes, will significantly boost the company’s robust spices portfolio with iconic brands like Frank's RedHot Hot Sauce, French's Mustard, French's Crispy Vegetables and Cattlemen's BBQ Sauce. Notably, both Frank's RedHot and French's Mustard hold top most positions in their respective categories in the U.S. and Canada. As a result, these brands will position the company in the leading U.S. condiments category and will strengthen and expand McCormick's business presence internationally too.

With the addition of foods business, McCormick expects cost synergies of approximately $50 million which will be achieved by 2020. The company expects to achieve significant margin and earnings accretion in 2017 and will achieve additional favorable impacts following the realization of targeted synergies.

Share Price Performance

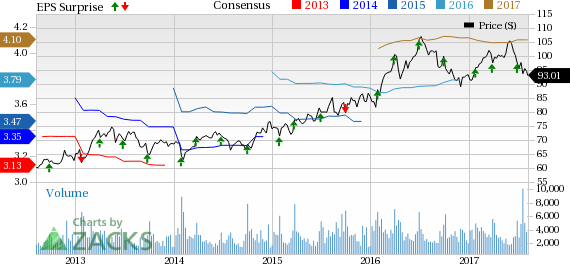

A promising portfolio combined with robust initiatives has been favoring this Zacks Rank #3 (Hold) company, which has delivered positive earnings surprise in 12 of the last 14 quarters. However, negative impact of material costs and currency has been impacting the company’s performance of late. Currency headwinds of approximately 2% impacted the second-quarter results of the company. Such impacts are likely to persist throughout fiscal 2017.

We note that shares of McCormick have declined 4.6% on a quarter-to-date basis against the industry, which grew 0.7% in the same time frame.

Do Consumer Staples Stocks Interest You? Check These

Investors may consider better ranked stocks from the same sector such as Inter Parfums, Inc. (NASDAQ:IPAR) , Nu Skin Enterprises, Inc. (NYSE:NUS) and Constellation Brands, Inc. (NYSE:STZ) all carrying a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inter Parfums has an average positive earnings surprise of 15.6% over the last four quarters. It has a long-term earnings growth rate of 12.3%.

Nu Skin has an average positive earnings surprise of 10.8% % over the last four quarters. It has a long-term earnings growth rate of 8.7%.

Constellation Brands has an average positive earnings surprise of 11.7% over the last four quarters. It has a long-term earnings growth rate of 18.2%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Constellation Brands Inc (STZ): Free Stock Analysis Report

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

Original post

Zacks Investment Research