McCormick & Company, Incorporated (NYSE:MKC) posted first-quarter fiscal 2019 results, wherein both earnings and sales improved year over year and the former came ahead of the Zacks Consensus Estimate. Results benefited from improved volumes and product mix in the company’s base business and new product offerings. Also, focus on Comprehensive Continuous Improvement (CCI) program aided the adjusted operating income.

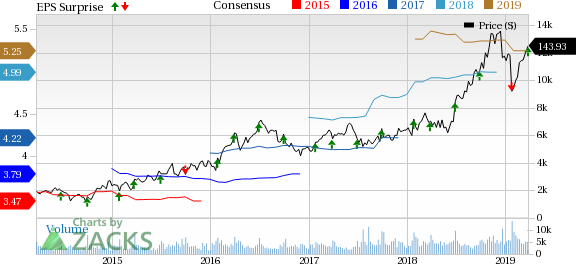

This Zacks Rank #3 (Hold) stock has gained 12.2% in the past six months, against the industry’s decline of 7.7%.

Quarter in Detail

Adjusted earnings of $1.12 per share improved 12% on a year-over-year basis, and surpassed the Zacks Consensus Estimate of $1.06. The bottom-line growth was backed by increased adjusted operating income and lower adjusted tax rate. However, foreign currency rates had an adverse effect on the bottom line.

This global leader of flavors and spices generated sales of $ 1,231.5 million that advanced nearly 1% year over year, including currency headwinds of roughly 3%. On a constant-currency (cc) basis, the top line improved 4%. Top-line growth was completely organic, and fuelled by increased volumes and favorable product mix. Further, both Consumer Business and Flavor Solutions segments witnessed higher sales at cc. However, reported sales fell short of the Zacks Consensus Estimate of $1,233 million.

Gross profit rose 1.4% to $466.9 million, whereas the gross margin remained flat at 37.9%.

Adjusted operating income increased about 4% to $199 million, while it rose 6% at cc. Further, adjusted operating income margin expanded 40 basis points (bps). The upside can be accountable to improved sales and savings from the company’s CCI program.

Segment Details

Consumer Business: Sales remained almost flat at $744.9 million, though it grew 3% at cc, buoyed by improvements across all regions. This, in turn, was driven by improved distribution, new products, and solid marketing and promotional plans. Sales in the Americas rose 3% at cc. This was mainly driven by volume growth and improved product mix. Sales in the Asia-Pacific region grew 4% at cc, mainly owing to contributions from China. In the EMEA region, sales rose 1% at cc, owing to volume enhancements and product mix.

Flavor Solutions: Sales in the segment rose 3% from the prior-year quarter’s figure to $486.6 million. At cc, sales increased 6% on improved performance in the Americas and EMEA regions. This, in turn, was backed by improved volumes and product mix at the base business and new products. Sales in the Americas grew 7% at cc, driven by improved sales to quick-service restaurants, and increased sales of flavors and seasonings. Sales in the EMEA region improved 9% at cc, driven by broad-based growth. Sales in the Asia-Pacific region remained flat at cc and were hit by promotional activities by customers.

Financial Update

McCormick exited the quarter with cash and cash equivalents of $102.3 million, long-term debt of $4,034.0 million and shareholders’ equity of $3,342.7 million.

For the first quarter of fiscal 2019, net cash provided by operating activities was $103.6 million. Also, the company anticipates strong cash flow for fiscal 2019.

Fiscal 2019 Guidance

Management expects continued rise in global demand for flavors and fresh food offerings. With strong growth strategies in place, the company expects to successfully meet consumers’ rising demand. To this end, McCormick is striving to utilize resources more efficiently and reduce costs to increase savings.

That said, management reiterated its projections for fiscal 2019. The company expects sales to grow 1-3% (up 3-5% at cc). The company expects to achieve top-line growth completely on an organic basis, as it anticipates no benefits from acquisitions. That said, sales are likely to be driven by efforts like product launches, and expanded distribution and marketing. Also, strong pricing is expected to aid sales growth and counter elevated cost hurdles.

Incidentally, the company intends to achieve cost savings of almost $110 million in fiscal 2019, which will be utilized for enhancing margins, sponsoring growth-oriented investments and offsetting high costs. Adjusted operating income is anticipated to grow 7-9%, while it is likely to be up 9-11% at cc.

Finally, adjusted earnings for fiscal 2019 are projected to be $5.17-$5.27 per share, reflecting year-on-year rise of 4-6%. The bottom line is expected to grow 6-8% at cc. The consensus mark is currently pegged at $5.25.

Don’t Miss These Solid Food Stocks

MEDIFAST (NYSE:MED) , with long-term EPS growth rate of 20%, sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

General Mills (NYSE:GIS) , with a Zacks Rank #2 (Buy), has long-term earnings per share growth rate of 7.3%.

Sysco Corporation (NYSE:SYY) , with long-term earnings per share growth rate of 10.3%, carries a Zacks Rank #2.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Click to get it free >>

Sysco Corporation (SYY): Free Stock Analysis Report

General Mills, Inc. (GIS): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

MEDIFAST INC (MED): Free Stock Analysis Report

Original post

Zacks Investment Research