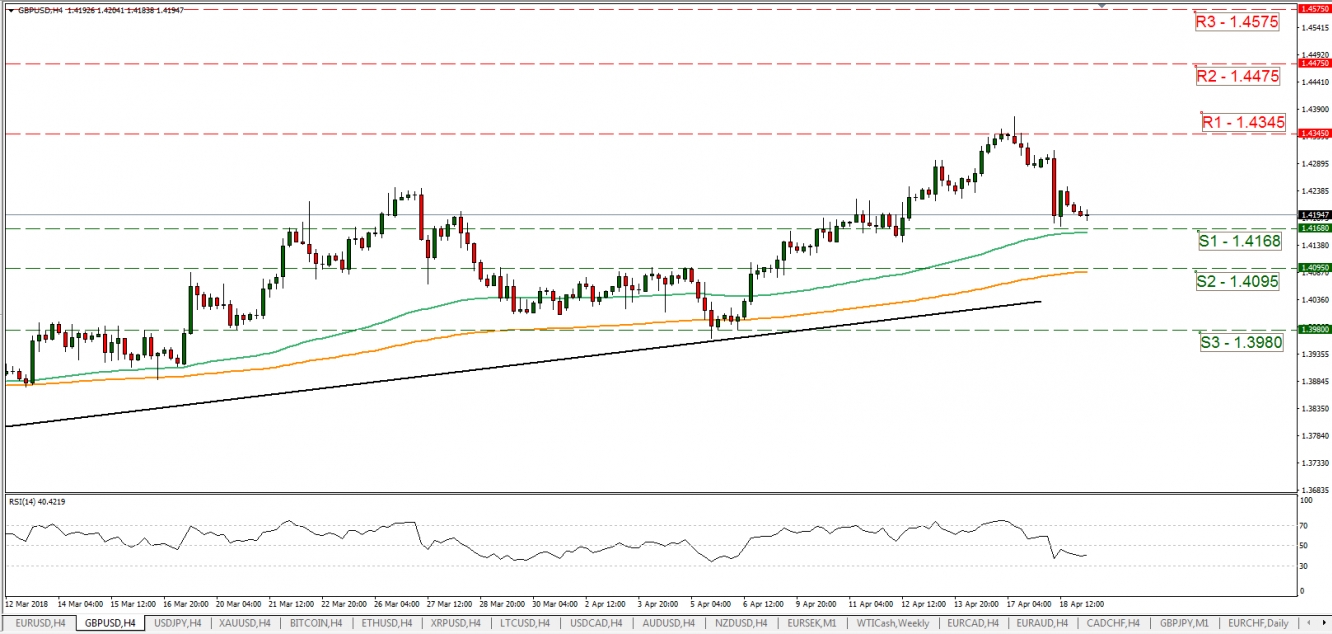

May defeated in the House of Lords

- The House of Lords voted against a main part of PM May’s Brexit policy with a majority difference larger than 100 votes. Despite the vote not being binding, the heavy defeat of the government could be interpreted as a strengthening of the soft Brexit side and possible further defeats for the Prime Minister may lay ahead. Another interesting aspect of yesterday’s vote would be that the soft Brexit side seems to be consolidating across the main UK parties and seems currently in place to threaten Theresa May. On other news, the first day of the Brexit negotiations ended with little progress as British negotiators received EU guidelines for the after Brexit EU-UK relationships. Should there be further negative headlines about Brexit or the inner UK political stage we could see the pound weakening.

- Cable dropped considerably yesterday testing the 1.4168 (S1) support level as the market was taken by surprise by the adverse UK inflation data. We see the case for the pair to continue to drop albeit in a slower pace as political uncertainty continues and the Retail Sales growth rate release later on today could weaken the pound. Should the bears continue to have the upper hand we could see the pair breaking the 1.4168 (S1) support level and aim for the 1.4095 (S2) support barrier. Should the bulls have the upper hand we could see the pair aiming or even breaching the 1.4345 (R1) resistance level.

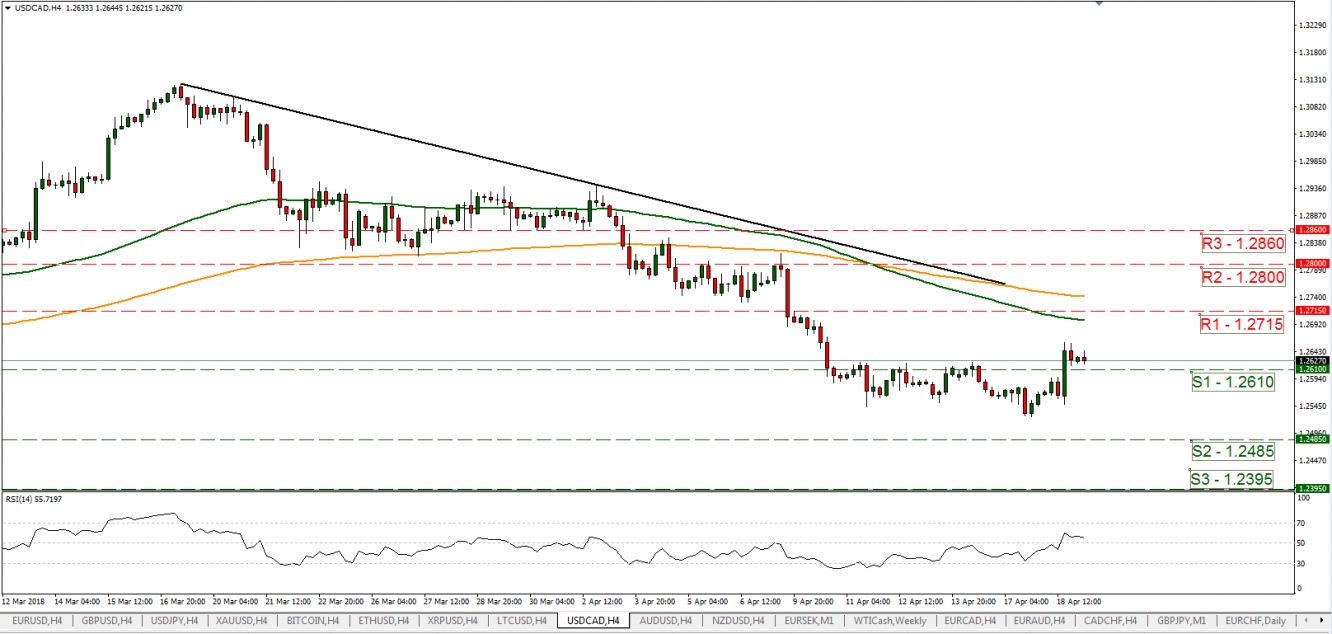

BOC decided to remain on hold at +1.25%

- BoC decided to remain on hold at 1.25% with an accompanying statement that rather disappointed the hawks. The accompanying statement stated that progress on inflation and wages could reinforce that higher rates will be needed over time. On the other hand, it also stated that policy accommodation will still be needed to keep inflation on target and that BoC will be cautious with respect to future hikes. We see the case for the CAD to be rather sensitive to headlines which may come out later today regarding NAFTA, but also to the inflation data on Friday. Overall, a correction to yesterday’s USD/CAD surge may also happen.

- USD/CAD spiked yesterday after BoC’s interest rate decision, breaking the 1.2610 (S1) resistance line (now turned to support). We see the case for the pair to correct somewhat as the CAD recovers from BoC’s decision. Also the release of Canada’s inflation and retail sales data tomorrow could support the CAD somewhat and the market could start positioning itself today. Should the pair come under selling interest we could see the pair breaking the 1.2610 (S1) support line and aim for the 1.2485 (S2) support level. Should it find new buying orders along its path we could see it aiming for the 1.2715 (R1) resistance level.

In today’s other economic highlights:

- During today’s European session we get the Eurozone’s Current Account figure for February, the UK retail sales growth rate for March. In the American session, we get the Philadelphia Fed Manufacturing index for April and the Initial Jobless Claims figure. As for speakers, FOMC members Lael Brainard and Randal Quarles, as well as Bank of England MPC member Jon Cunliffe speak.

USD/CAD

·Support: 1.2610 (S1), 1.2485 (S2), 1.2395 (S3)

·Resistance: 1.2715 (R1), 1.2800 (R2), 1.2860 (R3)

·Support: 1.4168(S1), 1.4095(S2), 1.3980(S3)

·Resistance: 1.4345(R1), 1.4475(R2), 1.4575(R3)