Aussie gets crushed under the weight of a 50-bp chop to the RBA cash target rate and dovish guidance. With mostly tepid May Day action, we have a look at a couple of interesting big picture charts on the USD and FX volatility in general.

Australia’s RBA cut 50 rather than 25 bps and caught most of the market by surprise. The guidance was also dovish, so Australian 2-year swap rates fell a chunky 17 bps. Were it not for surging metals prices and risk appetite of late, the aussie would be in the cellar. As it is, it sold off deeply and the fundamental background pressure remains to the downside, particularly if the commodities and risk picture were to deteriorate.

Manufacturing PMI’s

The manufacturing survey results around the world weren’t particularly inspiring. Australia’s was exceptionally weak. China only released its official tally, which not surprisingly was fairly in-line with expectations, only slightly disappointed expectations and came out at a 13-month high. One wonders who China is producing for…the strong official tally likely has something to do with increased activity by dictate at state-owned enterprises rather than any healthy sign of the Chinese economy picking up again.

Anecdotal articles suggest that the smaller firms are struggling. Last month saw a very large divergence between the official survey (in at 53.1) and the HSBC survey (at 48.3) and we’ll get the HSBC data tonight – will be interesting if this divergence continues.

World manufacturing PMI day did not include the continental European PMI’s today as much of Europe was out in recognition of the May Day holiday, though we got the flash readings a couple of weeks back. The final versions of the surveys are set for release tomorrow and then we’ll have “world services PM day” on Thursday, together with the ECB. Remember that Germany’s initial April manufacturing reading came in at a shocking 46.3. That’s the one I will watch the closest.

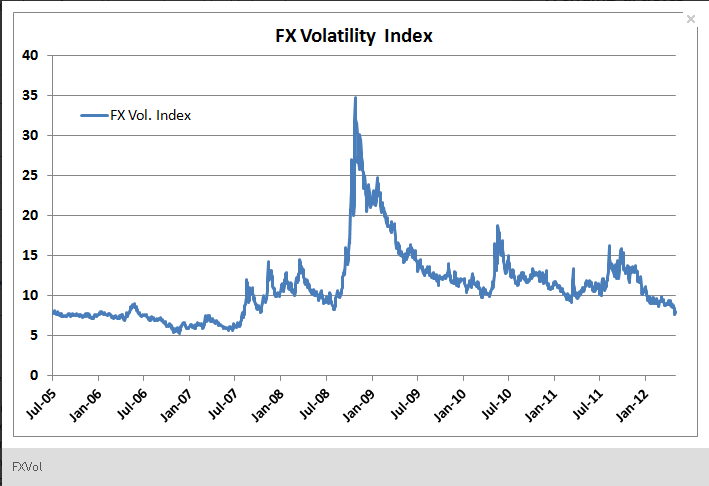

Here’s a chart of the US dollar versus an equally weighted basket of G-10 currencies. It’s trading very close to the 200-day moving average and one can easily spot the ever-narrowing range of the USD over the last several months. At some point, particularly given the risks to our global financial system, we’ll have to see a breakout either way. We’ve been looking for a breakout higher for some time now, but nothing has unfolded so far. Nonetheless, volatility is dying everywhere, a sure sign that we’re working toward something big (see chart below).

Here is an index of 1-month FX volatility that I created using a number of major pairs. Even though the index might have a bit too much bias toward JPY volatility, it’s easy to see how implied volatility expectations of late have collapsed. It might be tempting to see the 2005-06 quiet period as “normal,” but remember those were perhaps the two greatest years for the crazy credit bubble before it started unwinding in 2007.

Are we headed back toward crazy credit bubble days or is the market simply complacent because it believes that authorities everywhere will at all times remove the tail risks from financial markets? The latter is, of course, more plausible. But can central bankers maintain such control forever? No – but between now and the next big surprise is a very unknown time period. Suffice it to say that the market is getting very complacent relative to historical levels as judged by measures of near-term volatility. A grey swan flying around might not be a welcome sight. Stay tuned.

Looking Ahead

Today’s focus is the US ISM Manufacturing data up shortly – I’m expecting a weak data point after all of the regional manufacturing surveys in the US this month were weak and I will be interested in how risk appetite responds to this – seems nothing can get it down lately, but at some point, one would think the market would begin to fret a weak patch in the economy, QE potential or no.

Once again, it is interesting to note the JPY’s surge considering that we’re in the midst of a holiday week in Japan and considering that the BoJ has just launched a new expansion of its QE programme. With bonds on the up and up, the pressure remains to the upside for the JPY and to the downside for JPY crosses, though I would suspect we would get verbal intervention not far below here in USD/JPY if it fails to right itself. EUR/JPY today was down having a look at its 200-day moving average at around 105.50.

Stay careful out there.

Economic Data Highlights

- Australia RBA lowered Cash Target 50 bps to 3.75% vs. 4.00% expected

- UK Apr. PMI Manufacturing Out at 50.5 vs. 51.5 expected and 51.9 in Mar.