There is nowhere to store oil for May delivery. That's what's behind the price crash. The CME says it will allow prices to go negative.

The last day for May trading is today. Traders who long the May contract are in deep trouble. This could happen again in June.

The Art of a Failed Oil Deal

Supposedly, U.S. President Donald Trump saved the oil market with his production cut deal with the Saudis earlier this month.

On April 14, the Wall Street Journal crowed about The Art of an Oil Deal.

I panned that idea on April 15 in The Art of a Failed Oil Deal.

These were my comments.

Real Deal

As soon as storage facilities fill up, nations will have to curb production.

Trump did not negotiate a thing that would not have occurred on its own by brute force of the market.

A cut of 9-10 million barrels was not enough. So the price fell after a brief market surge.

Hooray, the Saudis saved face. But what good did it do? The cuts were coming because they had to.

Voilla!

If demand destruction amounts to 20 million barrels per day, guess what?

Production will ultimately fall by 20 million barrels per day, deal or no deal.

I believe we now know which view was correct.

COT View

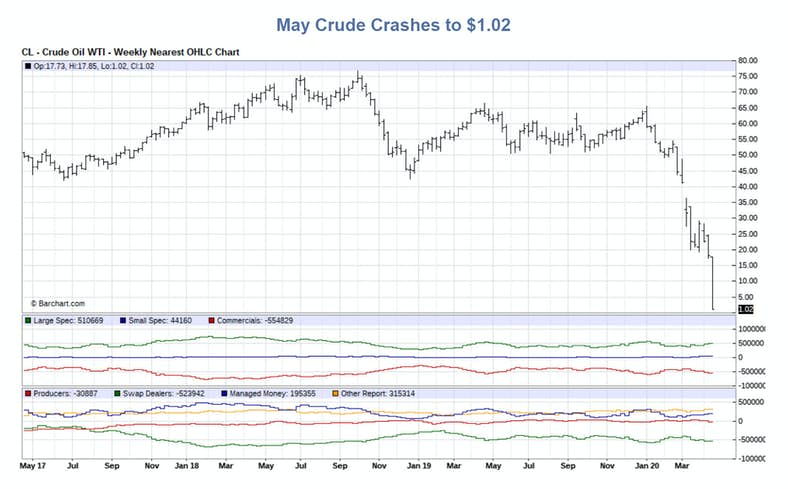

The above chart shows speculators were long 195,355 contracts.

Anyone long the May contract has now been carted out the door.

I do not have a count as I believe most of those contracts are for June. Even still, those losses are massive.

Some traders will be wiped out today.