[Editors Note: This post was delayed due to problems at the US Census Website]

US Census says manufacturing new orders declined. Our analysis agrees but indicates the decline was even worse. Although the data was soft - the big headwind this month was from civilian and military aircraft.

Follow up:

- The Federal Reserve’s Industrial Production and the US Census disagree that May was worse than April.

- The 3 month moving average of unadjusted new orders is still accelerating because of the strength of the March 2014 data.

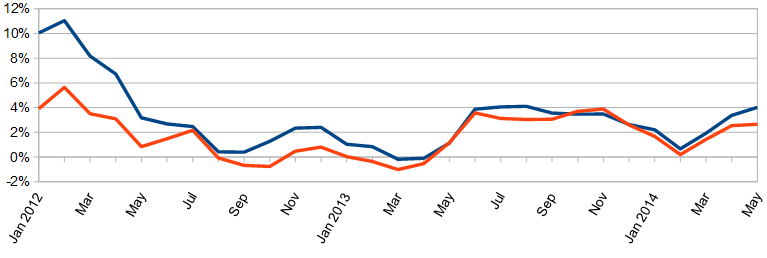

3 Month Rolling Average – Unadjusted Manufacturing New Orders (blue line), Inflation Adjusted New Orders from the Unadjusted Data (red line)

- The seasonally adjusted manufacturing new orders is down 0.5% month-over-month, and up 2.5% year-to-date.

- Market expected month-over-month growth of -0.5% to +1.0% (consensus -0.3%).

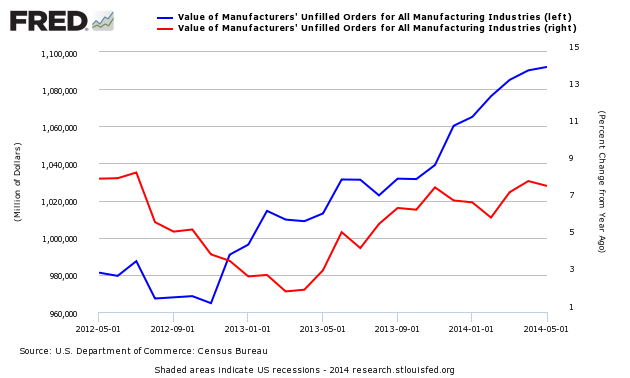

- Manufacturing unfilled orders up 0.6% month-over-month, and up 7.8% year-to-date

Econintersect Analysis:

- Unadjusted manufacturing new orders growth decelerated 3.8% month-over-month, and up 1.3% year-over-year

- Unadjusted manufacturing new orders (but inflation adjusted) down 0.2% year-over-year

- Unadjusted manufacturing unfilled orders growth decelerated 0.3% month-over-month, and up 7.8% year-over-year

- As a comparison to the inflation adjusted new orders data, the manufacturing subindex of the Federal Reserves Industrial Production was growth accelerated 0.7% month-over-month, and up 3.8% year-over-year.

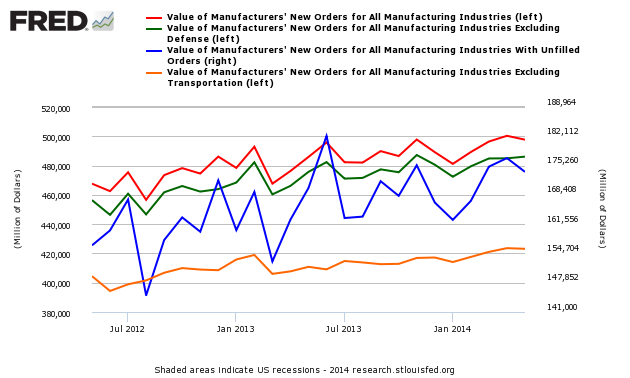

Seasonally Adjusted Manufacturing Value of New Orders – All (red line, left axis), All except Defense (green line, left axis), All with Unfilled Orders (orange line, left axis), and all except transport (blue line, right axis)

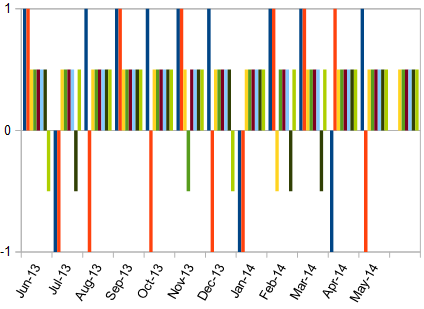

From the above graphic, one can see that defense spending was one of the tailwinds this month. The graph below shows sector growth year-over-year.

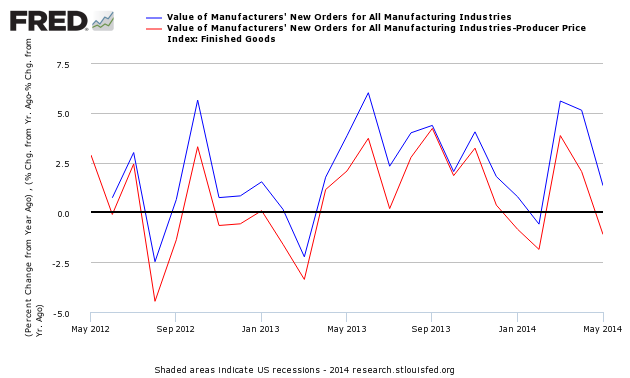

Year-over-Year Change Manufacturing New Orders – Unadjusted (blue line) and Inflation Adjusted (red line)

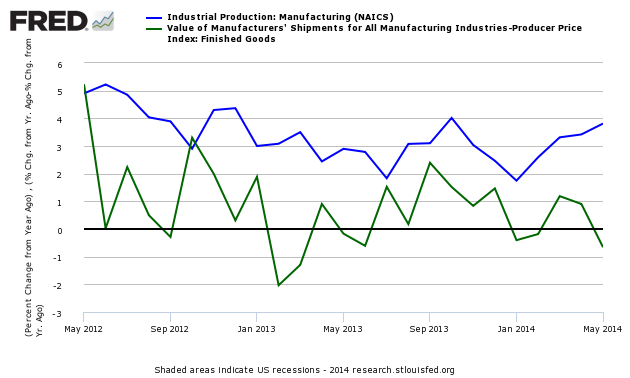

Now look at the manufacturing component of industrial production. While it is true that these are slightly different pulse points (inventory not accounted in shipments) – they should not have different trends for long periods of time. Although the general trend is mixed - but in narrow channels.

Comparing Year-over-Year Change – Manufacturing Industrial Production (blue line) to Inflation Adjusted Manufacturers Shipments (green line)

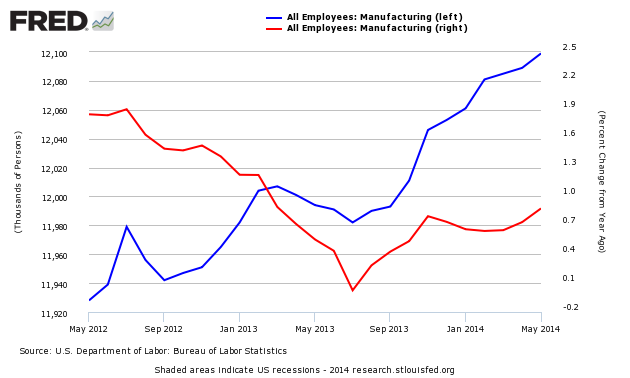

Using employment to confirm manufacturing growth says this industry is growing year-over-year.

Employment Growth – Manufacturing (Seasonally Adjusted) – Total Employment (blue line) and Year-over-Year Change (red line)

The health of manufacturing is gauged by the growth of unfilled orders. The 3 month rolling average rate of growth is currently accelerating.

Unadjusted Unfilled Orders – Total Current Value (blue line, left axis) and Year-over-Year Change (red line, right axis)

A declining unfilled orders backlog could be a recessionary indication as unfilled orders generally decline in poor economic times. Keep the score on surveys, the following is a comparison of surveys to hard data – this Census data is the orange bars.

Comparing Surveys to Hard Data

Caveats on the Use of Manufacturing Sales

The data in this index continues to be revised up to 3 months following initial reporting. The revision usually is not significant enough to change the interpretation of each month’s data in real time. Generally there are also annual revisions to this data series. The methodology used by US Census Bureau to seasonally adjust the data is not providing a realistic understanding of the month-to-month movements of the data. One reason is that US Census uses data over multiple years which includes the largest modern recession which likely distorts the analysis. Further, Econintersect believes there has been a fundamental shift in seasonality in the aftermath of the Great Recession of 2007 – the New Normal.Econintersect determines the month-over-month change by subtracting the current month’s year-over-year change from the previous month’s year-over-year change. This is the best of the bad options available to determine month-over-month trends – as the preferred methodology would be to use multi-year data (but the New Normal effects and the Great Depression distort historical data). This series is NOT inflation adjusted –Econintersect uses the PPI – subindex All Manufactured Goods. However, this is a rear view look at the economy. Manufacturing new orders or unfilled orders generally correlates to the economy – but it is not obvious in real time whether a recession is imminent. So in context to economy watchers – manufacturing by itself cannot be used as an economic gauge.

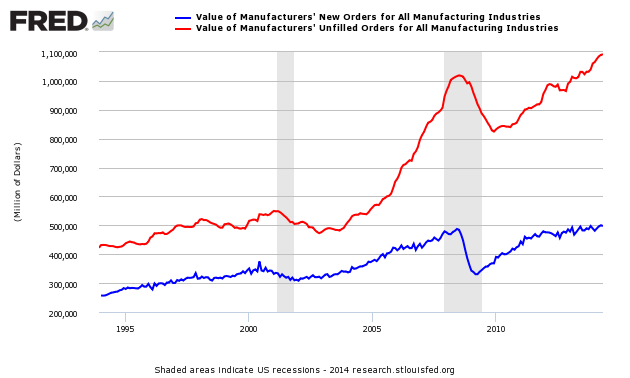

Adjusted Value – New Orders (blue line) and Unfilled Orders (red line)

The same issues are also evident if manufacturing backlog is used as a recession gauge.